You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

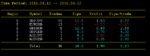

This is my real account balance for the day...fall fall & then climbing. But now I am over 28 trades, win rate 54%. Consecutive win 5 & consecutive losses 2

Daily pl is still -24. But glad that reduced it from -57. I could try trading more. But I don't think it will rise any more. This week, I will trade demo only

Was trading Demo side by side, demo is in 19 pips pure profit. Let see tomorrow.

That's it!

Enough losses I received.

I am no longer trading in real. No what ever people says. I will trade real account on that day, when I will earn 200 pips in 2 weeks on my demo trading.

------------------------------------------------------------------------------------

Hi Sun,

Last week market was a bitch with me and I also stopped trading real. I've come to realize that, as long as one trades on demo as seriously as it was real, there is no point to go real when the "system" is not giving positive results.

I'm feeling pretty depressed with my trading right now🙁. I'll be on demo until I get my mojo back.

Cheers,

K

Hi R,Last stats...

View attachment 222282

The maximum consecutive wins increased to 60 now 😉

It's mainly because I take some freedom with drawdown. Trades are not stopped as short as F says.

There is a important law I apply: "never trade majors"

R.

Glad to see you're doing so well. Keep it up.

On your last posts, you touched two topics that are very interesting to me. I know you're a real trader and can share a sensible opinion.

First the drawdown: anyone trading live will know that F's recommended DD of -2 pips is totally unrealistic (for the lack of a better word😀). While it's wise to cut losses soon, working with a very tight DD will bring only losses that will add up to a big loss over not too many trades. I'm sure Sun can relate to that. So, what sensible DD do you think is "healthy" when scalping (more sort of day trading when one is shooting for 10+ profit pips)?

Second, trading the crosses: I've been observing how to trade a cross based on the movements of its majors. My conclusion is that the cross' moves are guided by the majors (I hope I explain myself well enough). So, say, a S/R area on the cross depends only on the major's moves, so a sound technical analysis on the cross can not be done appropriately without analyzing its majors. Am I wrong on that view? How do you approach the TA/Price action of the crosses?

Keep inspiring us with your great results.

Cheers,

keen246

I use a lot of F's method and add some realism too. 😀

I will pm you.

It's a relief to read that from you, Nick. I thought it was only me who sensed that or that I was somewhat wrongly biased.

remulix

Active member

- Messages

- 151

- Likes

- 133

Hi R,

Glad to see you're doing so well. Keep it up.

On your last posts, you touched two topics that are very interesting to me. I know you're a real trader and can share a sensible opinion.

First the drawdown: anyone trading live will know that F's recommended DD of -2 pips is totally unrealistic (for the lack of a better word😀). While it's wise to cut losses soon, working with a very tight DD will bring only losses that will add up to a big loss over not too many trades. I'm sure Sun can relate to that. So, what sensible DD do you think is "healthy" when scalping (more sort of day trading when one is shooting for 10+ profit pips)?

Second, trading the crosses: I've been observing how to trade a cross based on the movements of its majors. My conclusion is that the cross' moves are guided by the majors (I hope I explain myself well enough). So, say, a S/R area on the cross depends only on the major's moves, so a sound technical analysis on the cross can not be done appropriately without analyzing its majors. Am I wrong on that view? How do you approach the TA/Price action of the crosses?

Keep inspiring us with your great results.

Cheers,

keen246

Hi K,

Sorry to read that you are having some bad issues with your real results. I think you are right to trade in demo again, get more experience and insurance and then trade real again (before to be absolutely dry 😢)

I agree, here are 2 very important topics 😉

Please take note tham I'm not registered as a teacher and don't mean to be :smart:, so what I will say is only my opinion and can be absolutely wrong in the long term (or short maybe 😱)

First, the DD:

Well, I don't apply a strict law to DD; I just avoid to go "deeper" than 10% for 3 trades opened simultaneously.

Think that I made a short description some posts ago.

Second, the crosses:

It's closely linked to DD, take the example of GA; this pair is some kind of lift going up and down endlessly; many "traders" are using martingale on GA even for some years without crash (Beware, I don't say anyone should do it).

Concerning majors, yes they are conditioning crosses behavior but never forget that FX is a zero sum game...

It's not clear enough ? Okay, you don't expect me to tell you everything ? 😆

Seriously, do you think that someone having a reliable trading method would give it on a forum ?

Probably not...:whistling

All the best.

R.

It's a relief to read that from you, Nick. I thought it was only me who sensed that or that I was somewhat wrongly biased.

Well of course a 2 pip stop is not possible, unlike as you said to constantly get kicked out and rack up charges on your account.

I still look at the lr's but as I have said more than once they are just another m/a indicator, possibly faster. If I am trading I am watching constantly and could draw lr's to a naked chart by now and in reality it is not much different to what I have done for years scalping on the Dax. I have levels marked and look for short term changes which you can see visibly if you are glued to the screen.

I take differing stops and size depends if I am going with or against the medium trend, medium being our very short term trading style. I certainly don't go short whilst long simultaneously so I can claim huge pippage. I also will enter a trade in parts, so to a certain extent I don't mind the pullback as I think my average is lower but if it goes against fast get out and rethink it. Yes it costs but better to get out -8 than -28 or doubling up.

As for your comment on major pairs. In general they are of course correlated and I don't trade EA without watching EU and AU as I want to know what is the driver here. Also this last 2 weeks I have traded so much on GJ UJ and GU and of course they are all connected too. Sometimes it is useful to watch the major as you may spot support or resistance in the major that isn't on the minor chart yet and you can take account of it.

GL

on the 1m I suggest you also look at patterns formations as double and triple top, 3 pushes up, fail final flag and two legs pullback in a strong trend.

Keep in mind 60% of the time the high/low of the day is formed in the first couple hours starting from Frankfurt/London.

At times if you can catch the high of the day and if you got the guts to stay with it you can make 100 pips by risking 10.

Remember only 30% of the time you have trend days, the other days are range days, here best is to fade the new extreme.

Always wait for a trend bar to confirm your entry.

Mark the HLOC of the day and see how prices react to them, also draw proper trendlines, But I would focus particularly on the above patterns mentioned.

Be patient, if market is not showing her legs do not ask her out.

GL

Keep in mind 60% of the time the high/low of the day is formed in the first couple hours starting from Frankfurt/London.

At times if you can catch the high of the day and if you got the guts to stay with it you can make 100 pips by risking 10.

Remember only 30% of the time you have trend days, the other days are range days, here best is to fade the new extreme.

Always wait for a trend bar to confirm your entry.

Mark the HLOC of the day and see how prices react to them, also draw proper trendlines, But I would focus particularly on the above patterns mentioned.

Be patient, if market is not showing her legs do not ask her out.

GL

Last edited:

And this is what I am talking about: the grey H line is the high of the previous day, here, she made a complex triple top..... confirmed by a bear trend bar, my entries are just below it by 1 pip plus spread, my SL is placed above the extreme. Took profit nearly about 3 times my risk at the upper trendline.

Also notice before the triple top there was a breakout pullback of the previous day high and then she stalled the way down after the TT at the previous day high.

Why I did not take the BOPB? Because I am a counter trader and I always look for early morning reversals, that is why I suggested the above patterns, they are all counter trade patterns, except the two legs PB in a strong trend, when there is a strong trend from the open I look for a TLPB or abcd pattern.

Also notice before the triple top there was a breakout pullback of the previous day high and then she stalled the way down after the TT at the previous day high.

Why I did not take the BOPB? Because I am a counter trader and I always look for early morning reversals, that is why I suggested the above patterns, they are all counter trade patterns, except the two legs PB in a strong trend, when there is a strong trend from the open I look for a TLPB or abcd pattern.

Attachments

Last edited:

And this is what I am talking about: the grey H line is the high of the previous day, here, she made a complex triple top..... confirmed by a bear trend bar, my entries are just below it by 1 pip plus spread, my SL is placed above the extreme. Took profit nearly about 3 times my risk at the upper trendline.

Also notice before the triple top there was a breakout pullback of the previous day high and then she stalled the way down after the TT at the previous day high.

Why I did not take the BOPB? Because I am a counter trader and I always look for early morning reversals, that is why I suggested the above patterns, they are all counter trade patterns, except the two legs PB in a strong trend, when there is a strong trend from the open I look for a TLPB or abcd pattern.

last thing....only trade one pair (not more than 4 hours session) maybe two but I do not suggest it, you are against the best traders and total focus is essential.

last thing....only trade one pair (not more than 4 hours session) maybe two but I do not suggest it, you are against the best traders and total focus is essential.

Hi Fugazsy,

Good to hear from you...

Thank you for sharing your trading view. Focusing one 1-2 pairs F also suggested that. Also mentioned the importance of 1st 2 hours of opening session. I like the idea of 10 by 100. That's the main objective of SSS method.

I do use patterns, Last day I used it for EU. Price action is always the main part.

Today trading was good, but only thing I notice that for 70% of my trade I exited early specially with cross pairs.

Like my last trade with GA:

Area where I exited, market moved more than 25+ pips.

Regards

S.

Well of course a 2 pip stop is not possible, unlike as you said to constantly get kicked out and rack up charges on your account.

I still look at the lr's but as I have said more than once they are just another m/a indicator, possibly faster. If I am trading I am watching constantly and could draw lr's to a naked chart by now and in reality it is not much different to what I have done for years scalping on the Dax. I have levels marked and look for short term changes which you can see visibly if you are glued to the screen.

I take differing stops and size depends if I am going with or against the medium trend, medium being our very short term trading style. I certainly don't go short whilst long simultaneously so I can claim huge pippage. I also will enter a trade in parts, so to a certain extent I don't mind the pullback as I think my average is lower but if it goes against fast get out and rethink it. Yes it costs but better to get out -8 than -28 or doubling up.

As for your comment on major pairs. In general they are of course correlated and I don't trade EA without watching EU and AU as I want to know what is the driver here. Also this last 2 weeks I have traded so much on GJ UJ and GU and of course they are all connected too. Sometimes it is useful to watch the major as you may spot support or resistance in the major that isn't on the minor chart yet and you can take account of it.

GL

Hi Nick,

Thanks for sharing your approach. You gave me something to chew on👍..."I also will enter a trade in parts, so to a certain extent I don't mind the pullback as I think my average is lower but if it goes against fast get out and rethink it.".

More often than not, I get the direction right, but the frequent pullback kicks me out. I'm thinking your technique can be the answer to bear with the pullback and exit with a minor injury if the pullback happens to be a reversal.

I had read before a similar approach from Lance Beggs, but never liked the idea as he enters full size and scales out as the trade goes his way. The problem I see is that, if the trade goes immediately against you, you lose twice.

If I understood your concept well, you enter with half the intended lot size, and when you see the the pullback is over or if the trade goes your way immediately, you enter the second half of the lot. Is that right, or I'm making false assumptions?

I'm looking forward to reading what you think about the other "topic". As you said, while there are some useful concepts, I always found it weird and wondered why😱.

Thanks again.

Cheers,

Keen236

Hi R,Hi K,

Sorry to read that you are having some bad issues with your real results. I think you are right to trade in demo again, get more experience and insurance and then trade real again (before to be absolutely dry 😢)

I agree, here are 2 very important topics 😉

Please take note tham I'm not registered as a teacher and don't mean to be :smart:, so what I will say is only my opinion and can be absolutely wrong in the long term (or short maybe 😱)

First, the DD:

Well, I don't apply a strict law to DD; I just avoid to go "deeper" than 10% for 3 trades opened simultaneously.

Think that I made a short description some posts ago.

Second, the crosses:

It's closely linked to DD, take the example of GA; this pair is some kind of lift going up and down endlessly; many "traders" are using martingale on GA even for some years without crash (Beware, I don't say anyone should do it).

Concerning majors, yes they are conditioning crosses behavior but never forget that FX is a zero sum game...

It's not clear enough ? Okay, you don't expect me to tell you everything ? 😆

Seriously, do you think that someone having a reliable trading method would give it on a forum ?

Probably not...:whistling

All the best.

R.

Thanks for your reply.

I'm focusing my attention on what is the cause of most of my losing trades, which I pinpointed to be the DD and the pullbacks (and FEAR!). That's why I asked.

Sure, nobody should expect to find in these forums a detailed working trade system. Trading is not a science, and there are not fixed rules that suit everybody. But once in a while, people share tips and good advice which can be helpful. I guess that's the main reason we all are here.

Keep up the good trading.

Cheers,

K

Last edited:

remulix

Active member

- Messages

- 151

- Likes

- 133

Hi R,

Thanks for your reply.

I'm focusing my attention on what is the cause of most of my losing trades, which I pinpointed to be the DD and the pullbacks (and FEAR!). That's why I asked.

