MajorMagnuM

Legendary member

- Messages

- 9,284

- Likes

- 888

one of my trades:

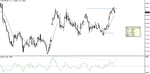

A bear swing, a block range (at the bottom), a break out that block range the way up, a break out of upper channel line and a break out of the resistance line, then we have a bear range bar, skipped the first entry due the strong move up and of the nature of that bear range bar..... in at the second entry, target profit reached in a jiffy...

So a fail break out range block, a failed break out of the upper channel line, a failed break out of the resistance line and a second entry which is more reliable entry.

All well here, having a break from the forum.....will be back. Ta.

Fugazsy.

yes, that's very interesting info on how to read a bar by bar account after a strong move up and reminds me to always remember to be range aware.

to be clear , when you say :the outside bar broke above and failed trapping the bulls you mean the large black bodied one with larger wicks that touches both the top and bottom of the cyan box.

broke also above the upper channel line.

see my attachment for the red and purple dynamic lines being retested at 8.00 am precisely

the third bar after 1 bar trades below his previous one at a more expansive price then the first entry which is a second entry. : i think what you are saying here is that the larger range of the third bar from the first (the fourth bar which comes off your dotted upper channel line) is significant because its range is larger than the previous one and further traps some bears.ty for this good info. My question is what about bar three? the spinning top with the small white body. would bulls be add there or getting out from a bad long taken at bar 1?

re my attachment.

the boxes just show how the range doubled, halved, then doubled, then held at about 75% range. Interestingly it dropped 17 pips out of range having held about the same from the top of the marked range. the red and purple lines show more meaningful info than the white one above price. i think this as the red and purple have been there longer.