You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Paddington

Junior member

- Messages

- 47

- Likes

- 7

I agree Steve - made th esame point above, even before the ISM slide. Mkt doesn't seem to be looking for reasons to go up at the moment.

can't see any serious support before 200dma at around 8500 now

can't see any serious support before 200dma at around 8500 now

Tom,

I assume they wanted a bullish take on the market after today's sea of red,hence the parading of all the regular bulls.

These guys never happy until they've dragged everyone into the market.

After reading Jim Cramers book he was regularly dumped from CNBC if he didn't have a +ve spin on the market.

I assume they wanted a bullish take on the market after today's sea of red,hence the parading of all the regular bulls.

These guys never happy until they've dragged everyone into the market.

After reading Jim Cramers book he was regularly dumped from CNBC if he didn't have a +ve spin on the market.

Car Key Boi

Well-known member

- Messages

- 396

- Likes

- 8

Tom, sorry to hear that yuo got bumped on CNBC

The market hit an important equal wave retracement and reversed powerfully. It also left the market on the verge of a big breakout. IBM and Microsoft all saw strong intra-day reversals and will most likely lead the upside today. I will be long above 980 and short below 977. The market should move higher today but it may be volatile. I would watch for a gap higher, then uncertainty during the middle of the day and another big market-on-close buy program, in order to jam the bears in the holiday.

The market is panning out exactly as was discussed 10 days ago. We may already have seen the high for the year, but it is possible that we will see a lower high in the beginning of July, or perhaps even a marginally new high. This is in my opinion going to be as far as we go for the year. The market will then drop to new lows or simply enter into a trading range. I will have patience on the short positions here. It is not unlikely that the Dow could rally 300 points in this low volume environment but I will scale into short positions as the market moves higher. I am undecided if I want to wait until Thursday night to put on a short position or wait until after the holiday period. It will depend on the breadth of the rally and the momentum. If we get a huge up day today I will begin to scale in to shorts.

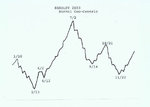

The Bradley model is indicating a reversal right here but the thing that most misunderstand about the Bradley model is that it does not give direction. It only indicates turning points. This could in theory mean that the “high” was a low instead and we will accelerate to the upside. Anything can happen and I am not going to rule out that possibility if the Dow gets a close above the 9350 area. That is why I recommend patience here.

The FTSE 100 cash index needs to get above 4000 in a hurry to have a chance of rallying. I will be sceptical on its ability to rally until I see a close above 4000 again. After that it will need to get above 4085 to be in bullish territory again.

The Expected Path had a ver profitable morning and a terrible afternoon. The good thing about the path is that I can always tell very quickly when things invert.

I have included the Bradley geo-centric model for your viewing pleasure

The market is panning out exactly as was discussed 10 days ago. We may already have seen the high for the year, but it is possible that we will see a lower high in the beginning of July, or perhaps even a marginally new high. This is in my opinion going to be as far as we go for the year. The market will then drop to new lows or simply enter into a trading range. I will have patience on the short positions here. It is not unlikely that the Dow could rally 300 points in this low volume environment but I will scale into short positions as the market moves higher. I am undecided if I want to wait until Thursday night to put on a short position or wait until after the holiday period. It will depend on the breadth of the rally and the momentum. If we get a huge up day today I will begin to scale in to shorts.

The Bradley model is indicating a reversal right here but the thing that most misunderstand about the Bradley model is that it does not give direction. It only indicates turning points. This could in theory mean that the “high” was a low instead and we will accelerate to the upside. Anything can happen and I am not going to rule out that possibility if the Dow gets a close above the 9350 area. That is why I recommend patience here.

The FTSE 100 cash index needs to get above 4000 in a hurry to have a chance of rallying. I will be sceptical on its ability to rally until I see a close above 4000 again. After that it will need to get above 4085 to be in bullish territory again.

The Expected Path had a ver profitable morning and a terrible afternoon. The good thing about the path is that I can always tell very quickly when things invert.

I have included the Bradley geo-centric model for your viewing pleasure

Attachments

After yesterday's good rally Sid's Model is suggesting a volatile session today leading to lots of whipsaw frustrations. I took out 14.5 ES points yesterday and I won't be giving them back today!

The short day tomorrow could yield a big move as Sun says with light volume. Last year I didn't bother trading the short day as I didn't think there was enough time for a reasonable move. The dow rallied 300 pts and I regretted that decision! At the time though Sid's Model wasn't fully developed and I was basically just guessing and handing over wads of cash to City Index on a regular basis.

The short day tomorrow could yield a big move as Sun says with light volume. Last year I didn't bother trading the short day as I didn't think there was enough time for a reasonable move. The dow rallied 300 pts and I regretted that decision! At the time though Sid's Model wasn't fully developed and I was basically just guessing and handing over wads of cash to City Index on a regular basis.

Similar threads

- Replies

- 1K

- Views

- 145K

- Replies

- 112

- Views

- 19K

- Replies

- 833

- Views

- 119K