Mr Flibble

Well-known member

- Messages

- 371

- Likes

- 20

Lo chaps

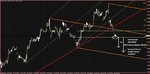

Lets have a little play then short USD/CAD 10130

SL: @ 10147

Target @ 10020

Hoping that minor breakout of trend was a fakeout ---usually followed by a lower low. RR too good not to try. Now I'm going to watch your chaps trades for a little.

Lets have a little play then short USD/CAD 10130

SL: @ 10147

Target @ 10020

Hoping that minor breakout of trend was a fakeout ---usually followed by a lower low. RR too good not to try. Now I'm going to watch your chaps trades for a little.