You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ES tonight

- Thread starter rathcoole_exile

- Start date

- Watchers 30

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

Keeping in mind that basically all indices are extrememly highly correlated, if one goes up there is absolutely no question that the others are up to the same antics,

that's fine, given the time zones, i'm as much interested in the tradeable hours as much as anything

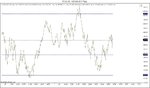

If you are looking at DAX, you might find this chart of a slice of tonight's action a bit interesting.

On the price plot, the blue bands are the developing market profile upper and lower value areas. The black line in between is the VWAP, horizontal blue line is the MP upper value area (at the close of yesterdays session) and horizontal black line is the pivot. The chart is constant volume with 250 contracts per bar.

Actually, the MP levels are calculated by volume rather than TPOs, but it doesn't make much difference. eg LVA is the level such that 15% of volume for the session traded at a price below that level.

DAX likes pivots, MP levels and VWAP.

On the price plot, the blue bands are the developing market profile upper and lower value areas. The black line in between is the VWAP, horizontal blue line is the MP upper value area (at the close of yesterdays session) and horizontal black line is the pivot. The chart is constant volume with 250 contracts per bar.

Actually, the MP levels are calculated by volume rather than TPOs, but it doesn't make much difference. eg LVA is the level such that 15% of volume for the session traded at a price below that level.

DAX likes pivots, MP levels and VWAP.

Attachments

Last edited:

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

very interesting, i definitely need to get my asss in gear and improve my MP ability, especially VWAP too !

thanks, garry

thanks, garry

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

options expiry day today, so i'll use that as an opportunity to down tools for the holidays. see youse in the new year.

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

i wish !!

i think i do need to go down that path, but have no idea how to do so.

we're having a xmas drink, the few t2w traders in bangkok, on saturday and pedro001 seems to know his stuff, so i'm going to try to persuade him to take a look with a few pints..... it would certainly make lif a lot easier and let me catch some sleep some time !

The beers are on you then ! :clap:

I'd be more than happy to help - you just have to promise not to become a vendor and start selling signals on line... :whistling

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

ESH9 (Weekly) w/c 5 Jan09

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 969.23 ..... 968.88....... 954.42

Reversal Short ........ 947.36 ..... 939.97 ...... 929.13

PP ...................... 903.83...... 911.06...... 903.83

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 903.64...... 900.22 ...... 889.38

Breakdown Short ..... 881.78 ..... 889.38 ...... 874.92

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 969.23 ..... 968.88....... 954.42

Reversal Short ........ 947.36 ..... 939.97 ...... 929.13

PP ...................... 903.83...... 911.06...... 903.83

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 903.64...... 900.22 ...... 889.38

Breakdown Short ..... 881.78 ..... 889.38 ...... 874.92

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

ESH9 (Daily) Mon 5 Jan09

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 945.44 ..... 947.25....... 940.00

Reversal Short ........ 935.47 ..... 934.57 ...... 929.11

PP ...................... 918.25...... 921.88...... 918.21

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 915.53...... 916.44 ...... 910.98

Breakdown Short ..... 905.56 ..... 911.00 ...... 903.75

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 945.44 ..... 947.25....... 940.00

Reversal Short ........ 935.47 ..... 934.57 ...... 929.11

PP ...................... 918.25...... 921.88...... 918.21

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 915.53...... 916.44 ...... 910.98

Breakdown Short ..... 905.56 ..... 911.00 ...... 903.75

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

ESH9 Daily 6 Jan09

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 937.26 ..... 939.75....... 935.67

Reversal Short ........ 932.38 ..... 933.94 ...... 930.88

PP ...................... 926.08...... 928.13...... 926.08

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 922.62...... 925.07 ...... 922.00

Breakdown Short ..... 917.74 ..... 922.00 ...... 917.92

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 937.26 ..... 939.75....... 935.67

Reversal Short ........ 932.38 ..... 933.94 ...... 930.88

PP ...................... 926.08...... 928.13...... 926.08

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 922.62...... 925.07 ...... 922.00

Breakdown Short ..... 917.74 ..... 922.00 ...... 917.92

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

DeM reversal Long @ 925

I'd rather see price drop to 922 to complete the Camarilla Short, but I can't ignore the Rev Long on the DeMark set-ups, although I'll keep it tight and go for +1 +2 & +3

target just just just touched, phew

out for +1, +2, +3, now flat

I'd rather see price drop to 922 to complete the Camarilla Short, but I can't ignore the Rev Long on the DeMark set-ups, although I'll keep it tight and go for +1 +2 & +3

target just just just touched, phew

out for +1, +2, +3, now flat

Attachments

Last edited:

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

ESH9 Daily Weds 07 Jan09

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 941.09...... 946.25....... 941.00

Reversal Short ........ 935.79 ..... 940.57 ...... 936.63

PP ...................... 932.25...... 934.88 ...... 932.25

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 925.21...... 930.94 ...... 927.00

Breakdown Short ..... 919.91 ..... 927.00 ...... 921.75

HKZ .................... Cam......... DeM ......... FTP

Breakout Long ........ 941.09...... 946.25....... 941.00

Reversal Short ........ 935.79 ..... 940.57 ...... 936.63

PP ...................... 932.25...... 934.88 ...... 932.25

LKZ .................... Cam ......... DeM ......... FTP

Reversal Long ........ 925.21...... 930.94 ...... 927.00

Breakdown Short ..... 919.91 ..... 927.00 ...... 921.75

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

when the market is in a clear, defined trend, I try to use 9 lots, 3x3 for trades in the direction of the trade, but only 3 lots, 3x1 for counter-trend trades

when, as now, there is no clear trend, i just use 3 lots, 3x1 on all trades

so current market conditions means +1,+2+3 is only $300 :-(

when, as now, there is no clear trend, i just use 3 lots, 3x1 on all trades

so current market conditions means +1,+2+3 is only $300 :-(

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

obviously I'd like to build up to be doing 30 lots, 60 lots, 90 lots in sets of 3 ....... but I'm trying (struggling) not to be too greedy or rush things ....

Similar threads

- Replies

- 105

- Views

- 21K