mr.marcus said:

.....good try jacinto....i would like to give you a couple of questions to think about......what exactly is indecision....indecision with who.....weak hands...strong hands...sometimes we use terms and dont consider what we actually mean...have a think about this simple term which is freely but incorrectly used.if youd like to mail me on it feel free....after the recent exploits im worried not to upset anyone by asking questions back.although they are poignant of course and leading you to very valuable answers..

cheers mark j

thanks mark. you dont upset me, that is for sure. this type of question is the one that is relevant, and I would actually encourage you to keep on having a go with them.

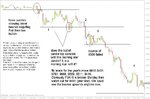

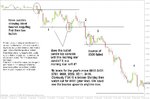

Indecision: you are right, I shoud first think before i write, and I guess I should take that back until i know how to define it. What was in my mind in that chart was that after the break, on every push up, price cant close up, immediately rejected. apparently same with pushes down. however, red candle in the middle engulfes small green spinning top, and the following candle simply breaks and closes at the bottom, making a lower low. following candle manages to push up, pip above previous candle and close in the middle of the range. until that point, is where i see the indecision (hence rectangle showing price action finishes there). after that, the market reveals itself, since there is no single close or relevant new high above that level(only 1 new high by 1 pip) and confirms move is down.

mr.marcus said:

...and a second question....what exactly was it that shook you out of the move...

to answer it to the point:

1) fear of loss. fear of having a situation in which I enter into doubt and hope, fear of not having placed my stop adequately, fear that I analysed wrongly the situation (clearly, my first chart does not have the thorough analysis i did on the post trade analysis. it gives me a lesson) etc. (I am open to talk about the psychological aspect in public, but wont expand on this topic on this thread. )

2) probably having memory of price being rangebound before, with clear rejections with that type of action (clearly under different circumstances) and not wanting to be in a scenario where I could have closed without a loss instead of waiting for my stop to be hit. I guess that is the excuse, and not the explanation, and is related to the above.

3) probably missing the whole point of what I was reading. Not that i want to use text book jargon, but the break of the hourly inside bar is the bar that would tell me intent, and that my stop would have been completely safe at the top, I guess doubt made me forget that.

mr.marcus said:

if so....one simple point....ask yourself this....have you seen markets v from these points?bigger picture locations key here...if not ....wait for a test of the lows....if pros are short it wont take out the highs at this point....so you were safe to hold as intent was downside ...in pretty sure looking at the action....the bigger picture market had already been falling away from the highs and the early part fo the chart is at the top of a correction......so this was all about weak demand ....as in weak hands buying the upside....all of the top....and short term weak shorts getting shakin out......pros small amounts but that wasn't the primary motive here...this is an exchange on a correction but not a major top.

any idea where the intent was confirmed to be supply(selling)...there are 3 very telling candles....in fact this is a fantastic chart to analysis....im looking forward to it...i will be doing it in 2 sections......one will be the top.....and one the break ....i will explain in detail the market has basically 2 modes.....exchanging and controlling.bare with me on this chaps....as its gonna mean a good 5 hrs work i need tosqueeze in somewhere this week.

cheers mark j

first paragraph, I guess it also tells me a mistake, stayed at the shorter timeframe and forgot to keep a good eye on the larger timeframe. it is a mistake on that front. I dont want to answer your points just yet, need to think.

Second paragraph about intent.

a) the not so obvious (in my eyes at least) 2 candles prior to the bounce that made me get out. I think that one reveals intent quickly. It breaks a 60 min inside bar (not that i want to get into text book jargon)

b) The more less obvious (in my eyes, and obviously post chart analysis), is the bar that closes prior to breaking the spinning top that makes the third attempt at the low of the overnight range (the 3rd lower high). A break of that candle, IMHO, simply says it will be a down day.

c) There is one that is obvious, and is the one that breaks the weekly low and down consolidation (prior to the so called indecision rectangle, just as a description for simplicity, not a definition)

Well, that was the go at the intent question. Probably I should have waited, but there it is.

Thanks for the time mark, truly appreciated

j