The Standard & Poor’s 500 Index capped its first weekly decline of the year, after reaching the highest level since October 2007, amid increasing concern the Federal Reserve will curtail its stimulus program.

Equities rebounded on the last day of the week as German business confidence rose more than estimated. Freeport-McMoRan Copper & Gold Inc. and U.S. Steel Corp. sank at least 7.3 percent to pace declines in raw-material companies. Abercrombie & Fitch Co. tumbled 8 percent as it forecast a first-quarter loss. Hewlett-Packard Co. (HPQ), the largest personal-computer maker, surged 14 percent after forecasting profit that beat estimates.

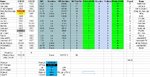

The S&P 500 slid 0.3 percent for the holiday-shortened week to 1,515.60. The index snapped a seven-week advance, the longest stretch since January 2011. The Dow Jones Industrial Average advanced 18.81 points, or 0.1 percent, to 14,000.57.

“When things seem to go in straight lines, it makes me wonder how long the good times can keep rolling,” said Brian Jacobsen, who helps oversee about $217 billion as chief portfolio strategist at Wells Fargo Advantage (EAD) Funds, in Menomonee Falls, Wisconsin. “The Fed didn’t tell us anything we didn’t already know, but sometimes it doesn’t take a lot to push prices around.”

Equities fell as several policy makers said the central bank should be ready to vary the pace of their $85 billion in monthly bond purchases, according to minutes of the Fed’s latest meeting. Concern about the debate over the risks and benefits of further quantitative easing helped give the S&P 500 its biggest two-day decline since November during the week.

Spending Cuts

Next week’s March 1 deadline to avoid automatic U.S. spending cuts may get investors’ attention. It marks another fiscal showdown between President Barack Obama and congressional Republicans. If Congress doesn’t act, federal spending will be reduced by $85 billion in the final seven months of this fiscal year and by $1.2 trillion over the next nine years.

The S&P 500 has gained 6.3 percent this year as U.S. lawmakers agreed on a compromise on taxes in January and amid better-than-estimated corporate earnings. About 73 percent of the S&P 500 companies that have released quarterly results beat profit estimates, according to data compiled by Bloomberg. The index trades at 14.97 times reported earnings, below the average since 1954 (SPX) of 16.4.

“The support for the market remains,” John Carey, fund manager with Boston-based Pioneer Investment Management, said in a telephone interview. His firm oversees $200 billion. “There’s been a fairly good stream of earnings. There’s certainly nothing to scare anyone.”

Biggest Losses

Measures of commodity and consumer discretionary companies had the biggest losses in the S&P 500 among 10 industries in the week, slumping at least 1.4 percent. The Morgan Stanley Cyclical Index of companies most-tied to economic growth retreated 1.7 percent, the most since November.

The Chicago Board Options Exchange Volatility Index, which measures the cost of using options as insurance against declines in the S&P 500, surged 14 percent to 14.17. The gauge, which had the biggest weekly advance this year, rose after sliding to the lowest level since April 2007 on Feb. 19.

Abercrombie (ANF) tumbled 8 percent, the most since August, to $46.86. The retailer said it anticipates a “slight” loss in earnings per share in the first quarter, citing a tough economy and difficulty tied to cold-weather inventory.

‘Very Concerned’

The company is “very concerned around the macroeconomic situation coming into the first quarter,” Chief Executive Officer Michael Jeffries said. Abercrombie will “see a resumption of healthier sales” in the second quarter, he said.

Apple Inc. (AAPL) declined 2 percent to $450.81. Foxconn Technology Group, the maker of products including the iPhone, froze hiring across China, fueling concern that the move reflects diminished demand for consumer electronics. Bruce Liu, a spokesman for Taipei-based Foxconn, said the company halted recruitment until the end of March after more workers returned from the Lunar New Year break than a year earlier.

Apple has retreated 36 percent from a record high in September, compared with a 3.7 percent gain for the S&P 500.

A measure of homebuilders in S&P indexes slumped 6 percent, the biggest decline since September. Toll Brothers Inc., the largest U.S. luxury-home builder, tumbled 6.7 percent to $34.59 after reporting fiscal first-quarter earnings that trailed analyst estimates and projecting narrower margins.

Garmin Ltd. (GRMN) sank 11 percent to $35. The biggest maker of navigation devices forecast 2013 sales and profit that missed estimates as consumers switch to smartphones for maps and directions.

Missing Estimates

VeriFone Systems Inc. plunged 42 percent, the most since November 2008, to $18.92. The maker of credit-card terminals forecast second-quarter profit that missed analysts’ estimates amid weak economic conditions in Europe.

Hewlett-Packard added 14 percent, the most since March 2009, to $19.20. The company is using job cuts to bolster profit as demand for printers and personal computers slumps and companies curtail purchases of higher-margin hardware and software. Chief Executive Officer Meg Whitman said she feels “pretty good” about fiscal 2013 and reaffirmed a prediction that the company will resume growth next year, evidence of progress on a five-year turnaround plan even as competitive pressures linger.

Google Inc. (GOOG) rose 0.9 percent to $799.71. The operator of the world’s largest Web-search engine surpassed $800 for the first time as mobile computing bolsters growth.