You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the US the Naz/Mr. Charts Way

- Thread starter Mr. Charts

- Start date

- Watchers 59

- Status

- Not open for further replies.

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Hi Russ,

I'll look forward to seeing you - just come over and say hello!

Best wishes,

Richard

I'll look forward to seeing you - just come over and say hello!

Best wishes,

Richard

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

And mine too. I just don't know how he does it!rdstagg said:

Intrigued by your exit - way better than mine!

Good luck tomorrow Richard. Don't be phased by the big boys - you just do your stuff.

hi Paul,

Your trading examples are very informative, post 590.

I started to trade Nasdaq stocks recently, mostly story stocks. For those stocks, I work out the price target based on the support and resistance established in the past.

I haven't traded a single non story stock, because I wasn't sure if I can exit with a profit. The story stocks are traded heavily, so there is a momentume, to push the price towards the next resistance and support level.

For general stock, how do you work out your price target for day trading?

Can anyone else share how you work out a price target that works reliably?

thanks in advance.

lagalere

Your trading examples are very informative, post 590.

I started to trade Nasdaq stocks recently, mostly story stocks. For those stocks, I work out the price target based on the support and resistance established in the past.

I haven't traded a single non story stock, because I wasn't sure if I can exit with a profit. The story stocks are traded heavily, so there is a momentume, to push the price towards the next resistance and support level.

For general stock, how do you work out your price target for day trading?

Can anyone else share how you work out a price target that works reliably?

thanks in advance.

lagalere

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Bobby,

"Futurology" is not in my skills set, but I can sometimes tell what is going to happen next before it appears on a chart from my reading of level2 and the tape.

I will email you and explain how I found HSIC without any inside knowledge - I am so far outside that life I am no longer an insider ;-)))

Richard

"Futurology" is not in my skills set, but I can sometimes tell what is going to happen next before it appears on a chart from my reading of level2 and the tape.

I will email you and explain how I found HSIC without any inside knowledge - I am so far outside that life I am no longer an insider ;-)))

Richard

Salty Gibbon

Experienced member

- Messages

- 1,535

- Likes

- 6

Yes Richard - I did wonder how you managed to be in the right place at the right time.

I have had a conversation about this problem today with another member and it appears to be a common problem.

Just how do you position yourself so that you get to be looking at the right stock at the right time other than constantly flicking through charts or by having a stroke of luck. There have to be more scientific ways.

I have had a conversation about this problem today with another member and it appears to be a common problem.

Just how do you position yourself so that you get to be looking at the right stock at the right time other than constantly flicking through charts or by having a stroke of luck. There have to be more scientific ways.

Salty Gibbon

Experienced member

- Messages

- 1,535

- Likes

- 6

By the way, what happened shortly afterwards ?

The chart just stops.

The chart just stops.

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Salty,

I do not publicly disclose detailed reasons for stock selection as that is one of the subjects I coach.

However, in broad terms my radar list includes certain news stories, my core trading stocks and the specific use of a scanner. This is a process that entails about 40 minutes of premarket preparation; my scanning is done a few times during my trading hours and takes about 5 seconds.

HSIC trading was halted due to the Chiron ramifications.

Richard

I do not publicly disclose detailed reasons for stock selection as that is one of the subjects I coach.

However, in broad terms my radar list includes certain news stories, my core trading stocks and the specific use of a scanner. This is a process that entails about 40 minutes of premarket preparation; my scanning is done a few times during my trading hours and takes about 5 seconds.

HSIC trading was halted due to the Chiron ramifications.

Richard

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

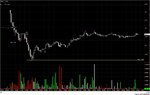

Here's a nice obvious trade I did today:

the entry was a real no brainer, first exit of 50% also obvious, second exit of 50% based on reading the tape and level2.

SYMC short 55.98

covered half 55.60

for profit +38c/share

covered rest 55.18

for profit +80c/share

I exited the first half because the probability of it going down further had dropped to around 50/50 at that point. You must trade what you see, regardless of what you think may/may not happen, so I locked in some profits.

It's very easy to say with hindsight, "oh I should have stayed in longer", but you must trade according to your rules and methods when you know that they work long term.

This is a probability business and you need to trade accordingly.

Although this one was a no brainer, had it actually initially gone against me by more than a few cents and had there been firm buying reading the tape/level2 , I would have exited with a loss of just a few cents.

This approach means that when I do get it wrong, I never lose more than a few cents, but that is not too often as I only take the high probability trades anyway.

the entry was a real no brainer, first exit of 50% also obvious, second exit of 50% based on reading the tape and level2.

SYMC short 55.98

covered half 55.60

for profit +38c/share

covered rest 55.18

for profit +80c/share

I exited the first half because the probability of it going down further had dropped to around 50/50 at that point. You must trade what you see, regardless of what you think may/may not happen, so I locked in some profits.

