snowrider

Well-known member

- Messages

- 423

- Likes

- 3

Quote from Wide Tailz:

For similar reasons, I have a lot against fundamental analysis.

EW fits into my trend following system by filtering the buy signals by wave type. My be$t trades, by far, have been during a third wave (either the general market or the stock itself).

Wave 3 is the first higher low and breaks the previous trend line, and typically follows noticeable divergence in MACD, RSI, money flow, Stochastics, ROC, and any other momentum indicator. A huge candle as the dam breaks is the final confirmation.

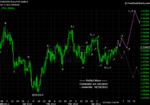

OP: my comment for your analysis is that I'm amazed how far you take the corrective wave counts. I've never had much success trying to analyze them. I see the SP500 currently in a B wave completing the C wave of next lower degree, itself seeing wave 5 of next lower degree completing as I type.....

😀

Wide Tailz - Thanks for commenting. Believe it or not, I don't give a shxt on any fundamental analysis. Ironically, I used to be doing and writting a lot of fundamental analysis, and I knew that it was just like writing some stories because people wanted to read stories.

I strongly agree with you that the best and easist trades are on the wave-3. About the question how I "take the corrective wave counts", I start from the highest possible degree of timeframe (e.g., montly chart) to analyze and then scale down to the tradeable timeframe (e.g., daily chart). Therefore, sometime a corrective wave in a monthly chart still has some impulsive wave in the daily chart which we can make money from. 🙂