alexwinkler

Experienced member

- Messages

- 1,308

- Likes

- 17

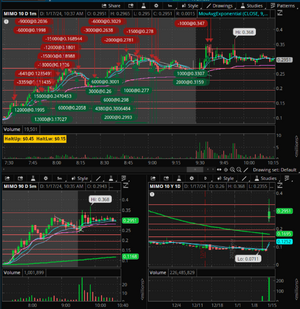

$MIMO what a PM! I started to trade it late but after 20m I got a bit more comfy trading the sub-dollar and was able to make some decent profits. The open technically had 2 beautiful setups but I small-sized them with lack of conviction it wouldn't halt. $BFRG also took away some of my attention.

In today's YT recap, I'll also share how I have #halt indicators on my #TOS layout.

You can see them in the screenshots below "HaltUP & HaltLW" by the vol.

For now.. here's the #ThinkScript Share URL: https://tos.mx/HH1mHwJ

In today's YT recap, I'll also share how I have #halt indicators on my #TOS layout.

You can see them in the screenshots below "HaltUP & HaltLW" by the vol.

For now.. here's the #ThinkScript Share URL: https://tos.mx/HH1mHwJ