hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

Interesting take hh..am i correct in saying you have no stops in there..just profit targets..do the stops go in next day?

I tend to trade stocks as you are physically buying a share which will cause the market differently than other financial instruments. That has been my experience.

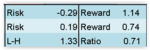

As for the stops, I don't use automated stops, only discretionary stops. To clarify, If I put a loss prevention order for 1% below the avg px., it can cause unnecessary losses. For example, BTU closed @ 9.64, sometimes the stock may dip below the "stop" and then recover to make a profit later. If BTU dropped below 9.54 the next day, then it would sell when I do not want it to. To that effect, I create time dependent stops instead. I have discretionary stops on a per equity basis. They are all slightly different. If the equity has not reached a target price by a specified time, then I sell if it positive. If it is negative, then I wait and so far it has worked about 95% of the time. I have enough assets that I do not mind having that cash tied up while I wait.

I have several open trades at a time as you saw there so if one doesn't reach a target price I wait it out.

I was not paying close attention and forgot that the market closed at 1:00 PM EST today. I will be changing those prices to adjust for my mistake. 😆

Last edited: