You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Re: whats going on ?...monday pm...

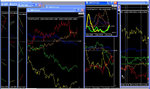

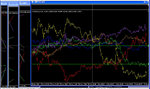

Heres the 5m corrie on a 1000/1 setting vs the simple GBPUSD pairs chart to show where simon was making his money today....a few of us are working together in a private forum to see if the corrie can make his Full time trading activities even more profitable and its started quite well even just using the core settings and indicators I offer to share for free on this thread.....I know Simons fond of a little GBPEuro action as well so left the Big blue in as well...

GBP's demise started around 5ish this morning and thats also when USD started getting perky going upwards.......about 180 pips later now perhaps the parties over but I'm not convinced if the BOJ starts buying USD this week....time will tell. Euro stuffed the GBP all day as well !

from a practical trading perspective lets also keep this very real here.....a marketeer will now tell you his forex orgasmatron V3 just gave you 180 pips on the G/U..... so buy it.....Experienced and professional traders know that due to the way trading works it is almost impossible to take high percentages of any "normal" Trend pattern due to the risks and retraces you have to manage along the way whilst taking profits...its just the way it is.....

in my humble opinion I would have been chuffed to take 40-50 pips out of that today as thats the nature of the beast....i'd say to newbies work on eventually getting to a third of the big moves and dont beat yourself up with fictitious targets promised by "Expert" traders and marketeers selling you something. when you have perfected your Trading and strategies you can eventually look at compounding trades going in and coming out to optimise the returns you get from your pippage gained.

Hey - anyone seen a little yellow chicky ?....answers to the name of Ronald....i'm getting worried.......where is he 😢

N

Hi N,

Been shorting cable all day long as the volatility was good and an obvious trend down with small pullbacks along the way - ideal re-entry points for some more scalps a la cherokee style. Also was watching your corrie on other screen and got some excellent confirmation signals, erratic price jerks plus a few "quirky" things to see if they repeat in the future for discussion with you and everyone else on board the good ship corrie.

Trade well and regards,

Simon.

Heres the 5m corrie on a 1000/1 setting vs the simple GBPUSD pairs chart to show where simon was making his money today....a few of us are working together in a private forum to see if the corrie can make his Full time trading activities even more profitable and its started quite well even just using the core settings and indicators I offer to share for free on this thread.....I know Simons fond of a little GBPEuro action as well so left the Big blue in as well...

GBP's demise started around 5ish this morning and thats also when USD started getting perky going upwards.......about 180 pips later now perhaps the parties over but I'm not convinced if the BOJ starts buying USD this week....time will tell. Euro stuffed the GBP all day as well !

from a practical trading perspective lets also keep this very real here.....a marketeer will now tell you his forex orgasmatron V3 just gave you 180 pips on the G/U..... so buy it.....Experienced and professional traders know that due to the way trading works it is almost impossible to take high percentages of any "normal" Trend pattern due to the risks and retraces you have to manage along the way whilst taking profits...its just the way it is.....

in my humble opinion I would have been chuffed to take 40-50 pips out of that today as thats the nature of the beast....i'd say to newbies work on eventually getting to a third of the big moves and dont beat yourself up with fictitious targets promised by "Expert" traders and marketeers selling you something. when you have perfected your Trading and strategies you can eventually look at compounding trades going in and coming out to optimise the returns you get from your pippage gained.

Hey - anyone seen a little yellow chicky ?....answers to the name of Ronald....i'm getting worried.......where is he 😢

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Expanded 3 ducks charts....

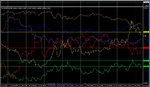

hi gang......

ssshhh..all the chicks are asleep now...Ronald was hiding in the airing cupboard so ive locked it now

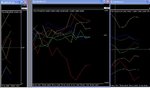

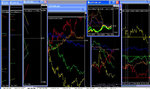

since 2 are quite high TF's they can be easily expanded to show how they were moving today......the 5m we will not expand as that would clearly be a real mess on the screen

so here it is......look at the 4H for today (far right), there were minor crossovers in this period but naturally it was GBP (red) that was the biggest one ....falling below the turquoise NZD to become the weakest of the G8

the middle chart is the expanded 1H corrie on the 60/1....starts around 7am ish

loads more activity and you can see how it was moving around a lot during this volatile day.

