Today taken less trade, I will be doing home work now. Need to review few things.

Today my trade was around 1-5 pips. But from tomorrow , new month i will holding my trades little longer until i get minimum 3 pips profit. So from tomorrow, i might get -60 to -100 pips losses in total. Expecting the worst. So lets see..

To F, I already made many post today with examples. I asked few questions. Hope you don't mind. There is no hurry. When ever you get time, reply at your pace.

Good night.

Hi Sun

Not long got back and have not been trading this afternoon although do have some 30% partial stakes still on from early on this morning

OK - will answer your questions later on - and meanwhile a couple of comment and I have updated the UCad 1 min chart so you can see it from a full day view along with all the LR's

For now - its too complex to go straight to 9 + LRs - but I am sure you can see how they might assist more to help identify PA and PS with either bull or bear bias

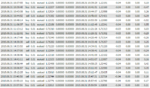

I have also shown the intraday S & R levels - based on a 1 min chart over the last week as well as from yesterday and today. - Red is R and Green is support

Note HH's and HL's and also some other LRs keeping you in a buy up to the R area

Also I have added some KT's - I was not here to take the scalps unfortunately.

Dont worry about your losses - they will not be minus 60 or minus 100 + pips etc any day or days this week - unless we got a black swan and your stops etc got gapped. There is a way round that as well - but will explain that later on after stage 5 .

The reason being - you have to keep your maximum loss to 5 pips - ideally including spreads and so for minus 60 pips - you need 12 losses in a row

Please check through your first 500 scalps - I am sure you would have say 3 or 5 consecutive losses etc - but I dont think you would have over 7.

Normally if you have over 3 in a row - stop trading have 30 or 60 mins off

But - as you will find out later - I can have 3 or 4 losses in a row some really bad periods - but they might only be minus 2 or minus 4 - B/E or minus 2 - so even 4 losses for me can still be under 10 pips - easy to get back with 1 or 2 good scalps

Thats why tight stops are key

If you are wrong get out ASAP - you will end up being wrong but because your entry is so good - you still get out plus 1 or just B/E -its all possible as your skills improve etc etc

Also this week I expect you to have the odd winner over 10 pips - in fact you might have a few - so what should happen if you can keep over 65% win rate - ( we will get it over 75%) then with a few larger wins - suddenly everything changes and you win days might be 15 or 20 pips rather than 4 or 7 pips.

The key is doing a minimum 10 trades ( although if you have just 7 or 8 great winners in a row - just stop) and able to take up to 25 if need be to out trump any losses of say 6 or 8 small losses.

Hopefully your losses stay under 4 pips and you wins start to average over 7 pips and then the odd 15 or 20 pip winner is cream on the cake etc

More to follow later

Regards#

F