samich1262

Well-known member

- Messages

- 293

- Likes

- 3

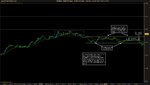

No problem here with the second SB. The higher lows in the pullback are not on particularly strong bars, and you waited for the SB, which followed a lower high. Seems like a good opportunity to me. When in doubt, you could have waited for a breakout pullback, which occurred a few bars later.

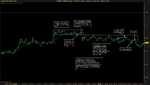

John

You're right, but for some reason I haven't ever taken advantage of a 2nd chance entry that isn't another setup. I really need to start paying attention to that, cause right now, if I miss a setup and it doesn't come back to the entry price, I usually skip it. 🙁