The interesting thing is that the Yen was only top dog for the early morning and I could have sworn it was top dog in my earlier bulletins on the 1H so i'm checking back :|

the 5m was manic so assume it was 1H volatility X 10 !!

so there you have it.......these Charts get compressed and we use them "elevator style" for real time support for our trading...but they can be expanded at any time if you want to get your bearings.....

until tomorrow

N

hi gang......

ssshhh..all the chicks are asleep now...Ronald was hiding in the airing cupboard so ive locked it now

since 2 are quite high TF's they can be easily expanded to show how they were moving today......the 5m we will not expand as that would clearly be a real mess on the screen

so here it is......look at the 4H for today (far right), there were minor crossovers in this period but naturally it was GBP (red) that was the biggest one ....falling below the turquoise NZD to become the weakest of the G8

the middle chart is the expanded 1H corrie on the 60/1....starts around 7am ish

loads more activity and you can see how it was moving around a lot during this volatile day.

The interesting thing is that the Yen was only top dog for the early morning and I could have sworn it was top dog in my earlier bulletins on the 1H so i'm checking back :|

the 5m was manic so assume it was 1H volatility X 10 !!

so there you have it.......these Charts get compressed and we use them "elevator style" for real time support for our trading...but they can be expanded at any time if you want to get your bearings.....

until tomorrow

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Pinch punch.......Decembers here !

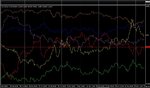

Hi all

its the merry month of december..........!

ok - the chicks were up early (even Ronald)....and so therefore was I 😴

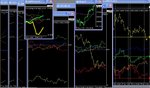

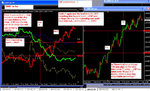

heres the corrie world at 6.07 am

the Nikkei had a good session (so i assume that the F.East was generally good) therefore the Yen has retreated a little overnight against everything....

look at the turquoise NZD on the Quackometer....top dog in the 5m and 30m charts now

(I must investigate that dudes behaviour more..unless I have a volunteer to offer thoughts on how it ticks ?)

summary

Aside from any news releases today (sorry no idea) heres whats looking interesting

ive put 3 S/R lines on the 30m corrie on the far right

Yen yellow - that line was a significant breach level last week and has been hit yesterday ...Its not exact science but trade the bounce or the fall ...its key to todays trading and lets see what next hour does

USD Green - significant breach line last week on friday , then it fell, then tested upwards yesterday ....so again lets see what direction manifests now in next hours or so........i'm also looking to see if the Tag team will continue to display uncorrelated activity.....and that the Greenback becomes more part of the G6 behaviour to the volatile Yen (as it has done this morning)....I'm not a big fan of trading the YENUSD pair but this is becoming more attractive in the current Market conditions

GBP (red) - that line was a resistance level last week that the GBP did not breach....then tested again yesterday and now heading back again ?...will it hold ?

The Quackometer currently shows buy trades for Euro (blue), Swissie (Grey) and the Cad against most other currencies (except Yen that holds the 4H pole)..GBP stinks on all TF's....so up to you there if you follow the yellow fluffy ones....

ladies and gentlemen place your bets please........😉

different strategies / opinions but all key to what happens today so watch them.....get my software and please play along as ive got to feed the damn chicks now

N

Hi all

its the merry month of december..........!

ok - the chicks were up early (even Ronald)....and so therefore was I 😴

heres the corrie world at 6.07 am

the Nikkei had a good session (so i assume that the F.East was generally good) therefore the Yen has retreated a little overnight against everything....

look at the turquoise NZD on the Quackometer....top dog in the 5m and 30m charts now

(I must investigate that dudes behaviour more..unless I have a volunteer to offer thoughts on how it ticks ?)

summary

Aside from any news releases today (sorry no idea) heres whats looking interesting

ive put 3 S/R lines on the 30m corrie on the far right

Yen yellow - that line was a significant breach level last week and has been hit yesterday ...Its not exact science but trade the bounce or the fall ...its key to todays trading and lets see what next hour does

USD Green - significant breach line last week on friday , then it fell, then tested upwards yesterday ....so again lets see what direction manifests now in next hours or so........i'm also looking to see if the Tag team will continue to display uncorrelated activity.....and that the Greenback becomes more part of the G6 behaviour to the volatile Yen (as it has done this morning)....I'm not a big fan of trading the YENUSD pair but this is becoming more attractive in the current Market conditions

GBP (red) - that line was a resistance level last week that the GBP did not breach....then tested again yesterday and now heading back again ?...will it hold ?

The Quackometer currently shows buy trades for Euro (blue), Swissie (Grey) and the Cad against most other currencies (except Yen that holds the 4H pole)..GBP stinks on all TF's....so up to you there if you follow the yellow fluffy ones....

ladies and gentlemen place your bets please........😉

different strategies / opinions but all key to what happens today so watch them.....get my software and please play along as ive got to feed the damn chicks now

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

9am update..........

Hi all...............brrrrr driving today !

ok the markets have spoken.......in a volatile scenario (ie yen mania) sometimes its simpler to stick to your guns and trade what you always do, looking for the normal patterns and trades..........

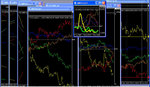

this morning the USD quietly attacked that 30m resistance line shown and has now turned downwards supported by the Yen and the markets generally rising (Gold especially on that little 5m corrie index chart you see)......

Euro and AUD have actually followed the tag down...but there were still pips there as their fall is slower.....the real winner is the GBP that has piled upwards off the Resistance level again shown on the 30m Corrie chart far right side...

The Quackometer is showing the tag team as joint bottom feeders now on both the 5m and the 1hr elevator charts on the far left side....however Yen is still top dog on the 4h chart but being crossed now by the CAD...with the euro and swissie real close as well - but pointing down (this Elevator compressed Tripleplay chart system has rules all to itself and is showing real promise for me👍 )

According to the Quakorama rules it is showing the following signals as a entry points (and already in or out of them dependent on targets).....remember the trading window is when a currency is above or below another currency in all 3 elevators

Buy CAD vs sell pretty much everything !

Buy Euro vs Swissie and USD

Thats it..... remember we are trialling this on the famous 3 ducks (60ma) setting to see if it is suitable....this system is all about the MA vs the 3 TF's you allocate, and the differentials in the multiples.....tooo fast an MA and you will be whipsawed to death...tooo slow and you will never see a trade.....the 60ma is a nice balance but I'm stil not convinced about the jumps in multiples from 5m to 1h (X12) then it falls to X4 for the second TF (and i am tempted to speed it up a little to say a 40MA***see comments further below) ........still i'm not arguing as the ducks are getting bigger and meaner by the day ! 😱

N

*** I have mentioned before in this thread about my opinion re "balanced" TF/MA multiples.......I like a multiple of say 6-10 for each seperate chart to get a balanced view of the market conditions.....you can easily do this on 3 charts by picking your TF's and then use the MA's to balance it to your preference....on the 3 duckies this setup is both inside and outside these paramaters but such is life ...I am not going to argue with the second most popular thread ever in this area of T2W !! (109,000 views and rising) 👍

Hi all...............brrrrr driving today !

ok the markets have spoken.......in a volatile scenario (ie yen mania) sometimes its simpler to stick to your guns and trade what you always do, looking for the normal patterns and trades..........

this morning the USD quietly attacked that 30m resistance line shown and has now turned downwards supported by the Yen and the markets generally rising (Gold especially on that little 5m corrie index chart you see)......

