Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

Sun

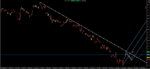

staying with GU

If you scalp bought on a tick chart - you need to have done it at 4306 -8 area

If you wait to 12 or even 15 - its far too late

What was your entry price ?

Personally - i preferred the scalp sell after 9 39 am - a key time on tick than the buy