Chorlton

Established member

- Messages

- 693

- Likes

- 48

OK that all makes sense. Your backtest results looked good and I was curious about your results since your last post in March but if you are still working on the system, there won't be any results yet.

Long term, if your #'s produce the results from above, there are many people who would pay to trade your system. And if you're not independently wealthy, then this is always an attractive path. And IMO, there is no better time than now to start testing trading systems on real time data. Paper trading is free and can be automated.

Hello Zig Zag,

Thanks for your comments.

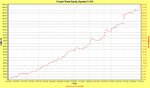

The current version of the system (which I'm still working on) is now quite a lot different to what was posted at the start of this thread. From memory the net return is now around 28% per Annum with a MaxDD of around 6%. Not that it really matters in terms of overall performance but the win rate has also increased to just over 50%. This metric may provide some level of "comfort" when trading live although I intend to follow the system's signals whatever the outcome of each trade during trading. It should be noted that I do have a particular metric which I will use for monitoring the system's performance while trading and should it be met, the system would be turned off, otherwise the system will be simply followed.

The improvements made, thus far, have been based around my own new ideas for developing Entry and Exit conditions as opposed to simple optimisation of the original system. There has been some tweaking of some values (which may contribute to some level of curve-fitting) but I don't believe the changes made to these values will impact too much on overall robustness of the system, as the variables used only contribute a small amount to the overall system's conditions for entering and exiting.

I shall post Monte Carlo results for this latest incarnation over the next day or so, purely for an update to this thread, and would welcome comments on those results at that time.

However, in should be noted that the system is yet to be exposed to any "out-of-sample" data (which is the first "real" test) although I do intend to complete this step within the next week or so (time permitting!!). I expect the performance of the overall system to drop during this phase (for obvious reasons) but feel confident that the overall performance will remain within the boundaries of what I'm hoping to achieve long-term.

FYI The in-sample data period was between 1998 & 2004, where the UK Mkrt experienced all three Mrkt conditions (Ranging , Bear and Bull Mrkt).

Regarding your comment on paper-trading, How would one automate this? My approach was to simply paper trade the system for a period of time (after completing forward-testing) and assuming performance was as expected during this period, simply introduce real money.

Chorlton