Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

12 Reasons Why Gold Will Rebound and Make New Highs in 2014

Best summary I've ever read on gold:

https://www.goldstockbull.com/articles/12-reasons-gold-will-make-new-highs-2014/

I will quote the things I like the most.

#1 – Rapidly Growing Debt

#3 – QE to Infinity Confirmed, as FED Balance Sheet Explodes

#4 – Dollar Losing Status as World Reserve Currency

#5 – Global Race to Debase

#6 – Inflation Will Pick Up as Velocity of Money Accelerates

#7 – Diversification of Price Discovery and Decreased Power to Manipulate Commodity Markets

#8 – Increasing Physical Demand Worldwide, Including Central Bank Demand

#9 – Stagnant or Declining Supply

#10 – Tiny Size of Gold Market versus Stock or Bond Market Will Provide Leverage

#12 – Prices Have Dropped to the All-In Cost of Production, Which Typically Provides Support

Conclusion

Best summary I've ever read on gold:

https://www.goldstockbull.com/articles/12-reasons-gold-will-make-new-highs-2014/

I will quote the things I like the most.

#1 – Rapidly Growing Debt

...The U.S. national debt has increased by more than a trillion dollars in the past 12 months. This pushed the total debt above $17 trillion for the first time in history...

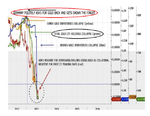

#3 – QE to Infinity Confirmed, as FED Balance Sheet Explodes

At Gold Stock Bull, we have long been calling QE3, “QE to Infinity” and doubting that any major tapering would occur. With weak economic growth and low official inflation, the FED’s dual mandates would dictate more stimulus, not less. Just weeks ago there was a consensus for tapering in September. Now, analysts are talking about March of 2014 at the earliest. My expectation is that they will change the QE program, maybe give it a different name, but the end result will always be a net increase in stimulus efforts.

The FED’s balance sheet has already increased from $869 billion in August of 2007 to $3.8 trillion today! The nomination of Janet Yellen as FED chief adds gasoline to the fire, as she is expected to be at least as accommodative as her predecessor and potentially much looser with the printing press. Helicopter Yellen?

#4 – Dollar Losing Status as World Reserve Currency

The exorbitant privilege of being able to print the world reserve currency is coming to end. “It is perhaps a good time for the befuddled world to start considering building a de-Americanized world,” said a statement on Monday by Xinhua, the state news agency of China — which holds some $1.3 trillion in Treasury bonds.

...

Takeaway: The dollar historically has an inverse relationship to gold. As the dollar continues to lose its role as world reserve currency and its purchasing power declines, the gold price will move higher. Mike Maloney and other analysts have calculated that the gold price needs to climb past $15,000 per ounce to account for all of the paper dollars that exist today. As more and more money is printed and debt is monetized, this target price only increases.

#5 – Global Race to Debase

Takeaway: The race to debase has only intensified in the past few years, as evidenced by new stimulus programs in Europe and Abenomics in Japan. Put simply, the more fiat money that is created in this currency war, the higher the price of gold and other commodities will climb.

#6 – Inflation Will Pick Up as Velocity of Money Accelerates

Up until this point, a large portion of the new money printed since the financial crisis has been parked with the banks or as excess reserves with the FED. Banks are reluctant to lend and corporations are also hoarding cash. Individuals are consuming less, tightening their budgets amidst high unemployment and stagnant wages and paying down debt. This means that money has not been circulating throughout the economy at a very fast pace. The stimulus has disproportionately benefited banks and the wealthiest people in society, doing little for the middle class that continues to get squeezed.

To get money flowing, future stimulus efforts must be focused on tax breaks or refunds for the working class, who are more likely to spend that money into the economy than the rich that aren’t living near the margin. With unemployment higher than desired and official inflation lower than desired, I think we will see Yellen and the FED focus more on consumer stimulus now that the banks finances have been shored up. This will lead to a sharp increase in the velocity of money and when multiplied by all of the money created in the last few years, it could lead to high inflation or even hyperinflation if the FED fails to soak up the excess liquidity in time.

#7 – Diversification of Price Discovery and Decreased Power to Manipulate Commodity Markets

With the rising power and influence of the East, we are seeing the centers of global finance reposition. These include the Shanghai Exchange and Pan Asian Exchange, where an increasing amount of physical gold and silver are being traded. If you believe the COMEX and London Bullion Market Association (LBMA) are helping to manipulate the prices of precious metals, it will be welcomed news to see new exchanges emerge that can provide alternative price discovery.

Takeaway: The diversification of price discovery in the gold market will lessen the ability of Western powers to manipulate prices. As this trend plays out, the artificial downward pressure on prices should be removed and allow precious metals to more accurately reflect the fundamental conditions around them. If GATA and others are correct about the degree of manipulation, any diminishing of this manipulative ability will be very bullish for gold.

#8 – Increasing Physical Demand Worldwide, Including Central Bank Demand

Consumer demand for gold was up 53% in Q2 according to the WGC. Total bar and coin demand set a new quarterly record, exceeding 500 tonnes for the first time and U.S. silver eagles sales are on pace for a record year. Central banks continue buying at a frenzied pace, adding 534.6 metric tons to reserves in 2012, the most in almost a half century. And these are just the reported purchases. China, Russia and other nations are thought to be buying discretely via third parties.

Furthermore, there is a growing movement of gold repartriation around the globe. First Venezuela, now Germany, the Netherlands, Switzerland, Poland, Romania, Finland, Ecuador and others are demanding their gold back from the FED and Western financial institutions.

#9 – Stagnant or Declining Supply

Total gold supply contracted 6% during the latest quarter to 1,025.5 tonnes, driven by a sharp drop in recycling activity. There have been huge outflows from COMEX and Shanghai stocks. With prices at or near the cost of production, several mining operations have been suspended or shuttered, which will further restrict supply. Mints in the U.S. and Canada have resorted to rationing supplies of their popular bullion coins, a further signs of tightening supplies.

Takeaway: Economics 101 dictates that increasing demand and declining supply leads to higher prices.

#10 – Tiny Size of Gold Market versus Stock or Bond Market Will Provide Leverage

It has been estimated that all of the gold ever refined would form a single cube 20 m (66 ft) on a side. This cube would contain around 5.5 billion ounces of gold and be worth roughly $7 trillion. By comparison, the world stock market is estimated at $50 trillion and the bond market at around $100 trillion. So, it would only take a small percentage of money moving from these larger markets into the gold market to overwhelm available supply and send prices substantially higher.

#12 – Prices Have Dropped to the All-In Cost of Production, Which Typically Provides Support

It is not often that a commodity will drop to a price below the cost of production. Can you think of many things that you can buy for less than it costs to produce it? At current price levels, many miners are being forced to suspend operations as their all-in sustaining cost to produce an ounce of gold makes the operation unprofitable. Even some of the best miners are just barely squeezing out quarterly earnings, propelled by increasing production and cost controls. Supply levels have already been impacted, but any further drop in the price of gold and silver will lead to additional mines shuttering operations. As these mines stop producing and supplies drop, prices will rise to reflect this change.

Takeaway: As costs rise, so do prices. Either precious metals will climb to levels where miners are profitable or they will stop mining and destroy supply levels. The price can certainly drop below the cost of production for a short time period, but it is not likely to last. This all-in sustaining cost usually proves to be a solid floor during corrections, so the downside is limited at this juncture.

Conclusion

As the gold price climbs back towards its inflation-adjusted high of $2,400, Shadowstats target of $8,000 or Mike Maloney target of $15,000, we will look back at this current correction as nothing more than a bump in the road and excellent buying opportunity.

Last edited: