Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

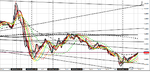

GU - Friday am Session from LO

I am going to post some charts on the GU this morning - as its been nice with regards to Key Times and Time Windows

All together I have had 8 trades on it so far - and its not Midday

EU as not been that nice - nor the EJ - and UCad and UJ only average

But the GU had far nicer PA and suited my method -

Time shown with arrow directions etc starting from LO and 8 00 am

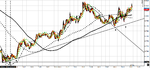

8 00 am was sell time - and after 9 00 am was buy time above

Then

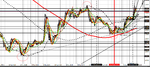

We add the sell again at another key time

And finally -

After 10 00 am the turn again shown with up arrow but for me it was alter on after 10 21 amd 10 30 am more scalp buys

Now live at 11 36 am we have broken above up past last interim high to 5418

I am going to post some charts on the GU this morning - as its been nice with regards to Key Times and Time Windows

All together I have had 8 trades on it so far - and its not Midday

EU as not been that nice - nor the EJ - and UCad and UJ only average

But the GU had far nicer PA and suited my method -

Time shown with arrow directions etc starting from LO and 8 00 am

8 00 am was sell time - and after 9 00 am was buy time above

Then

We add the sell again at another key time

And finally -

After 10 00 am the turn again shown with up arrow but for me it was alter on after 10 21 amd 10 30 am more scalp buys

Now live at 11 36 am we have broken above up past last interim high to 5418