Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

CME volumes

I'm back again. I will now do a quick study on the CME volumes, because I am worried that they might be declining, and that'd be a problem for my MKT orders.

...

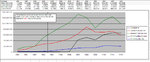

Ok, from my own data, this picture below is pretty eloquent and it shows that volumes are actually going down for all futures:

View attachment comparison_from_my_systems_data.xls

Just as I feared. The average drop from from 2012 to 2013 is -18%, -20% if we exclude HG (copper) which is an outlier. If once again we exclude HG, and we go back 2 years to 2011 and do the same comparison, the drop in volume is on average -12%. Which means 2012 has lower volume than 2011.

Let's see if the folks at CME acknowledge this fact.

I could not find anything yet, but there's plenty of independent articles on this fact, from 2011, 2012 and 2013:

CME Trading Volume Slumps; ICE Also Sees Declines - WSJ.com

CME Group’s Q4 Profit Hit by Declining Trading Volumes -- Trefis

CME volume declines - Chicago Commodities and Futures Trading | Examiner.com

Declining trading volumes hit CME

Oh, good. On the examiner.com's article I found a link to some CME data:

http://www.cmegroup.com/wrappedpages/web_monthly_report/Web_Volume_Report_CMEG.pdf

This link leads to a .pdf file that gets updated every month, so I will upload what I am seeing and take a picture to show it to you:

View attachment Web_Volume_Report_CMEG.pdf

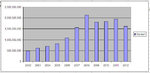

I found the image above on page 19. All it does is comparing July 2012 to July 2013, and we see a slight increase in volume. Big deal. I want a chart of all volume for all years.

I'm going to look harder.

...

No luck at the CME, but getting closer elsewhere...

Statistics | World Federation of Exchanges

...bingo!

Annual Query Tool | World Federation of Exchanges

...

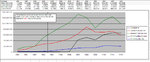

All done, my analysis can be seen in the picture below, and downloaded from here:

View attachment CME_futures_yearly_volumes_from_world-exchanges.org.xls

I am not really worried. If financial collapse takes place, we're all screwed. If it doesn't then there's nothing to worry about. The problem however is if in the meanwhile the Chinese futures are rising in volume. Let's go check that out.

SHFE only trades commodity futures, and it rose much more but also fell in recent years:

Now I'll check out ALL exchanges for all stock index futures, which are the ones that make me worry the most.

Ok, all combined, the world exchanges for the stock index futures, behave exactly like CME:

View attachment all_exchanges_for_stock_index_futures.xls

However, we have to be careful here, because CME represent almost half of all this volume, so we want to make sure that other exchanges aren't rising while the CME is falling.

Well, first of all, how does the general fall compare to the CME fall?

The world falls by 25%. The CME fall by... 33%.

Ok, so far so good, I mean that it is acceptable. Because you know, I am always monitoring the collapse of the American empire. And this doesn't seem to be a signal.

Let's monitor the same exchanges, one by one.

But let's first get rid of Oslo, Warsaw, Johannesburg and other exchanges I am not worried about.

...

Ok, all done:

View attachment all_exchanges_for_stock_index_futures.xls

Ok, let's not worry about it. The collapse of the American empire is not here yet, although there are some early warning signs.

The small Asian derivative exchanges are still rising in 2008-2012, while the bigger US, European and Indian fall.

For now I wouldn't worry about the volume issue anymore, because it definitely concerns most of the world, and not just the CME.

...

Thinking back to it, the next day, while I am still able to edit this post, I will add this.

The decline which we witness starting in 2008 on the major exchanges (US, Germany, India), and that we don't see on all other Asian (smaller) exchanges, might be due to the following. Not all derivative investors are like me, where the 2008 crash in the markets makes no difference. Some investors, like funds, get their cash from ordinary people. So, whether they're good or not in bearish / volatile markets, the ordinary people will still withdraw their funds, out of their stupidity/ignorance. So, regardless of what the fund manager thinks or how he trades and how good he is in volatile/bearish markets, he will have less money to invest, and as a consequence volume will decrease.

Why then didn't the volume decrease in most of the Asian Exchanges? Maybe their being smaller played some role. Another factor is that they probably had different customers. And there's other factors that for sure I ignore. Another factor might be that the "crisis" wasn't perceived as much in Asia.

The decrease in volume in the US and Europe (vs none in Asia) has, I believe, nothing to do with the decline of the American empire, which is something I have to monitor, because when this will happen, my capital will become worthless.