Sure, nobody should expect to find in these forums a detailed working trade system. Trading is not a science, and there are not fixed rules that suit everybody. But once in a while, people share tips and good advice which can be helpful. I guess that's the main reason we all here.

Keep up the good trading.

Cheers,

K

Hi K,

Of course we are sharing tips and I agree that's why we are all here.

To be perfectly honest, I'm a "recent" trader (2013) and even if I have good results I dunno if it's the right way to do. Moreover I don't plan to do this all my life, I function better with the sun in my eyes.

Nick is much more experienced and following his advice is probably the best thing to do.

All the best.

R.

Hi Fugs!on the 1m I suggest you also look at patterns formations as double and triple top, 3 pushes up, fail final flag and two legs pullback in a strong trend.

Keep in mind 60% of the time the high/low of the day is formed in the first couple hours starting from Frankfurt/London.

At times if you can catch the high of the day and if you got the guts to stay with it you can make 100 pips by risking 10.

Remember only 30% of the time you have trend days, the other days are range days, here best is to fade the new extreme.

Always wait for a trend bar to confirm your entry.

Mark the HLOC of the day and see how prices react to them, also draw proper trendlines, But I would focus particularly on the above patterns mentioned.

Be patient, if market is not showing her legs do not ask her out.

GL

Very good advice you just shared on this post. Waiting for those patterns requires a lot of patience, but sure they happen all the time.

I'm not sure what these two patterns "..fail final flag and two legs pullback.." are to you. When you have some time, could please upload an example of each. People tend to give personalized names to the patterns. My log book is full of pattern names that I'm sure on one would understand:cheesy:.

What you call "a trend bar", is a strong bar on the counter trend direction that strongly engulfs the previous bar(s). Is that so, or there is another distinct characteristic for such trend bar?

Cheers,

Keen246

Hi Fugazsy,

Good to hear from you...

Thank you for sharing your trading view. Focusing one 1-2 pairs F also suggested that. Also mentioned the importance of 1st 2 hours of opening session. I like the idea of 10 by 100. That's the main objective of SSS method.

I do use patterns, Last day I used it for EU. Price action is always the main part.

Today trading was good, but only thing I notice that for 70% of my trade I exited early specially with cross pairs.

Like my last trade with GA:

View attachment 222500

View attachment 222498

Area where I exited, market moved more than 25+ pips.

Regards

S.

Hi Sunny.

Keep in mind the 100 pips do happen every day but will happen 30% of the time, we need to adapt to the market conditions.

Most days are range, fading the new extreme is what the best traders do, you can cover most at the other extreme and leave some in case continues.

Profit taking is an art form, you need to have a plan, having a plan keeps fear at bay.

In my view you are taking too many trades and you are shooting from the hips, your job is to make money not to be right.

The big financial institutions will place their best traders on the majors, you need to be aware of that and get prepared.

hugs from Fugs

Hi Fugs!

Very good advice you just shared on this post. Waiting for those patterns requires a lot of patience, but sure they happen all the time.

I'm not sure what these two patterns "..fail final flag and two legs pullback.." are to you. When you have some time, could please upload an example of each. People tend to give personalized names to the patterns. My log book is full of pattern names that I'm sure on one would understand:cheesy:.

What you call "a trend bar", is a strong bar on the counter trend direction that strongly engulfs the previous bar(s). Is that so, or there is another distinct characteristic for such trend bar?

Cheers,

Keen246

Hi Keen

Good to hear from you.

A fail final flag is a move in one direction and a pause (flag), a break out of that flag and then a failure.

A two legs pull back in a bear trend is the bulls trying to counter the bears twice and then it fails: one push up, a small retrace, another push up and a failure.

A bear trend bar is a bar which closes near its low and most of the time covers the body of the previous bull bar. Is a strong bar.

Keen do not get lost in terminology, you are not a clerk file, patterns are a translation of trader psychology, there are tugs of war going on at each point of the chart, even when the price is not moving, it only means the parts are settling in.

As a retail trader we need to be cautious and have great patience, especially in scalping........

Normally when prices try to do one thing twice and fail the opposite will happen and here lays the core significance of the pattern I mentioned.

Always weight the direction of the least resistance and take trade in that direction but not always.....market does not have to do anything, market just is and the trader needs to have an open mind to trade what is there not what he/she thinks will be. Trade traders not patterns.

Similar threads

- Replies

- 15

- Views

- 58K