Yeah, that's it. That's how it develops. That's how a small loss turns into a huge loss that blows out my account.

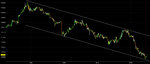

You go LONG at the market still keeps falling. Then you say: well, now it makes even more sense to go LONG and you add a LONG position. Then the market keeps falling, and you say: wow, great opportunity to add another contract... but it keeps falling. Then, after a few days, you've blown out your account.

9 times out of 10, it works. But one time out of ten it doesn't work. And you blow out your account.

Unless of course you have a million dollars and you start with 1 contract. Then your chance of succeeding is closer to 100 percent. But then if it goes your way from the start, you will be making a very small return, because you will have 1 contract invested with 1 million of capital. So, in any case, this method doesn't make sense, unless your objective is to just win at all costs your next trade, regardless of your return.

Ok, so now I've understood this mechanism, but will it prevent me from taking this risk the next time? Maybe not. Because I had understood and seen this mechanism at work each time I've blown my account before.

Maybe the loss is so big and your willingness to accept your loss is so small that you'd rather run the 5 percent risk of blowing out your account rather than accepting your loss. The bigger your loss gets the more willing you will be to risk blowing out your account in order to recover from it.

That's why you should never allow your loss to be bigger than you can accept, because it will drive you crazy.

I can't find any similar situations in other areas of life, and maybe that's why I can't get this into my head.

Maybe it's like not going to work. One day you decide you won't go to work and call in sick. The second day, it's harder to go to work, and therefore you don't go either. The third day, it's harder. The more time goes by, the more unlikely you will be to go back to work.

Maybe it's also like washing dishes, even though I rarely experience it, since I wash them immediately. If you don't wash them one day out of laziness, the next day there'll be more dishes. But then your laziness of yesterday will be there today as well, except the dishes are more. Eventually you're going to feel overwhelmed and not know what to do.

The same happens with being tidy and orderly, whereby you're either tidy all the time or never. That's why I don't believe in

putting things in order but in

keeping things in order. Because as the number of days increases since the last time you put everything in order, your order decreases and you're benefitting from it first of all. But second of all, because you're overwhelmed by disorder and that keeps you from being tidy in the first place. So you get home and you should hang your jacket rather than throw it somewhere. That way you keep tidy, rather than having to tidy up your room once in a while, which is useless.

Anyway, of all these examples, maybe washing dishes is the one that fits best: you should not allow your losses to cumulate like you don't allow your dishes to pile up in the sink. Because the more they do, the more they will paralyze you. Because if you're too lazy to wash one dish, there's no reason you will be more likely to wash two dishes and so on. And if you're unwilling to close your trade with a loss of 100, there's no reason you will be willing to do it with a loss of 200.

There is one difference though. After a given level, if your account is still not blown out, the markets will turn around and your loss will decrease. Whereas the dishes will never start washing themselves.

Another thing in common is margin needed. If you don't have the margin, your positions will be closed, and that might save you from losing further. If you don't have the dishes, that will save you from piling up more dishes in the sink. So maybe having a small account would be as good as just having one dish. It will force you to face reality and wash your one dish in order to use it again, and it will keep you from losing more because it will be empty. However, I've had a small account for 12 years and I kept on wiring money to it. That would be like someone with just one dish, who goes and buy more dishes when they get dirty, but the comparison can only go so far.

Basically, I now understand the process better than ever, but I also remember this was a feeling I've experienced before and yet it did not keep me from blowing out accounts later.

What has made me and will make me take that 5% chance of blowing out my account again is that possibly:

1) the account is small and it doesn't kill me if I blow it out.

2) can't think of other reasons

Could that be it?

Or maybe, due to how I was brought up, I am extremely afraid of failing, and I'd rather take huge risks each time rather than accept a loss, which to me is like a failure to be ashamed of.

Whatever the reason, I know it's still there, hiding somewhere inside my head.

I didn't feel any huge loss as my account gets emptied so maybe I don't care that much and that is the problem. If you don't care, you can't remove the problem from your habits and your ways of thinking. No pain no gain.

But maybe gain can happen without pain. Or maybe not. Maybe discipline is what I need, and I refuse discipline because I've always refused discipline in all areas of my life. But this is not true either.

I always brush my teeth regularly and that is discipline. I take showers, I shave...

Why can't I take losses the way I brush my teeth?

It must have something to do with a faulty reasoning encouraged by the up and down of the markets, whereby you feel that they will bounce sooner or later and do not know exactly when you should cut your loss, because it could always be one minute before they start going your way.

After all, it might have nothing to do with everything I said above. It might simply be that the markets trick your mind, and unless you have some fixed rule that will stop you from being tricked, like

Ulysses ordered to be tied to resist the syrens, you will not survive the tricking.

You need to be tied to your stoploss the way Ulysses was tied to the mast. And not let the sailors untie you until you keep on asking so because you're hearing the syrens. But the problem is that when you trade you're both Ulysses and the sailors at once and you can untie yourself, provided that you tied yourself to begin with.