dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

I'll take a look at your developing a plan book. I just got done reading the book you posted in your first post on this thread and understood maybe 80% of it. In the book you quote Richard Wyckoff a lot, i could read his book eventually.

The O'neil book you recommended though it has stocks in the title can still be useful for forex and futures, right?

I thought i could start with an hourly chart and 15 minute while paying attention to the trend in the daily and weekly and the support and resistance levels.

I am a poor person so futures is not an option right now to start with because the required account size. I heard of a site called Nadex and thought i could start there so i already deposited a little over $300 there. I'm not going to trade with real money though until i know i'm ready, and i know if i can't make money in demo i won't make money live.

Eventually i would love to make a living trading, but know that i can't do it overnight.

You mentioned falling for bad courses and stuff so i thought i'd mention that i did find good reviews on a course by Chris Capre from 2ndskiesforex where he teaches price action. Based on your response i would guess you wouldn't recommend this.

Trading seems complicated, but i imagine for people who have found the truth it is simple. I got sucked into the whole indicator thing and it wasn't doing very well so i'm glad i found this thread, because i want to start from scratch, because i feel like i know nothing.

1. The SLA, uploaded to post 1, is for those who already have a pretty good idea of what they want, or who have experienced repeated failures and have a real good idea of what they don't want.

2. O'N's book applies to any auction market. I urge you, however, to avoid forex and futures.

3. If by "start" you mean what you're going to observe during the observation phase, I suggest you look at something smaller. There's a lot going on in even a 15m bar that you'll never see if you don't look at anything smaller. Even if you're not interested in trading price, it's important that you know what's going on with it so that you can interpret your indicator properly.

4. With all due respect to Mr. Capre, there are no "price action traders" of whom I'm aware that focus on price action without the aid of indicators and/or patterns. I wish there were. Then of course there's the $500 each for his courses.

You should also know that every "price action trader" of whom I'm aware -- including Seiden, Beggs, and Brooks -- derive everything they have from Wyckoff. This is not a personal criticism, just an acknowledgement of the work done by the real pioneers: Wyckoff, Livermore, Gartley, Schabacker, Hamilton, Rhea, et al. As for patterns, a surprising number come from -- of all places -- Oliver Velez (yes, the much maligned Oliver Velez; go figure).

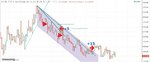

If you've already experienced failure, you're already beginning behind the starting block. Be very careful. Study the market. Determine for yourself where and when and how price goes up and down. It's not complicated. You don't have to spend hundreds and thousands of dollars on books and courses. The charts below were annotated by a nine-year-old girl.