Geofract

Experienced member

- Messages

- 1,483

- Likes

- 112

GBP JPY continues to get hammered - so no trade there, despite my comments yesterday - £CHF worked ok for a good few pips if you managed to get in in.

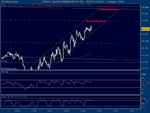

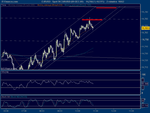

Looking at FTSE now for possible shorts, but lots of retrace required - 5272 or thereabouts could be a lovely area to short. This would also be a 61.8 fib of todays low and yesterdays high and SR level, presuming current low holds. 5250 is possible short area too imho.

Looking at FTSE now for possible shorts, but lots of retrace required - 5272 or thereabouts could be a lovely area to short. This would also be a 61.8 fib of todays low and yesterdays high and SR level, presuming current low holds. 5250 is possible short area too imho.