Black Mamba- Just thought I would add my two cents...

IMO your first emerging ETF, EPOL, is showing mixed signals within the Weinstein method. First the good: 1) The volume has doubled as of recent weeks which shows strong interest. 2) The price is above its 30 week WMA and the current trend looks strong. 3) Its relative performance v SPX is strengthening and although still negative,is showing a buy signal.

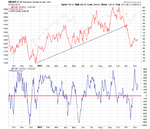

Now for the bad: 1) Not sure what your target is but I see two very strong points of resistance at both 30 and 40 bucks. The problem is that the 30 dollar resistance level looks to be extremely strong..it has served as both the support and resistance- So in my opinion, if it did break 30, it would have a fairly easy ride to 40 where you would have some more decisions to make. 2) My second concern is the overall market. If we are in the beginnings of a stage 4 decline as per Weinstein's words in his recent interview, I could not imagine buying into anything at this point until he is confirmed wrong by a strong performance on the major charts, even if it is the Polish Investable ITF.

As for the second ETF IRL, I like it more than I do EPOL for a few reasons. 1) Although still seemingly low, the volume has had its stong weeks recently and seems to be gaining in momentum when compared to the last couple of years or so. 2) It is also above its 30 week WMA and its relative strength v SPX is above the 0 line. 3) The strongest reason is that there is no recent overhead resistance. The price crashed in from 07 to 09 and has been in a stage 1 basing phase for a long time. (I know that Weinstein said the bigger the stage 3, the bigger the stage 4...not sure if that logic would also apply to stage 1 moving into stage 2...need to go back and read that) Having just broken the strong resistance level, it looks to be in great shape for a long stage 2 run.

One question, what are your price targets for these two ETFs?