It's very easy to say with hindsight, "oh I should have stayed in longer", but you must trade according to your rules and methods when you know that they work long term.

This is a probability business and you need to trade accordingly.

Although this one was a no brainer, had it actually initially gone against me by more than a few cents and had there been firm buying reading the tape/level2 , I would have exited with a loss of just a few cents.

This approach means that when I do get it wrong, I never lose more than a few cents, but that is not too often as I only take the high probability trades anyway.

Attachments

SOCRATES

Veteren member

- Messages

- 4,966

- Likes

- 136

Yes, very prudent, arresting volume forming there ~ sometimes difficult to suss the intent and whether it is going to be fulfilled and it is going to go further or not. Here the arresting volume presents a significant volumetric shift that in my view you were correct not to ignore, whatever the subsequent resolution.

Salty Gibbon

Experienced member

- Messages

- 1,535

- Likes

- 6

By " arresting" volume, do you mean a volume spike ?

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Yes, indeed, Socrates. That was one of the main reasons for exiting half - though it was re-inforced by other factors.

Trust you to have seen that ;-)

Richard

Trust you to have seen that ;-)

Richard

Sirlosealot

Member

- Messages

- 63

- Likes

- 4

Salty Gibbon said:By " arresting" volume, do you mean a volume spike ?

Or perhaps the two lower volume bars on relatively wide spread down at the right hand edge in the middle chart . This could mean a drying up of sellers perhaps signalling a possible upturn. It would seem to me that no buyers arrived and sellers held back until the 55.60 resistance was broken just after 10:30.

The next bar after the last one shown on the right hand chart (I can post a chart if anyones intereseted) is a very widespread up bar on large volume. However this did not herald the begining of an up turn up and the price continued to slide down to 54.80.

For me at my level there are therefore two false signals here and this is what spooks me. When looking at the hard right edge I seem to find that I get duff signals just as much as good signals. Is this just a question of more practice and late nights with lots of coffee studying charts or any I missing something fundemental.

Regards

Gerard

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

"until the 55.60 resistance was broken just after 10:30."

"resistance"?

"this did not herald the begining of an up turn up "

actually it rose to 55.58, 43c above the previous low - look how it actually rose to previous support - exactly - before heading south again - a classic support turning into resistance

"the price continued to slide down to 54.80".

price fell to 54.59 (ok so I'm being pedantic ;-))

So, Gerard, imho, the first "false" signal wasn't, as although the indication was that sellers were indeed drying up, it does NOT follow that buyers will pile in; it becomes, as I said, perhaps 50/50.

A good way of looking at this is to consider an object falling to a hard surface. Unless you know the nature of the object, you cannot judge whether it will bounce or stay still. That's why I exited half.

Your second "false" signal wasn't either, imho, as it bounced a considerable distance; it simply then demonstrated a rubber ball like nature, bounced and fell.

May I suggest that you do not look so much for "signals" as for pieces in an ever changing puzzle where you can integrate all into a more coherent and understandable picture. This means you must not "expect" an effect from what you deem to be a cause, merely an unfolding dynamic scenario.

Only then can you even start to understand how markets work.

Now there are certain elements that enable me to read those evolving influences with a substantially high degree of probability, but I will not discuss those publicly, they are reserved.

You cannot impose order on markets with simple rules, you can only understand and trade accordingly.

I sympathise with your hard right edge problem and agree that often you will see what you think are false signals with volume - and yes they most certainly happen, but those elements I alluded to act as an efficient filter and reduce the number of false positives/false negatives to a minimum. For the occasions when the market does behave contrarily, and that is far, far less often than most people believe, stops protect you well. Although I will usually exit a trade long before a stop is hit if those elements tell me the market is going tjhe wrong way rather than just wiggling.

Sorry to be so long in this answer, but I've had half a bottle of Chardonnay and want to be absolutely sure I'm expressing what I mean ;-)

I hope you find the above helpful, Gerard.

Back to the wine..............

Richard

"resistance"?

"this did not herald the begining of an up turn up "

actually it rose to 55.58, 43c above the previous low - look how it actually rose to previous support - exactly - before heading south again - a classic support turning into resistance

"the price continued to slide down to 54.80".

price fell to 54.59 (ok so I'm being pedantic ;-))

So, Gerard, imho, the first "false" signal wasn't, as although the indication was that sellers were indeed drying up, it does NOT follow that buyers will pile in; it becomes, as I said, perhaps 50/50.

A good way of looking at this is to consider an object falling to a hard surface. Unless you know the nature of the object, you cannot judge whether it will bounce or stay still. That's why I exited half.

Your second "false" signal wasn't either, imho, as it bounced a considerable distance; it simply then demonstrated a rubber ball like nature, bounced and fell.

May I suggest that you do not look so much for "signals" as for pieces in an ever changing puzzle where you can integrate all into a more coherent and understandable picture. This means you must not "expect" an effect from what you deem to be a cause, merely an unfolding dynamic scenario.

