wallstreet1928

Legendary member

- Messages

- 6,609

- Likes

- 89

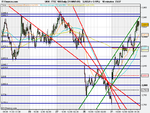

s500 dropped nearly 2% in the last 30 mins of trading

808 to 794

and I enjoyed every minute of it, why do you ask?

I'll let you work the rest out for yourselves

lets see what tomorrow will bring chaps

Analysis time

a special request goes out to those who follow this thread(I am very flattered by it, and It made me so happy today when i got a message from a newbie who put his first trade on for a profit and thanked me for the guidance i have given him)

I would like you to alert me when I start to diverge away from my trading plan the night before

i will be very grateful for it

i have done it twice in the last 2 weeks and It has cost me

Discipline is one of the hardest traits to master, no matter how long or how experienced you are as a trader ...............that's why only 5% of traders succeed and make money!!

I would like everyone on this thread to be amongst the 5%............