You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cycle analysis

Belflan

Grey1 has been in discussion with FW on another thread about where the market is headed and the pros and cons of TA and FA.

I thought a particularly useful summary was on post:

http://www.trade2win.com/boards/427544-post120.html

In that post Grey1 remarked:

Monthly , weekly and to day daily indicators based on market cycle have turned up ... would we really want to go against the cycle ? I use a fisher transform to measure the cycle ,,,others might use other indicators ,,, ( cycle analysis is the foundation of TA)

I thought that it would be worth capturing this on your swing thread to avoid this small point about cycle analysis being lost.

There are many links on Fisher transforms with relation to trading. One for example (needs powerpoint) is this one which relates to Tradestation code:

www.mesasoftware.com/Seminars/TSWorld04.ppt

Just thought it might be worth capturing cycle analysis as a particularly interesting subject to pursue

Charlton

Belflan

Grey1 has been in discussion with FW on another thread about where the market is headed and the pros and cons of TA and FA.

I thought a particularly useful summary was on post:

http://www.trade2win.com/boards/427544-post120.html

In that post Grey1 remarked:

Monthly , weekly and to day daily indicators based on market cycle have turned up ... would we really want to go against the cycle ? I use a fisher transform to measure the cycle ,,,others might use other indicators ,,, ( cycle analysis is the foundation of TA)

I thought that it would be worth capturing this on your swing thread to avoid this small point about cycle analysis being lost.

There are many links on Fisher transforms with relation to trading. One for example (needs powerpoint) is this one which relates to Tradestation code:

www.mesasoftware.com/Seminars/TSWorld04.ppt

Just thought it might be worth capturing cycle analysis as a particularly interesting subject to pursue

Charlton

www.mesasoftware.com/Seminars/TSWorld04.ppt

Just thought it might be worth capturing cycle analysis as a particularly interesting subject to pursue

Charlton

Great link Charlton,

I'm not ready to study this yet (need to get the basics right first) but this will be a great starting point when I'm ready

Great stuff

belflan

Belflan

Grey1 has been in discussion with FW on another thread about where the market is headed and the pros and cons of TA and FA.

I thought a particularly useful summary was on post:

http://www.trade2win.com/boards/427544-post120.html

In that post Grey1 remarked:

Monthly , weekly and to day daily indicators based on market cycle have turned up ... would we really want to go against the cycle ? I use a fisher transform to measure the cycle ,,,others might use other indicators ,,, ( cycle analysis is the foundation of TA)

I thought that it would be worth capturing this on your swing thread to avoid this small point about cycle analysis being lost.

There are many links on Fisher transforms with relation to trading. One for example (needs powerpoint) is this one which relates to Tradestation code:

www.mesasoftware.com/Seminars/TSWorld04.ppt

Just thought it might be worth capturing cycle analysis as a particularly interesting subject to pursue

Charlton

Charlton, do you Ehlers MESA stuff. If so what do you think of it ?

For anybody without Powerpoint, get OpenOffice free from www: OpenOffice.org - The Free and Open Productivity Suite

Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

Belflan

Grey1 has been in discussion with FW on another thread about where the market is headed and the pros and cons of TA and FA.

I thought a particularly useful summary was on post:

http://www.trade2win.com/boards/427544-post120.html

In that post Grey1 remarked:

Monthly , weekly and to day daily indicators based on market cycle have turned up ... would we really want to go against the cycle ? I use a fisher transform to measure the cycle ,,,others might use other indicators ,,, ( cycle analysis is the foundation of TA)

I thought that it would be worth capturing this on your swing thread to avoid this small point about cycle analysis being lost.

There are many links on Fisher transforms with relation to trading. One for example (needs powerpoint) is this one which relates to Tradestation code:

www.mesasoftware.com/Seminars/TSWorld04.ppt

Just thought it might be worth capturing cycle analysis as a particularly interesting subject to pursue

Charlton

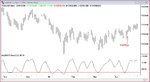

The Macci itself is a cyclic analysis tool and is gaussian by nature.

Some months ago I applied Inverse Fischer transform to it and, for me at least, it gave no advantage over the macci in terms of cyclic analysis.

I don't know whether Grey1 is using IFT Macci or applying IFT to something else, but this was my experience with the macci.

Glenn

there was a story on CNBC today saying that there was quite a few hedge funds with Billions in Cash sitting on the side lines waiting on the dow lows to be tested again before going long.. now its believed that money is now chasing the market wishing they'd bought in a while ago..

hats off Grey1, looks like your a head of the average hedge fund

belflan

looks like I missed the boat for now also

hats off Grey1, looks like your a head of the average hedge fund

belflan

looks like I missed the boat for now also

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

there was a story on CNBC today saying that there was quite a few hedge funds with Billions in Cash sitting on the side lines waiting on the dow lows to be tested again before going long..

hats off Grey1, looks like your a head of the average hedge fund

heheh they are dreaming .. THIS MARKET WILL NEVER EVER GO TO MARCH LOW .Oil hits 120$ and market rallies , is this a weak market ?

grey1

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

long portflio now opened

GREAT PLEASE GIVE US THE P/L DAILY

Thanks

grey1

GREAT PLEASE GIVE US THE P/L DAILY

Thanks

grey1

off to a good start +$1,133

just so that everyones knows this is still a forward test

I've a while to go yet before I go live

i will post all trades for a period of 6months when I go live also

good trading all

belflan

.. My reason for Fridays entry ; I thought everyone (weak hands) would be selling, there was a few days sell off, then a gap down on Friday, who wanted to hold over week end?? didn't have much to do with Macci's (although I new the 30min was on side) more to do with Grey1 coments, don't buy when everyone buying, buy when everyone is selling..

lets see how it works out..

Last edited:

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

off to a good start +$1,133

just so that everyones knows this is still a forward test

I've a while to go yet before I go live

i will post all trades for a period of 6months when I go live also

good trading all

belflan

.. My reason for Fridays entry ; I thought everyone (weak hands) would be selling, there was a few days sell off, then a gap down on Friday, who wanted to hold over week end?? didn't have much to do with Macci's (although I new the 30min was on side) more to do with Grey1 coments, don't buy when everyone buying, buy when everyone is selling..

lets see how it works out..

Goosd start,, other 3 portfolio's are doing really well too .GOOD TRADING GUYS

Grey1

Goosd start,, other 3 portfolio's are doing really well too .GOOD TRADING GUYS

Grey1

good start continues,

Dow down 40points

running total of long port = $2,835!

good start continues,

Dow down 40points

running total of long port = $2,835!

abit of a pull back

DAR getting hammered tonight

P/L = $1,340

belflan

closing GIGM o/b

opening AUO

Profit on GIGM = $1,164

running total = $1,578

belflan

running total = $1,218

Similar threads

- Replies

- 309

- Views

- 114K