roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

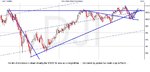

roguetrader said:Shaping up for a bumpy start to the week, open gaps below may be filled, not much in the way of economic data this week, so we may get an early test of the bulls resolve. Volume on Friday was difficult to guage due to expiry. Looking for support to hold on the INDU at 10,578, and 1210 on the SPX. Nasdaq still has formidable resistance overhead at 2100.

I told her to correct to 2018 before moving up here, but she wouldn't listen 😆

Gaps were duly filled with a slight overshoot on the INDU, but support held leaving us not far from unchanged on the day. Yet again an opportunity for the bears went begging, volume declined considerably from Friday, though as it was quad witching no surprise there, but volume also declined from Thur and Wed so the pattern of higher volume on the up days and lower on the down days persists. Internals were bearish throughout the day with only a brief visit to positive teritory in the last hour. After another brief visit below the 200 week sma the SOX closed with a bullish hammer above it. With little in the way of economic data this week, all the talk is of crude oil and its move toward the $60 mark.

As with the past few weeks the risk remains to the upside and we could well see a run into the quarter end.