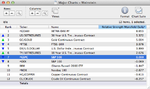

Attached are the major charts for stage analysis and relative performance table.

It was a big week in the markets with notable breakouts and breakdowns in the major charts. You'll see from the relative performance table that the 10 and 30 Year Treasuries and the Dollar Index are all now outperforming the S&P 500 highlighting that we are in a downtrend in the stock market.

30 Year Treasuries broke out strongly on Wednesday 7th above it's 4 month downtrend line to close the week near the highs of the summer. Volume on the 7th was the highest it's been since June and continued to be strong through the end of the week. Relative performance versus the S&P 500 crossed back above the zero line on the weekly chart and weekly cumulative volume also crossed it's own MA line to give a new buy signal. So the signs are looking positive that it could make a new Stage 2 continuation move and break out of the Stage 3 range it's been in all summer, which would add further pressure to equities if it does.

Gold also made a notable move above it's zero line again and has broken it's recent inverse relationship with the Dollar. Volume also picked up and was close to double the previous four weeks average volume. However, it's still below it's 50 day MA and has large volume resistance up to the 1780 level and so needs to get a weekly close back above there imo, as it's still within a much larger one year Stage 3 range currently.

Copper traded down to it's trend line convergence zone of the 1 year down trend line and 3 year uptrend line. Which could provide major support as convergences of long term trend lines are often key support/resistance zones imo.

The stock indexes traded down heavily last week and moved us into Stage 4 according to Weinstein in his interview this weekend.

Technician Stan Weinstein: Expect Markets to Head Lower Next 3 - 6 Months. I would like to add a note of caution though to this, as the S&P 500 finished the week right below it's 200 day MA and on a major one year trend line of which this is the third test, and so it could also possibly bounce around here to retest the breakdown around the 1400 level. So if you are not already short stocks or long treasuries from the breakdown/breakout levels then I'd personally suggest standing aside until you get a better risk reward opportunity, as a short trading stop loss on the S&P 500 would go around 1443.85 imo, and so you need a pullback to around 1400 to consider getting in with an acceptable 2.96 x ATR(200) risk.

The S&P 500 formed a small head and shoulders Stage 3 range over the last 3 months which gives us a swing target to 1318.61 imo from that range. I personally had considered it in Stage 2B- as I thought the range was too small for Stage 3, and broke down very quickly once it was below the 50 day MA. But it's Weinstein's method after all, so I bow to his superior knowledge. It does however give me further questions about defining the precise entry points for Stage 3 and Stage 4 as from the multiple examples we've been through on here the Stage 4A breakdown point is generally not until price forms a swing low below the 200 day MA and then breaks below that. Obviously, that hasn't happened in this case as the entire Stage 3 range developed above the 30 week SMA and he declared Stage 4 with a close below that and the 30 week SMA. So I need to delve back into the book and chart examples to clarify the Stage 4 breakdown point as I'm obviously being too conservative by waiting until the swing low below the 200 day MA to declare it and should just be looking for a breakdown from a consolidation range that then closes a week below the 30 week SMA. But that's why the recent interviews are useful, as it's the only access that retail investors that follow his method have, which helps us to enhance our understanding of the method and get more specific ourselves. As the $10,000 a year fee for the Global Trend Alert newsletter is simply not accessible for the vast majority of people and the book only gives you the foundations of the method and leaves a number of grey areas which I've tried to understand on this thread. So that's why I like to encourage detailed discussion on here, as Weinstein isn't interested in retail investors, as you might have noticed on the interviews as he's complained multiple times about people contacting him that can't afford his service, so we need to help ourselves by helping each other imo.

I've said previously that identifying the stages is only part of the method, as Weinstein has a number of proprietary gauges that he follows such as market breadth measures, the momentum index etc. Obviously, we don't have access to all of these measures as they are proprietary, but we can monitor some of them - which I try to do in the

market breadth thread on here, so that we can look at the weight of evidence that the market is showing in it's internals ourselves, and improve our market timing.