Thank you for everyone for helping me with this. It helps my confidence to know my trading is looking ok in terms of the calculations which I am not too good at if i'm honest.

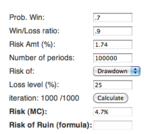

Thanks to fastcar for promoting the fact I should be trading at 1% to keep drawdowns to a minimum. It has always been my intention to reduce the 1.5% per trade to 1% when my account has grown bigger, so for now I will deal with the added risk of higher dd to grow the account more quickly.

I just wanted to give a little history how I ended up trading my system and would love some input on another aspect of this topic:

Do these figures ACTUALLY help in the real world when markets can change....

Ok before you all start shouting at me, let me explain...

I started to get in to mechanical trading around a year ago and realised this suited my personality better than discretionary decisions. At the time I met another guy who was making very good profits from a method which was using the same structure as mine but he had put a different spin on things making everything 100% mechanical.

I was shown a years period of trading this method and the results were quite simply astonishing...

1255 trades

702 wins (all at 1:1)

402 losses(Cut short to a net 360 (1:1))

151 Breakevens

This meant the winners to losers ratio was nearly 2:1 (1.95)

I honestly thought this was the holy grail. There had never been a losing month and each months profits were amazing. So I put all my time and effort in to it and he took time out to mentor me for endless hours for which I will be forever in his debt.

Now you would think with a sample size of 1255 trades that this was a well robust solid trading system.

I then decided to test the system on the 12 months before the original results had started. This took me many nights of eyestrain to achieve (did this manually, best way to test IMO), everything was done correctly and the data I was using was correct to the best of my knowledge. (Alpari and Oanda)

All of a sudden the win to losses was 1.1:1, there were losing months (3 months in a row!) and it would have been an absolute nightmare to trade. I know there are always drawdowns but for 8 months of the year it struggled severly...

Obviously this is how I ended up where I currently am with my own method of trading, which although hasnt got the high 1.95 ratio as before, has performed well on the last 2 years with the same kind of figures throughout! I still have to find time to backtest 2008-2009 but with live trading taking up my time at the moment it is difficult!

I guess the point of my post is that although we can calculate our expectancys, our profit ratios etc etc etc does it really matter considering the market can change at any time and all of a sudden the trading method you have used for the last year or so just stops working!!!!

Would love some brainstorming here!

Cheers again guys, you lot know your stuff when its comes to math/formulas!

T

what is you're system based on? the one that failed.