Euro and AUD have actually followed the tag down...but there were still pips there as their fall is slower.....the real winner is the GBP that has piled upwards off the Resistance level again shown on the 30m Corrie chart far right side...

The Quackometer is showing the tag team as joint bottom feeders now on both the 5m and the 1hr elevator charts on the far left side....however Yen is still top dog on the 4h chart but being crossed now by the CAD...with the euro and swissie real close as well - but pointing down (this Elevator compressed Tripleplay chart system has rules all to itself and is showing real promise for me👍 )

According to the Quakorama rules it is showing the following signals as a entry points (and already in or out of them dependent on targets).....remember the trading window is when a currency is above or below another currency in all 3 elevators

Buy CAD vs sell pretty much everything !

Buy Euro vs Swissie and USD

Thats it..... remember we are trialling this on the famous 3 ducks (60ma) setting to see if it is suitable....this system is all about the MA vs the 3 TF's you allocate, and the differentials in the multiples.....tooo fast an MA and you will be whipsawed to death...tooo slow and you will never see a trade.....the 60ma is a nice balance but I'm stil not convinced about the jumps in multiples from 5m to 1h (X12) then it falls to X4 for the second TF (and i am tempted to speed it up a little to say a 40MA***see comments further below) ........still i'm not arguing as the ducks are getting bigger and meaner by the day ! 😱

N

*** I have mentioned before in this thread about my opinion re "balanced" TF/MA multiples.......I like a multiple of say 6-10 for each seperate chart to get a balanced view of the market conditions.....you can easily do this on 3 charts by picking your TF's and then use the MA's to balance it to your preference....on the 3 duckies this setup is both inside and outside these paramaters but such is life ...I am not going to argue with the second most popular thread ever in this area of T2W !! (109,000 views and rising) 👍

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

best thread I have seen on T2W in a long time......(present company excepted🙂)

http://www.trade2win.com/boards/for...-website-course-discussion-20.html#post992282

Point 1 is why I dont trade..not enough time at present and only total involvment for me will be acceptable when i do.....

Point 2 is about why I now spend a lot of screentime/hours on the 1000/1 corrie slowly learning to read the market patterns and create my edge for the future....the point of the corrie is that it is the whole market (if you want to see the G8)...I dont need 20-30 screens to read all the patterns for each currency ....NO brain can do that.....the corrie can put it all on just one screen if you want......all G8 currencies or just 1 on it ...its up to you how much you want to be watching and deriving patterns from..👍.

I am not asking anyone to use all the Signals/systems we are gradually testing here with the corrie....find one then eat, sleep,dream and learn it until your eyeballs are on stalks ......then watch it some more in every trading scenario that unfolds each day....gradually the sceentime will produce second nature/instinctive behaviour/cognisance..... and then you can start to trade what you see "instinctively" as a standalone system or alongside your other methodologies......

I will 100% Guarantee the success of this approach .........and totally agree with Brett N. Steenbarger, Ph.D. mentioned in the excellent post above.........

N

http://www.trade2win.com/boards/for...-website-course-discussion-20.html#post992282

Point 1 is why I dont trade..not enough time at present and only total involvment for me will be acceptable when i do.....

Point 2 is about why I now spend a lot of screentime/hours on the 1000/1 corrie slowly learning to read the market patterns and create my edge for the future....the point of the corrie is that it is the whole market (if you want to see the G8)...I dont need 20-30 screens to read all the patterns for each currency ....NO brain can do that.....the corrie can put it all on just one screen if you want......all G8 currencies or just 1 on it ...its up to you how much you want to be watching and deriving patterns from..👍.

I am not asking anyone to use all the Signals/systems we are gradually testing here with the corrie....find one then eat, sleep,dream and learn it until your eyeballs are on stalks ......then watch it some more in every trading scenario that unfolds each day....gradually the sceentime will produce second nature/instinctive behaviour/cognisance..... and then you can start to trade what you see "instinctively" as a standalone system or alongside your other methodologies......

I will 100% Guarantee the success of this approach .........and totally agree with Brett N. Steenbarger, Ph.D. mentioned in the excellent post above.........

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

more thoughts.......

following on from the previus thread....If I was going to recommend a Corrie to learn inside out its the 1000/1 on whatever TF's you like

its Virtually real time .....it goes up it goes down , it recognises support and resistance, it really does recognise HH, HL and vice versa...in other words its as close as the corrie can ever get to price action patterns

lower Ma versions are much more geared around pure MA based methodologies and principles (crossovers , divergence , convergence) and thats great as well....but know what you want and start to learn it...the corrie Tripleplay elevators are such a system and if you learn them will be just as devistating as the price action systems above......but dont try to trade all 2 or 3 or seventeen we eventually get into on the Thread......I would personally drop everything else for the 1000/1 if I had to....but I dont as this is a learning/reseach thread :smart:

N

3 duck

following on from the previus thread....If I was going to recommend a Corrie to learn inside out its the 1000/1 on whatever TF's you like

its Virtually real time .....it goes up it goes down , it recognises support and resistance, it really does recognise HH, HL and vice versa...in other words its as close as the corrie can ever get to price action patterns

lower Ma versions are much more geared around pure MA based methodologies and principles (crossovers , divergence , convergence) and thats great as well....but know what you want and start to learn it...the corrie Tripleplay elevators are such a system and if you learn them will be just as devistating as the price action systems above......but dont try to trade all 2 or 3 or seventeen we eventually get into on the Thread......I would personally drop everything else for the 1000/1 if I had to....but I dont as this is a learning/reseach thread :smart:

N

3 duck

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

11 am ish......

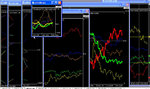

so what do you see..........?

I see a steadily rising GBP and all others falling (JRP...you enjoying the ride ?)

I see a USD that has breached below the horiz lines on the far right 30m corrie1000/1...

I see a index corrie on the 5m (small chart) threatening a fall in the indexes below the zero line

so what next ?

N

so what do you see..........?

I see a steadily rising GBP and all others falling (JRP...you enjoying the ride ?)

I see a USD that has breached below the horiz lines on the far right 30m corrie1000/1...

I see a index corrie on the 5m (small chart) threatening a fall in the indexes below the zero line

so what next ?

N

Attachments

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Re: 11 am ish......

Hi N,

Just poppen "in" to see if your corrie settings are same as mine on G/U cross analysis, which of course they are, so silly question Simon but its kind of nice to have a thumb sucking confirmation...

Riding the G/U roller coaster today like yesterday and, as volatility is up recently, I'm using the M5 tf for all trade positioning. Got first long at 08:05 hrs (local IK time) for a great 50 odd pipaduckies (!)profit, then re-entered again at 10:15 hrs for a smaller 23 odd pipaduckies which was closed about 10 minutes ago as I see a few signs of exhaustion creeping in - typical of mid morning stagnation.

Am probably going to switch over to E/U plus my favourite E/G for afternoon session, whilst keeping a watch on G/U to see if it falls over this morning's rise.

Corrie firing on all cylinders today and confirming both trades taken - nice indy there!

Trade well and regards,

Simon.

Hi N,

Just poppen "in" to see if your corrie settings are same as mine on G/U cross analysis, which of course they are, so silly question Simon but its kind of nice to have a thumb sucking confirmation...

Riding the G/U roller coaster today like yesterday and, as volatility is up recently, I'm using the M5 tf for all trade positioning. Got first long at 08:05 hrs (local IK time) for a great 50 odd pipaduckies (!)profit, then re-entered again at 10:15 hrs for a smaller 23 odd pipaduckies which was closed about 10 minutes ago as I see a few signs of exhaustion creeping in - typical of mid morning stagnation.

Am probably going to switch over to E/U plus my favourite E/G for afternoon session, whilst keeping a watch on G/U to see if it falls over this morning's rise.

Corrie firing on all cylinders today and confirming both trades taken - nice indy there!

Trade well and regards,

Simon.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

JRP masterclass.....

