Sure...Take you time...

Good night from me...😴

See you tomorrow...

Hi Sun

Ok back to the points on price action and reading price and candles or bars etc.

First of all with regards to exits - for now - when iN doubt and up in profit - take it

So if you are up 8 pips dont let it go back to 1 or 3 pips to exit.

As you develop i will show you how you stay in trades longer via whats know as pyramiding and peeling - but thats a bit away from.

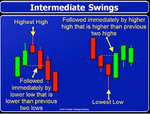

Reading price action on a 1 min chart is all down the HH's and HL's or opposite on moves and then interim S & R levels

Your example is fine but to add to its useful to always know both the level to look for for a reversal and the level that keeps you in the trade ongoing

I am going to give you an example on the UCad this afternoon as a daily low

Yes I caught it and also called it in my thread along with the scalp buy

But lets look at both the PA and the LRs and the time clues to assist us on the move that then took place

Look at the clues you will start to understand more

1 Ucad had fallen after news

2. It was trying to do a falling knife - false sentiment set up to get more bears in on sells before frying them

3. We had entered an hour TW - ie 1 51 pm to 2 09 pm - and important one as Europe coming back off lunch breaks and the US starting their day - so a big audience to trap or catch out

4. We had one low and stopped - during those few minutes price stalled and the LRs started to go under

5, the next pa gave us a sell again with a new low - just a few pips lower - but at a strong support area.

6. the candle gave us the bull signs - ie long wick and then the next 2 candles after 1 56 pm were strongly bullish

7. Lrs under time coming to hr change at 2 00 pm and PA reading on 2 or 5 candles - HH and HL's

8 2 00 pm confirmation we should be scalp buying although when you increase you skill levels you would buy at 1 57 pm prior to hr change as still would make you over 10 pips in those 2 or 3 mins

9. More Lrs under PA bullish and then after 30 mins from 1 56 pm with no breach of low - more clues for it trying up higher.

10. To try and do this naked without KT's and no LRs is more difficult - they are our aides / clues etc - as well as pure PA on the 1 min chart

12. When would I have pulled a scalp buy? - under 3113 after it made over 3114 - yes that close - that down to the momentum and the power of the change

13. When would I have sold again ? under the 3110 low at maybe 8 or 7 - I do think about both directions - I am fluid and dynamic - no fixed views or blinkers

To read PA and understand price movements on a 1 min chart is the same as on a 15 or 30 min chart -except quicker and more accurate allowing better RR wins

Trouble is - it's not easy or encouraged - like most things in life. You dont need 5000 or 10000 hrs to do what I am going to show you - but you will need over a thousand hrs at the coalface in the noise - that could take at just say 25 hrs a week nearly a year - but every month you will learn more and improve your skill level

We do need you with an ECN / STP broker - even on demo

If after a year or two you was not scalping for 3 -10 pips - then not so bad on 2 pip spreads if average wins were 12 - 20 + pips - its your choice etc

2 more days of this first week left - and all going to plan - so no worries from my side

Regards

F