Only then can you even start to understand how markets work.

Now there are certain elements that enable me to read those evolving influences with a substantially high degree of probability, but I will not discuss those publicly, they are reserved.

You cannot impose order on markets with simple rules, you can only understand and trade accordingly.

I sympathise with your hard right edge problem and agree that often you will see what you think are false signals with volume - and yes they most certainly happen, but those elements I alluded to act as an efficient filter and reduce the number of false positives/false negatives to a minimum. For the occasions when the market does behave contrarily, and that is far, far less often than most people believe, stops protect you well. Although I will usually exit a trade long before a stop is hit if those elements tell me the market is going tjhe wrong way rather than just wiggling.

Sorry to be so long in this answer, but I've had half a bottle of Chardonnay and want to be absolutely sure I'm expressing what I mean ;-)

I hope you find the above helpful, Gerard.

Back to the wine..............

Richard

SOCRATES

Veteren member

- Messages

- 4,966

- Likes

- 136

No, a volume spike is a volume spike and arresting volume is a different animal altogether.Salty Gibbon said:By " arresting" volume, do you mean a volume spike ?

Darn,

just erased my post - I'll start again then...

Thanks Mr C, (Fonz like or what?)

Exit at 55.59 (looks to be, my eyesight might be a cent or two out) due to falling interest (reducing volume) in continuing the move whilst drawing abeam a recent bottom where support might be expected to appear. I'm far from great at this, posessing an unerring knack for spotting the inconsequential while elephants thunder past unseen, but I think even I might have got that much of it right. Although 'right' is making profit, rather than passing the TA exam... Would you mind me asking why you picked that entry?

I appreciate that 'a real no brainer' lays me open a bit here, and looking at it I'd go for the falling volume on those two white bars from the last low, followed by a good fight over a Doji at the top which suggests a likely change in trend is imminent - going short here raises the very real possibility of a drop to the previous low whilst 'getting it wrong' will be pretty obvious the moment a move higher starts to be seen. Slightly longer term this looks like the sort of move where this last, short bullish move proves to be no more than a pause, and a second downward leg of about the same size is often seen - that would eventually bottom out around 5435 or so... again my eyeballs might be a few cents out.

I'd have thought the first exit was spot on, with every reason to expect some resistance to a lower move beyond that so taking some of the profit is prudent - as is leaving some to run of course! I don't see why the exit at 55.16 so readily though - it's still heading south, and although volume is weaker it's still a nice fat candle, not much bottom shadow (eyeballs suggest none) and nothing to provide an obvious support level about to kick in. Did you exit based on a profit target, a percentage limit you didn't want to exceed? I'd have thought some sort of close stop following the move down would have been a good way to maximise the half you ran?

Thanks for posting by the way, those of us with unerring accuracy in the foot department do appreciate it when we get free lessons from the more able.

Dave

just erased my post - I'll start again then...

Thanks Mr C, (Fonz like or what?)

Exit at 55.59 (looks to be, my eyesight might be a cent or two out) due to falling interest (reducing volume) in continuing the move whilst drawing abeam a recent bottom where support might be expected to appear. I'm far from great at this, posessing an unerring knack for spotting the inconsequential while elephants thunder past unseen, but I think even I might have got that much of it right. Although 'right' is making profit, rather than passing the TA exam... Would you mind me asking why you picked that entry?

I appreciate that 'a real no brainer' lays me open a bit here, and looking at it I'd go for the falling volume on those two white bars from the last low, followed by a good fight over a Doji at the top which suggests a likely change in trend is imminent - going short here raises the very real possibility of a drop to the previous low whilst 'getting it wrong' will be pretty obvious the moment a move higher starts to be seen. Slightly longer term this looks like the sort of move where this last, short bullish move proves to be no more than a pause, and a second downward leg of about the same size is often seen - that would eventually bottom out around 5435 or so... again my eyeballs might be a few cents out.

I'd have thought the first exit was spot on, with every reason to expect some resistance to a lower move beyond that so taking some of the profit is prudent - as is leaving some to run of course! I don't see why the exit at 55.16 so readily though - it's still heading south, and although volume is weaker it's still a nice fat candle, not much bottom shadow (eyeballs suggest none) and nothing to provide an obvious support level about to kick in. Did you exit based on a profit target, a percentage limit you didn't want to exceed? I'd have thought some sort of close stop following the move down would have been a good way to maximise the half you ran?

Thanks for posting by the way, those of us with unerring accuracy in the foot department do appreciate it when we get free lessons from the more able.

Dave

- Status

- Not open for further replies.

Similar threads

- Replies

- 254

- Views

- 44K

- Replies

- 6

- Views

- 4K

- Replies

- 134

- Views

- 30K

- Replies

- 18

- Views

- 5K