Yep.......i told you before, JRP is not a rookie.....😎

I am telling this story below through the FXcorrelators eyes.....I am working with JRP to see if the Correlator (or its derivatives) can possibly assist him in the future..

I am not stating that the corrie helped him in anyway here....just using it to show how

the corrie was up for those trades as well !

Each pair we trade is the sum of 2 independent variables....the Strength of one currency vs the strength of the another....in T1 below notice that GBP rose rapidly and USD was falling fast.....this is a double wammy generating serious pips and is the perfect trade to be in

in T2 however it got scrappier.....the GBP was aggressive and moved up still but look at the USD ....it rapidly went flattish and did not contribute much to the party really.......

We are here to study and learn the corrie so we can predict when 2 currencies in a potential trade are at their optimum probability to diverge(or converge) strongly and therefore give us T1 results every time !

oh.....one more important thing.......remember this is a 1000/1 corrie chart designed for pure price action....its not in a (much lower) MA mode (like the 3 duckies) so the crossovers mean nothing much at all.....each currency should be simply being judged individually....forget crossovers or above below Zero blah blah blah.....thats purely for lower MA territory as I say....

way to go JRP..........good to be working with you here 👍

N

Yep.......i told you before, JRP is not a rookie.....😎

I am telling this story below through the FXcorrelators eyes.....I am working with JRP to see if the Correlator (or its derivatives) can possibly assist him in the future..

I am not stating that the corrie helped him in anyway here....just using it to show how

the corrie was up for those trades as well !

Each pair we trade is the sum of 2 independent variables....the Strength of one currency vs the strength of the another....in T1 below notice that GBP rose rapidly and USD was falling fast.....this is a double wammy generating serious pips and is the perfect trade to be in

in T2 however it got scrappier.....the GBP was aggressive and moved up still but look at the USD ....it rapidly went flattish and did not contribute much to the party really.......

We are here to study and learn the corrie so we can predict when 2 currencies in a potential trade are at their optimum probability to diverge(or converge) strongly and therefore give us T1 results every time !

oh.....one more important thing.......remember this is a 1000/1 corrie chart designed for pure price action....its not in a (much lower) MA mode (like the 3 duckies) so the crossovers mean nothing much at all.....each currency should be simply being judged individually....forget crossovers or above below Zero blah blah blah.....thats purely for lower MA territory as I say....

way to go JRP..........good to be working with you here 👍

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

A message from your sponsor !

Hi everyone ...........

actually i am issuing a steady number of corries so thankyou....

please post and join the party though (tee hee).....: :whistling

This question has not been asked of me much so far in the private Messages, so I reproduce this now to state my intentions re this thread and the future.....:smart:

Hi there,

Thanks for your reply.

How come you have a licencing agreement for this? And what will you ultimately be vending?

Thanks

Hi Mate,

My ultimate ambition is to have a private forum dedicated to correlation strategies across all markets...not just Forex

This forum may attract a joining and ongoing subscription but thats way off in the future....(imagine a correlation version of the "James16" legendary Threads and private forums)

The FXcorrelator is one of the anchors for this and is testing quite nicely so far.........it's approach is not unique and theres plenty of similar stuff out there - but this is my interpretation of a Strengthmeter and I am adding as much identity and propriety to it as possible.....

I was told by a fellow programmer to put some licencing blurb up so that 's whats there.....anyone who joins in can offer help and advice in improving it but I do not want it appearing in every Forum and e-bay under the name of johns orgasmatron strengthometer for $199 a time when I am prepared to help Fellow traders and give it away for free.

join the party and test it (and post please !)....I am not charging for the FXcorrelator indicator and never will...

Cheers

N

nuff said ?...........👍

Hi everyone ...........

actually i am issuing a steady number of corries so thankyou....

please post and join the party though (tee hee).....: :whistling

This question has not been asked of me much so far in the private Messages, so I reproduce this now to state my intentions re this thread and the future.....:smart:

Hi there,

Thanks for your reply.

