You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

snowrider

Well-known member

- Messages

- 423

- Likes

- 3

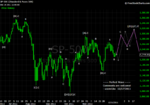

yupek - Thanks for reading my weekly posts. My prediction is based on the Elliott Wave principle that everyone can find tons of references on the web. About last week's prediction, say SP for example, my preferred count is the purple line. The market could have taken wave-II right away last Monday. In that case, wave-I.4 would be a simple correction. However, the market went flat for 3 more days, and wave-I.4 became a complex correction. Last Thursday's sell-off could be the final kick of an irregular wave-II before wave-III's marching north.Since you post the chart every week, is it ok to have some comments about the last week's prediction, if it is good, and if not, how you adjusted to it, etc. I think that it will be much appreciated. Thanks.

...

It's hard to answer the question about how to adjust wave count. If one wants to trade EW, at any moment, s/he needs to have a backup plan - that is the alternative count. When the market does not move in favor of one's preferred count, the alternative count may become the preferred one. Remember one thing ... anything can happen. Therefore, trading with EW is a process of constantly thinking. As I mentioned many times, it's just like playing chess with the market. I don't mind to share my view every weekend because I will be happy if readers make money and also share their thoughts with me. More people watch the game (of chess), more thoughtful the wave count would be.

snowrider

Well-known member

- Messages

- 423

- Likes

- 3

yupek - Yes, it is possible (and anything is possible). Please see the grey line alternative count. Also I explained that as a micro alternative count in last Thursday's posts. Say, if you have bot SP at Thursday's MOC, now your STP order can be placed 1 point right below last Thursday's low. If the STP gets hit, you don't lose nothing. We don't know if it will happen, but when an opportunity comes, one needs to evaluate if it is worth the risk to bet. Say, if you did not enter the long of SP at Thursday's MOC, when do you want to enter? After breaking out weekly high? Not really a good idea because once it happens, where are you going to place your STP order? It will be the same price (1 point right below last Thursday's low), but your risk will be much higher.Thanks for comments. It is very helpful.

I just feel that Thursday's correction is too shallow. It is still possible that we have two legs down. So we may revisit Thursday's low or even go to 1220. I'm wondering why you think that we should go up from here.

...

snowrider

Well-known member

- Messages

- 423

- Likes

- 3

yupek - I assume that you are talking about SP. Yes, it could break "the current big triangle" (as I believe that anything is possible). I did not mean to ignore that scenario, but I just did not want to draw a spiderweb on the chart to include all possible scenarios. You might want to ask why I favor those up scenarios over down scenarios? Last week's low is 50% pullback, and 1200 area is 61.8% pullback. There is no reason to assume that the market is weakening and going down before some key fibonacci ratios stop working.So the basic impression is: we will find a bottom soon (it may have been there, or a little lower than last week's low), and go up to pass the MA 200.

Just wonder why you ignore the possibility to break down from the current big triangle (breaking 1200).

...

snowrider

Well-known member

- Messages

- 423

- Likes

- 3

snowrider

Well-known member

- Messages

- 423

- Likes

- 3

Quote from ammo:

snow would you do this monthly ,i havent attempted to learn ew,but if this were wave 5,whats the longer /shorter than prev wave rule,or measured move,thanks and merry xmas

ammo - Thanks. Elliott Wave Principle is a very powerful tool. You'd better start learning that if you believe in Natural law. To answer your question, "if this were wave 5", my convention would label it as abcde instead of 12345 because the wave from the low of 2009-03 did not show an healthy impulsive movement. So, say, if we call it abcde, then your question is how high the final segment could go, right? OK, you see the second up leg from 2010-07 1011 to 2011-05 1371 has time span of 10 months and price span of 360. You can make a guess that the max target of the final up leg won't exceed the time A and the price B before a big correction because a rule says that the 3rd wave won't be the shortest. The answer can be measured from the correction of the second up leg, and it will be:

A = 10 months + 2011-10 = 2012-08

B = 360 + 1075 = 1435

snowrider

Well-known member

- Messages

- 423

- Likes

- 3

This thread is closed. Please visit the new one:

http://www.trade2win.com/boards/us-indices/142016-perfect-wave-2012-1-2-a.html

http://www.trade2win.com/boards/us-indices/142016-perfect-wave-2012-1-2-a.html

Similar threads

- Replies

- 31

- Views

- 11K