You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mine sector ob ?

which way BP ?

Hi Andy,

Nice to see you circulating.

Regards Split

Bladerunner

Guest

- Messages

- 104

- Likes

- 76

Just posted because of the weightings in the ftse

Tomorton

Just posted because of the weightings in the ftse

mines banks and bp, do not trade them, infact not trading at the moment at all, just posting a few charts to add a bit more confusion to the mix 😛

BP been in a large range forever from what I can see 😆 if support goes at 10% weighting is it ? could make quite a splash

If the copper bottom drops out of the miners at the same time 😱

Latter

Andy

Hi Andy -

BP first - if I had to trade this now it would be cautiously long. There are signs its forming an ascending triangle with resistance at 538 - if it can breach this it should resume upwards with the FTS100, which it is currently lagging, worryingly. This would take it back upwards into the wide range it has been trading since a year plus, with resistance maybe 620's, support in the 510's, so a very reasonable risk:reward. But for the precise entry I would await breach of 538, then a pullback over 3 days, then go long on the next day with a higher high and higher low - as I said, cautious.

My only reservation re trading the oil sector is unpredictable changes in the oil price. Sometimes the oil producers go up with the per barrel price, sometimes not, so I see BP etc. as derivatives - hard to TA with confidence.

Tomorton

Just posted because of the weightings in the ftse

mines banks and bp, do not trade them, infact not trading at the moment at all, just posting a few charts to add a bit more confusion to the mix 😛

BP been in a large range forever from what I can see 😆 if support goes at 10% weighting is it ? could make quite a splash

If the copper bottom drops out of the miners at the same time 😱

Latter

Andy

Bladerunner

Guest

- Messages

- 104

- Likes

- 76

much better.......... thank you

Thanks

circulation is much better thank you since I stopped daytrading

Andy

Hi Andy,

Nice to see you circulating.

Regards Split

Thanks

circulation is much better thank you since I stopped daytrading

Andy

Thanks

circulation is much better thank you since I stopped daytrading

Andy

You'd be surprised at how much a little adrenaline is good for the arteries,.😀

Split

Bladerunner

Guest

- Messages

- 104

- Likes

- 76

think I was over the health limit

to much of a good thing Split 🙂

macd histo = only half of the machine = pretty worthless without the fast and slow line visable and complete understanding of how it should be used

The complete macd is very ok if you get to no it inside out - bit like the 3 ducks really if used on 3 timeframes

good trading next week

Andy

to much of a good thing Split 🙂

macd histo = only half of the machine = pretty worthless without the fast and slow line visable and complete understanding of how it should be used

The complete macd is very ok if you get to no it inside out - bit like the 3 ducks really if used on 3 timeframes

good trading next week

Andy

Hello All again.

I am continuing with my paper trading before go alive, but really feel this would have been a perfect time to go live with my account🙂

I did some homework over the weekend and concluded that FTSE, CAC and tha DAX should continue their uptrend. I opened longs on both three this morning when they went lower at first.

FTSE100: Entry at 5430 with a stop at 5415 Target was 5500

DAX: Entry at 6400 with a stop at 6375 Target was 6500

CAC is just an experiment as i missed it in the morning. Entered at 4469 with a target to 4550

All of them is in profit and raised stop levels already over entry points by 10 points.

What do you think can be the estimated target for FTSE in the longer term?

Regards,

HW07

I am continuing with my paper trading before go alive, but really feel this would have been a perfect time to go live with my account🙂

I did some homework over the weekend and concluded that FTSE, CAC and tha DAX should continue their uptrend. I opened longs on both three this morning when they went lower at first.

FTSE100: Entry at 5430 with a stop at 5415 Target was 5500

DAX: Entry at 6400 with a stop at 6375 Target was 6500

CAC is just an experiment as i missed it in the morning. Entered at 4469 with a target to 4550

All of them is in profit and raised stop levels already over entry points by 10 points.

What do you think can be the estimated target for FTSE in the longer term?

Regards,

HW07

Bladerunner

Guest

- Messages

- 104

- Likes

- 76

looks a nice trade

"Hello All again.

I am continuing with my paper trading before go alive, but really feel this would have been a perfect time to go live with my account🙂

I did some homework over the weekend and concluded that FTSE, CAC and tha DAX should continue their uptrend. I opened longs on both three this morning when they went lower at first.

FTSE100: Entry at 5430 with a stop at 5415 Target was 5500

DAX: Entry at 6400 with a stop at 6375 Target was 6500

CAC is just an experiment as i missed it in the morning. Entered at 4469 with a target to 4550

All of them is in profit and raised stop levels already over entry points by 10 points.

What do you think can be the estimated target for FTSE in the longer term?

Regards,

HW07"

Hi

looks a very good trade to me 👍

"What do you think can be the estimated target for FTSE in the longer term?"

very long term 4000 🙂

5800 fut if the top of this range goes, and it might go faster than you can fill your order in when its ready after the persons in charge of scary spikes have finnished work 🙂

Today looks to easy = this is probably it 😆

50% of the last down move = 5733 fut

think we have a reverse head and shoulders in play day or pinbars on longer tf whatever you want to call the pattern gives approx target of 5800 ish 🙂

should get the usual suspects posting hard 🙂

Andy

"Hello All again.