How come you have a licencing agreement for this? And what will you ultimately be vending?

Thanks

Hi Mate,

My ultimate ambition is to have a private forum dedicated to correlation strategies across all markets...not just Forex

This forum may attract a joining and ongoing subscription but thats way off in the future....(imagine a correlation version of the "James16" legendary Threads and private forums)

The FXcorrelator is one of the anchors for this and is testing quite nicely so far.........it's approach is not unique and theres plenty of similar stuff out there - but this is my interpretation of a Strengthmeter and I am adding as much identity and propriety to it as possible.....

I was told by a fellow programmer to put some licencing blurb up so that 's whats there.....anyone who joins in can offer help and advice in improving it but I do not want it appearing in every Forum and e-bay under the name of johns orgasmatron strengthometer for $199 a time when I am prepared to help Fellow traders and give it away for free.

join the party and test it (and post please !)....I am not charging for the FXcorrelator indicator and never will...

Cheers

N

nuff said ?...........👍

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

2.50ish............consolidating !

nuff said..........watch that GBP...its nearly back at yesterdays high on the 30m far right chart (not shown)

if GBP breaches down on the low TF charts.....could be all change ?

index for the markets looking a tad overbought now and their fall may drive the tag up for a while.....

N

nuff said..........watch that GBP...its nearly back at yesterdays high on the 30m far right chart (not shown)

if GBP breaches down on the low TF charts.....could be all change ?

index for the markets looking a tad overbought now and their fall may drive the tag up for a while.....

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

confession to make........

Hi all

a confession to make.......😱

ive tweaked the duckies.........its now :-

5m ...60/1

30m..60/1 (X6)

4H....45/1 (X6)

on the charts you see from me........

the 3 ducks system is fantastic and please use the TF's as you wish - as thats what this thread is all about ....finding optimum systems

but I prefer to see the marketplace in a perfectly balanced and equal set of 3 Time/MA differentials......so the 6 multiple it is (at the moment !)....it will get us in faster on some trades...(yep - warts and all) plus this new 30m TF aligns to the 1000/1 30m TF corrie chart we have on the right hand side

Dont tell the chickies or Ronald........they are sleeping ! 😴

N

Hi all

a confession to make.......😱

ive tweaked the duckies.........its now :-

5m ...60/1

30m..60/1 (X6)

4H....45/1 (X6)

on the charts you see from me........

the 3 ducks system is fantastic and please use the TF's as you wish - as thats what this thread is all about ....finding optimum systems

but I prefer to see the marketplace in a perfectly balanced and equal set of 3 Time/MA differentials......so the 6 multiple it is (at the moment !)....it will get us in faster on some trades...(yep - warts and all) plus this new 30m TF aligns to the 1000/1 30m TF corrie chart we have on the right hand side

Dont tell the chickies or Ronald........they are sleeping ! 😴

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Buy cad dummy !!!!!

I love our tripleplay elevator thingymajig 😍😍

ok - its not the 3 ducks at the moment (as i am a heartless Bast""rd and am trying a slight tweak or to) ....but the basic principle is still there....I'm looking for domination of one currency over another currency in all 3 TF's

today the purple lines on the elevators (thats CAD by the way now as brown is tooo confusing with red) have been screaming "buy me !" all day ...and still is !!👍....ive expanded the 5m 1000/1 corrie on the right and look at the purple dude go !..........smooth as silk upwards ....nooo fuss

shame I dont trade it on my basic 1000/1 G5 charts..........(no no no no no !😢)

N

I love our tripleplay elevator thingymajig 😍😍

ok - its not the 3 ducks at the moment (as i am a heartless Bast""rd and am trying a slight tweak or to) ....but the basic principle is still there....I'm looking for domination of one currency over another currency in all 3 TF's

today the purple lines on the elevators (thats CAD by the way now as brown is tooo confusing with red) have been screaming "buy me !" all day ...and still is !!👍....ive expanded the 5m 1000/1 corrie on the right and look at the purple dude go !..........smooth as silk upwards ....nooo fuss

shame I dont trade it on my basic 1000/1 G5 charts..........(no no no no no !😢)

