Imitation is the sincerest form of Flattery - UCad - Friday 4th September 2 09 pm UK

I did not trade the Ucad that much yesterday - again preferring other pairs such as the EU / EJ and GU

I had set out the LiTs area on it pre 7 00 am for the Am session

For the UCad - it was 3180 to 3210 price area

Basically that was saying we should look more under 3180 for sells and over 3210 area for more buys.

Now that might be at 7 00 am in the morning a bit of "fortune telling" - ie more like the 4 hr / day monthly gamblers rather than for an intraday 12 hr session.

So once you have the LiTs area - normally anything from 20 to 50 pip range - you then put your Scalping hat on and start thinking every 30 mins and TW's etc

Also most important you time rules for interim high and lows - key to help you with the other clues for "fortune telling"

So if we don't go under 3180 and stay there for 30 -35 min - but instead stay above the level for over 35 mins and over an hour - that favours a reversal

Similar if we go over 3210 and stay over then for over 30 -35 mins and 60 mins - that favours higher and buys.

Many might say - that's a bit complex - having to consider time with TA - but really its not that complicated - especially if you really understand PA on the short frames and in the "noise" and at the "coalface".

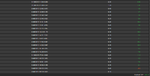

Lets have a look at the UCad chart for yesterday then

Notice the levels and the price structures and of course the time

Notice in red a 2 09 am sell - yes - a KT and a sell from our friend and alternative Fan team -

You must always praise a scalper with a winning trade

So WD Tar - must like that call - at a KT in a TW - it made good pips in a short term and i just hope he was on a 5 pip stop or under so he can claim a winner with a RR of 2 or more in under what 5 / 10 mins - excellent efficient trading

👍

BUT

We were then going to go above the LiTs area - maybe not got to that stage of the course and as we said at pre 7 00 am in the morning look for buys above the LiTs

Now if he done - he could - and should have made over 70 pips and even if he was trading after 6 00 pm another 40+ pips - and if he was PPND ing well - anything from 200 to 500 pips after that scalp the rest of the day.

Did I make over 200 pips on the UCad yesterday? ......... NO

Did I make that off other pairs ? ..........Yes

What time did i finish ?........ Before 4 30 pm with scalping with just partials then - all with stops in profit

Do the LiTs help me make more money than just scalping?........Yes - of course

Will I be showing any students etc how to capitalise on LiTs area during the next 4 to 8 months or so ?............ Yes - of course

Enjoy your weekend

Regards

F