I am continuing with my paper trading before go alive, but really feel this would have been a perfect time to go live with my account🙂

I did some homework over the weekend and concluded that FTSE, CAC and tha DAX should continue their uptrend. I opened longs on both three this morning when they went lower at first.

FTSE100: Entry at 5430 with a stop at 5415 Target was 5500

DAX: Entry at 6400 with a stop at 6375 Target was 6500

CAC is just an experiment as i missed it in the morning. Entered at 4469 with a target to 4550

All of them is in profit and raised stop levels already over entry points by 10 points.

What do you think can be the estimated target for FTSE in the longer term?

Regards,

HW07"

Hi

looks a very good trade to me 👍

"What do you think can be the estimated target for FTSE in the longer term?"

very long term 4000 🙂

5800 fut if the top of this range goes, and it might go faster than you can fill your order in when its ready after the persons in charge of scary spikes have finnished work 🙂

Today looks to easy = this is probably it 😆

50% of the last down move = 5733 fut

think we have a reverse head and shoulders in play day or pinbars on longer tf whatever you want to call the pattern gives approx target of 5800 ish 🙂

should get the usual suspects posting hard 🙂

Andy

Last edited:

Bladerunner

Guest

- Messages

- 104

- Likes

- 76

I wish i did that in my live account and not in my excel spreadsheet🙂

thanks Bladerunner, yes, i think, that 5800ish can be a valid target then. I have to check this inverted head and shoulders though. I missed that yesterday🙂

next time HW07 :clover: 🙂

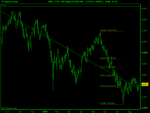

Pinbar week and day off below level

month a top on approx 50% of the old Bull run

15 th to 17 th July = Head

2nd to 10th July = left shoulder

21st July to 4th Aug = right shoulder

break out and triggered 5th August

think th 5th rivailand swing trend method went from down to up = about then anyway, sure Jon will correct me if I am out

Right shoulder does I think have / show increased volume, more consistant and the previous day lows appear to be supported

intra day hours have responded at suppport on increased volume rejecting the lows

See sector charts

Your guess is as good as anybodies = pays your money, takes your chance

Split and Barjon must be to busy counting the loot they have made to be bothered posting, noticed Split as started to trade and hold them overnight 😱

Good trading :clover:

Andy

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

Barjon, do you daytrade the FTSE index?

yeah, but only in my "play" account.

good trading

jon

Back home now and long this am on FTSE as price has breached yesterday's high and so far low holds. Nice that yesterday's low stayed above previous, 5261 on 29/07, swing trend remains up, but in other respects this chart looks bearish, so position small.

Bladerunner

Guest

- Messages

- 104

- Likes

- 76

Charts

Quick mark up this morning, volume dropped off and waiting .....

looks good Tom ........good luck

waiting for Berby babes to say its all really bad or really not good or maybe its not as bad as it looks folks 😆

Then another huge mark up in the US after some early fun and games

Good weekend all, just off to write some traffic light rules 🙂 :clover:

Andy

Quick mark up this morning, volume dropped off and waiting .....

looks good Tom ........good luck

waiting for Berby babes to say its all really bad or really not good or maybe its not as bad as it looks folks 😆

Then another huge mark up in the US after some early fun and games

Good weekend all, just off to write some traffic light rules 🙂 :clover:

Andy

Attachments

Bladerunner

Guest

- Messages

- 104

- Likes

- 76

10:05 a.m.Soothing words from Bernanke at Jackson Hole

🙂

Good trade Tomorton

🙂

Good trade Tomorton

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

Sorry guys, been remiss in keeping things up to date 😱.

We got the retracement, but it was a very messy affair with the second low pretty unconvincing and accompanied by a nasty downward opening gap on Tuesday to give the potential swing low. Nonetheless, some will have entered long around 5404/5 and those who tried that as a tester on Thursday will probably have built up to a full position yesterday. Some short termers will already be out and counting a nice day (take a bow tomo 😀) but we'll watch how it pans out on a position basis.

I've included a 2 day chart for interest. When the daily action is messy it often pays to merge daily candles and it certainly looks much better viewed this way.

good trading

jon

We got the retracement, but it was a very messy affair with the second low pretty unconvincing and accompanied by a nasty downward opening gap on Tuesday to give the potential swing low. Nonetheless, some will have entered long around 5404/5 and those who tried that as a tester on Thursday will probably have built up to a full position yesterday. Some short termers will already be out and counting a nice day (take a bow tomo 😀) but we'll watch how it pans out on a position basis.

I've included a 2 day chart for interest. When the daily action is messy it often pays to merge daily candles and it certainly looks much better viewed this way.

good trading

jon

Attachments

I should also add that I am long on BP, at least short-term, and after this came up in discussions here a week ago went long on BP Friday morning when it was 2p down, ended the day on 2p up, so a good start. Seems to have a nice range with support about 510, aiming towards about 620. Like to put my money where my mouth is but also found The Trader himself favoured this play in the IC a week ago.

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863