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Kathy Lien .......correlation comments / updates

one smart lady.........big respect to the max 👍

http://www.fx360.com/commentary/kathy/2371/the-strongest-forex-correlations.aspx

although Trading the Lower TF's in the forex market with 1 month historic correlations is STILL like boiling an egg using a calender as a timer.... 😆

my only issue with the Grid format is this...my corrie world brings currencies to life ...I dont want to know the correlation of the S&P to the GBPUSD pair.....I want to know the Correlation of the S&P to either the USD and/or the GBP...not the combination......one day we will produce these as statistical values ....we already are generating them in Chart form using the Corrie and its derivatives.....

N

one smart lady.........big respect to the max 👍

http://www.fx360.com/commentary/kathy/2371/the-strongest-forex-correlations.aspx

although Trading the Lower TF's in the forex market with 1 month historic correlations is STILL like boiling an egg using a calender as a timer.... 😆

my only issue with the Grid format is this...my corrie world brings currencies to life ...I dont want to know the correlation of the S&P to the GBPUSD pair.....I want to know the Correlation of the S&P to either the USD and/or the GBP...not the combination......one day we will produce these as statistical values ....we already are generating them in Chart form using the Corrie and its derivatives.....

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

4 hour chart 1000/1

waddya think guys...............will the GBP smash that ceiling ?

trace back along that (top) Red horizontal and check out how pivotal is was about 3 times previously (alhough the credibility deteriorates the further you go back in time due to an MA still having to be used - no matter if it is a very high 1000 ma)

The corrie 1000/1 tracks key S/R levels as good as any pairs chart

N

waddya think guys...............will the GBP smash that ceiling ?

trace back along that (top) Red horizontal and check out how pivotal is was about 3 times previously (alhough the credibility deteriorates the further you go back in time due to an MA still having to be used - no matter if it is a very high 1000 ma)

The corrie 1000/1 tracks key S/R levels as good as any pairs chart

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I've disconnected from this mindless garbage....

Jees......after 5,000 e-mails from Jason Fielder I have decided to stop being sent his information / mailshots......

I know everyone has to make a living and its not just jason out there telling me how to be a master of the forex universe but this stuff is rediculous and getting worse 🙁

Newbies....beware the marketeers in this industry....they lurk in every corner of all the Forex forums.....they will suck out your brains (and your bank accounts) if you give them a chance....

just say NO...make your own decisions and walk your own path in this business at your own pace .....the quicker you rush the faster you will lose that first stash of cash...(and dont worry - we all do it !)... .. 👍

N

Jees......after 5,000 e-mails from Jason Fielder I have decided to stop being sent his information / mailshots......

I know everyone has to make a living and its not just jason out there telling me how to be a master of the forex universe but this stuff is rediculous and getting worse 🙁

Newbies....beware the marketeers in this industry....they lurk in every corner of all the Forex forums.....they will suck out your brains (and your bank accounts) if you give them a chance....

just say NO...make your own decisions and walk your own path in this business at your own pace .....the quicker you rush the faster you will lose that first stash of cash...(and dont worry - we all do it !)... .. 👍

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Answer to Post # 478 above

ANSWER ....NO it didnt (See below)................

The corrie 1000/1 tracks key S/R levels as well as any pairs chart

N

waddya think guys...............will the GBP smash that ceiling ?

trace back along that (top) Red horizontal and check out how pivotal is was about 3 times previously (alhough the credibility deteriorates the further you go back in time due to an MA still having to be used - no matter if it is a very high 1000 ma)

The corrie 1000/1 tracks key S/R levels as good as any pairs chart

N

ANSWER ....NO it didnt (See below)................

The corrie 1000/1 tracks key S/R levels as well as any pairs chart

N

Attachments

Similar threads

- Replies

- 0

- Views

- 3K