Important Stats, Market Type, Trading Objectives.

Thanks to fastcar for promoting the fact I should be trading at 1% to keep drawdowns to a minimum. It has always been my intention to reduce the 1.5% per trade to 1% when my account has grown bigger, so for now I will deal with the added risk of higher dd to grow the account more quickly.

YW. Since you related how a similar system backtested poorly during a certain period, I would reduce leverage as soon as you are able.

1255 trades

702 wins (all at 1:1)

402 losses(Cut short to a net 360 (1:1))

151 Breakevens

What is a win at '1:1' mean? How do you cut short 402 losses into 360 '1:1' losses? (rhetorical) I realize these numbers mean something to you, but they might not to a lot of other readers.

If we could get in the habit of listing

the number of winners and the number of losers and the net winnings and losses, that would tell us 90% of what we need to know about your system.

Again, there is rarely such a thing as a 'breakeven' trade when commissions are included, and one should just decide which column to add such trades. If you trade FX and have a number of true break-even trades, just decide which column to put them into.

Break-evens into 'Winners'. This is for those who feel they 'win' when they don't lose. Good for those who feel better about a higher win rate. It boosts your win rate, and lowers your Payoff Ratio.

Break-evens into 'Losers'. This is for those who feel they made no money after investing their valuable time into trading. Good for those who like to see a high Reward to Risk ratio. It lowers your win rate but boosts your Payoff Ratio (Reward to Risk Ratio).

Decide which method you prefer, and stick with it.

Another item that would be useful is to list over what period of time the data was collected (how many days, weeks, months etc.)

...although we can calculate our expectancys, our profit ratios etc etc etc does it really matter considering the market can change at any time and all of a sudden the trading method you have used for the last year or so just stops working!!!!

TJZ, you should very clearly understand the

two basic market types: trending and sideways. You must have ways of determining which type you are looking at before your trade goes on.

Lastly, you MUST know how your system performs in each market. You can create an outstanding system for one market type that will destroy your account in the other market type. I suspect this explains the system's variability you report.

Furthermore,

WHAT ARE YOUR OBJECTIVES? This is one reason top traders keep system statistics.

Many spend an inordinate amount of time at trading. Is it worth it? How much do you need to make in order for it to be worth it?

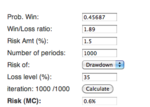

PAIN. If you have been trading long enough to sustain a serious drawdown, you have learned that trading is 100% psychological. If you start falling apart when you are -30%, and start making mistakes, skipping trades, breaking rules, losing sleep, etc. then one of your objectives may be to have no more than a 25% drawdown.

Your system has rules, and let's say for arguments sake it is complete (no more tweaking). The only way to change the likely size of your drawdown is through money management (position size).

The only way to start determining either of the above (likely returns, likely drawdowns) is by keeping good records, and using this data properly, through simulations. Further, there is the possibility that your system's characteristics (statistics) will not allow you to meet your objectives. If this is true, wouldn't you like to know?

None of this is new, but has been written about extensively. Van K. Tharp's book Super Trader, if nothing else, helps to get you thinking about some of these important questions.

Hope that helps,

fastcar