You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Quick Review

I've looked back over my trades, and I'm happy enough for the 1st day of intra day trading.

one point, the last three trades were taken a bit early, i may for done this in a rush coming up to market close.

also TS2ki is not stable enough on my PC to trade intra day for $$$$$$

it's hard to call a market technical or new driven before open (need experience to do this)

Glen

I've looked back over my trades, and I'm happy enough for the 1st day of intra day trading.

one point, the last three trades were taken a bit early, i may for done this in a rush coming up to market close.

also TS2ki is not stable enough on my PC to trade intra day for $$$$$$

it's hard to call a market technical or new driven before open (need experience to do this)

Glen

Last edited:

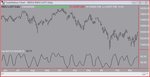

When you see the 1 and 5-min INDU Macci staying OB you have a good indication that the market is strong. It was OB in 60-min and 30 min too and these made no diference.

Hi Glenn,

how many time frames do you keep an eye on while day trading?

cheers

Glen

Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

Hi Glenn,

how many time frames do you keep an eye on while day trading?

cheers

Glen

$INDU 1-5-10 as Grey1 recommends. Anything higher is unlikely to be much use intraday becuase they are much slower to turn.

Overall have $INDU 1-min up to Monthly, but obviously not watching all those all the time. The longer timeframes can be helpful at OB/OS extremes though, e.g. Daily for swing portfolio as you know.

Glenn

$INDU 1-5-10 as Grey1 recommends. Anything higher is unlikely to be much use intraday becuase they are much slower to turn.

Overall have $INDU 1-min up to Monthly, but obviously not watching all those all the time. The longer timeframes can be helpful at OB/OS extremes though, e.g. Daily for swing portfolio as you know.

Glenn

can't add to your rep.

thanks mate

Glen

Technical or non technical

Following on from what Glenn said (the other Glenn) yesterday

will it be tech or not today, if you can not make this call correctly are you toast?

my take for today is as follows;

CNBC = no big news, still taking about BS news from yesterday

INDU = up about 400points last two day may consolidate today, INDU day macci heading o/b

Futures = up a bit pre market

FTSE etc = very strong

tech or non tech day who knows???????????//

I think it would be brave to go short early with strenght in FTSE, Longs only me thinks

Glen

Following on from what Glenn said (the other Glenn) yesterday

will it be tech or not today, if you can not make this call correctly are you toast?

my take for today is as follows;

CNBC = no big news, still taking about BS news from yesterday

INDU = up about 400points last two day may consolidate today, INDU day macci heading o/b

Futures = up a bit pre market

FTSE etc = very strong

tech or non tech day who knows???????????//

I think it would be brave to go short early with strenght in FTSE, Longs only me thinks

Glen

Attachments

Following on from what Glenn said (the other Glenn) yesterday

will it be tech or not today, if you can not make this call correctly are you toast?

my take for today is as follows;

CNBC = no big news, still taking about BS news from yesterday

INDU = up about 400points last two day may consolidate today, INDU day macci heading o/b

Futures = up a bit pre market

FTSE etc = very strong

tech or non tech day who knows???????????//

I think it would be brave to go short early with strenght in FTSE, Longs only me thinks

Glen

Consumer confidence figures at 10:00 US EST. These sometimes stir things up a bit.

On the topic of highly trending days, I have read somewhere that these days are freqently characterised by unusually high volume on the ES in the first half hour or so after the open. I can't remember the statistics and I hesitate to post this at all and complicate matters. Analysis paralysis can be a nasty affliction, as I well know.

Consumer confidence figures at 10:00 US EST. These sometimes stir things up a bit.

On the topic of highly trending days, I have read somewhere that these days are freqently characterised by unusually high volume on the ES in the first half hour or so after the open. I can't remember the statistics and I hesitate to post this at all and complicate matters. Analysis paralysis can be a nasty affliction, as I well know.

hey dc,

which figures calender do you use, i'd like to post one

cheers

Glen

Economic calendar | financial calendar | Forex economic calendar

There may be better ones available, but this seems to catch most significant releases.

There may be better ones available, but this seems to catch most significant releases.

Economic calendar | financial calendar | Forex economic calendar

There may be better ones available, but this seems to catch most significant releases.

thanks dc,

i think it would be good to have an earnings calendar as well, i think there's one on CNBC's site, i'll have a look

cheers

Glen

Attachments

Yahoo finance has one as well:

US Earnings: Company Earnings Calendar - Yahoo! Finance

I like Yahoo finance because it has nice simple HTML pages and they are fairly easy to "screen scrape" with custom software.

US Earnings: Company Earnings Calendar - Yahoo! Finance

I like Yahoo finance because it has nice simple HTML pages and they are fairly easy to "screen scrape" with custom software.

Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

tech or non tech day who knows???????????//

Glen

If you don't 'know' then don't trade until you do.

Having no position is still a position.

Glenn

Poor Housing figures

Home Prices Extend Slump In Most US Metro Areas - Retail * US * News * Story - MSNBC.com

not sure what the market expected??

Home Prices Extend Slump In Most US Metro Areas - Retail * US * News * Story - MSNBC.com

not sure what the market expected??

If you don't 'know' then don't trade until you do.

Having no position is still a position.

Glenn

what do you think Glenn,

technical or non technical (what's at the top of your page?)

cheers

Glen

Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

what do you think Glenn,

technical or non technical (what's at the top of your page?)

cheers

Glen

Tech but wait until after 2 pm (News due).

Glenn

Similar threads

- Replies

- 2

- Views

- 3K