dbp

At best I would have to say "randomly", albeit with what I feel is at least an eye to price action. At worst I would say, in an undisciplined and often self-destructing manner! 🙄

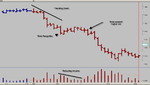

I continually carry out pattern study in an effort to find the confidence to develop a set of tested and defined entry rules. I hope these will take over from the current collection of ideas, which might include - sell a double top, buy a double bottom, enter against any tweezer tops/bottoms, look for reversal patterns at key price levels, attempt to identify S/R as an aid to entries, attempt to enter at pullbacks after breakouts.

I am well aware of my problems, and am attempting to put them right. The main obstacle I currently have is a psychological one which prevents holding winning trades due to the level of drawdown I have experienced on my futures account. Any profit has to be grabbed before it vanishes!

I'm just answering your question as candidly as I can - not in effort to gain sympathy, but hopefully as an aid to my own metamorphosis!

I spent the best part of the day today studying the 5min NQ chart, and I feel a lot better than the last time I did this, which seemed to confuse me further, by simply highlighting the random nature of the charts! I am looking to identify a single pattern which I can work with, and I believe I may be onto something. 🙄

Time as ever will tell. 😉

I hope this answers you question.

Q