Market Reversals And How To Spot Them

mix and match analysis

🙂

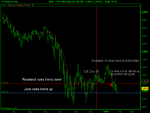

volume fut peaked 16 th Dec 08 High 4425

dropped off and price tested lows of range on low vol

point of control going back to last lows 2003 @ 4445 (see recent in last post)

volume dropped right off in new year, market becomes efficent in week / day (60 day)

value 4200 - 4400 upper 1/3 of month range, month not efficent

decending trend line breached, pullback into @ the minute

retrace being watched will consider Long entry

IF ! pick up in volume @ levels of last post

will post full details

IF an entry is made

minimum size

(Bear market) expect move to be long from lows of days accending channel

anythings possible ?

200-400 value zone

obvious 1st target for long is unfair high @ 4688 fut will be watching price volume action intra day to update

see price action being range bound in ascending channel (days) give or take while price moves across month bear channel to set up Bear fall on Swan event or the like

watching price action intra day when action of interest, today its not (capped no volume) payrolls out later so posting to kill time

🙂

Opinion expressed in this post could be updated at very

short notice and is just for FUN

🙂

Latter

Andy

nb: SPX and INDU .... mmmmmmmmmmmmmm :-( not as good imho but we will see

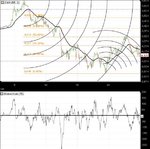

End of week:

Friday 9th : Volume on actual low 70/30 neg split, not much reaction to the awful number in the USA, Ftse move 100pts from top to tail off Dow open. both sides of the low volume range which developed if thats the right word

🙂 on the run up = hence no support offered on fall (no energy in intra day base)