Buy The Dips

Member

- Messages

- 70

- Likes

- 2

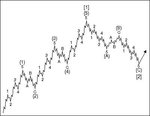

[QUOTE="Buy the Dips]There is a chorus of respectable forecasters out there are also mentioning that March 9-12 area as a bottom.

I have March 9-12 as a top.....dont know if that is good or bad yet for me being the lone bullish voice [/QUOTE]

Had this 3/12 area as a top last week.....lets see what happens tomorrow

I have March 9-12 as a top.....dont know if that is good or bad yet for me being the lone bullish voice [/QUOTE]

Had this 3/12 area as a top last week.....lets see what happens tomorrow