I'm back again. I will now do a quick study on the CME volumes, because I am worried that they might be declining, and that'd be a problem for my MKT orders.

...

Ok, from my own data, this picture below is pretty eloquent and it shows that volumes are actually going down for all futures:

View attachment comparison_from_my_systems_data.xls

Just as I feared. The average drop from from 2012 to 2013 is -18%, -20% if we exclude HG (copper) which is an outlier. If once again we exclude HG, and we go back 2 years to 2011 and do the same comparison, the drop in volume is on average -12%. Which means 2012 has lower volume than 2011.

Let's see if the folks at CME acknowledge this fact.

I could not find anything yet, but there's plenty of independent articles on this fact, from 2011, 2012 and 2013:

CME Trading Volume Slumps; ICE Also Sees Declines - WSJ.com

CME Group’s Q4 Profit Hit by Declining Trading Volumes -- Trefis

CME volume declines - Chicago Commodities and Futures Trading | Examiner.com

Declining trading volumes hit CME

Oh, good. On the examiner.com's article I found a link to some CME data:

http://www.cmegroup.com/wrappedpages/web_monthly_report/Web_Volume_Report_CMEG.pdf

This link leads to a .pdf file that gets updated every month, so I will upload what I am seeing and take a picture to show it to you:

View attachment Web_Volume_Report_CMEG.pdf

I found the image above on page 19. All it does is comparing July 2012 to July 2013, and we see a slight increase in volume. Big deal. I want a chart of all volume for all years.

I'm going to look harder.

...

No luck at the CME, but getting closer elsewhere...

Statistics | World Federation of Exchanges

...bingo!

Annual Query Tool | World Federation of Exchanges

...

All done, my analysis can be seen in the picture below, and downloaded from here:

View attachment CME_futures_yearly_volumes_from_world-exchanges.org.xls

I am not really worried. If financial collapse takes place, we're all screwed. If it doesn't then there's nothing to worry about. The problem however is if in the meanwhile the Chinese futures are rising in volume. Let's go check that out.

SHFE only trades commodity futures, and it rose much more but also fell in recent years:

Code:

2005 2006 2007 2008 2009 2010 2011 2012

33,789,754 58,105,997 85,563,833 140,263,185 434,864,068 621,898,215 308,239,140 365,329,379Now I'll check out ALL exchanges for all stock index futures, which are the ones that make me worry the most.

Ok, all combined, the world exchanges for the stock index futures, behave exactly like CME:

View attachment all_exchanges_for_stock_index_futures.xls

However, we have to be careful here, because CME represent almost half of all this volume, so we want to make sure that other exchanges aren't rising while the CME is falling.

Well, first of all, how does the general fall compare to the CME fall?

The world falls by 25%. The CME fall by... 33%.

Ok, so far so good, I mean that it is acceptable. Because you know, I am always monitoring the collapse of the American empire. And this doesn't seem to be a signal.

Let's monitor the same exchanges, one by one.

But let's first get rid of Oslo, Warsaw, Johannesburg and other exchanges I am not worried about.

...

Ok, all done:

View attachment all_exchanges_for_stock_index_futures.xls

Ok, let's not worry about it. The collapse of the American empire is not here yet, although there are some early warning signs.

The small Asian derivative exchanges are still rising in 2008-2012, while the bigger US, European and Indian fall.

For now I wouldn't worry about the volume issue anymore, because it definitely concerns most of the world, and not just the CME.

...

Thinking back to it, the next day, while I am still able to edit this post, I will add this.

The decline which we witness starting in 2008 on the major exchanges (US, Germany, India), and that we don't see on all other Asian (smaller) exchanges, might be due to the following. Not all derivative investors are like me, where the 2008 crash in the markets makes no difference. Some investors, like funds, get their cash from ordinary people. So, whether they're good or not in bearish / volatile markets, the ordinary people will still withdraw their funds, out of their stupidity/ignorance. So, regardless of what the fund manager thinks or how he trades and how good he is in volatile/bearish markets, he will have less money to invest, and as a consequence volume will decrease.

Why then didn't the volume decrease in most of the Asian Exchanges? Maybe their being smaller played some role. Another factor is that they probably had different customers. And there's other factors that for sure I ignore. Another factor might be that the "crisis" wasn't perceived as much in Asia.

The decrease in volume in the US and Europe (vs none in Asia) has, I believe, nothing to do with the decline of the American empire, which is something I have to monitor, because when this will happen, my capital will become worthless.

Last edited: