rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 969.23 ..... 968.88....... 954.42

Reversal Short ........ 947.36 ..... 939.97 ...... 929.13

PP ...................... 903.83...... 911.06...... 903.83

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 903.64...... 900.22 ...... 889.38

Breakdown Short ..... 881.78 ..... 889.38 ...... 874.92

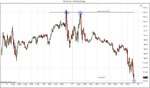

nice move just completed on the weekly DeMark -

Reversal Short from 939.75 down to weekly Pivot at 911 🙂