oildaytrader

Senior member

- Messages

- 2,806

- Likes

- 125

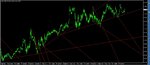

Confirmed falling wedges in an up trend are high probability set ups , and it is easy money..Many amateurs are using falling wedges in down trends, the best results for wedges are obtained by trading them with the trend.Many falling wedges along the up trend will fail depending on trend start, exhaustion and prime trend.The best ones are traded with the prime trend and are confirmed entries like other chart patterns.In the first example (no 1) there is a trendline in place ,the second one (no 2) is confirmed by trend lines and a reversal from the trend line to previous high.1DT is a falling wedge in a down trend.At no 1 the previous down trend has been reversed , and an up trend is in place.

The opposite scenario applies to rising wedges.They should be traded in in down trends for high probability trading.

The opposite scenario applies to rising wedges.They should be traded in in down trends for high probability trading.