L

Liquid validity

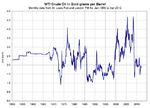

Agreed, at best the decline in oil production can be slowed down by new

survey and extraction technology. That still comes at a cost - extraction and field

development are more expensive, adding to upwards pressure on oil price.

As for alternatives, until recently I always thought the progression to

electric vehicles was a massive mistake.

For me the hydrogen fuel cell seemed more practical and realistic:

Honda Worldwide | Fuel Cell

BBC NEWS | Business | Honda makes first hydrogen cars

Obviously the dowside is perception,

the hindenburg being an obvious example despite technological advances.

That was until I came across a solar power variant:

Victorville Solar Power Generating Station, California - Power Technology

Solar mirror - Wikipedia, the free encyclopedia

Seems to be gathering pace and is on track to be the worlds largest

solar power experimental project.

Rolled out on a mass scale, that would answer the argument of fossil fuel

power stations generating electricity to charge electric vehicles.

With electric vehicles, the practicalities of recharging could be overcome by

adopting a universally agreed battery format.

That would allow a quick battery cahnge at a battery centre or even

as an additional service provided by petrol stations in the interim.

Personally, I think alternative energy plans have been in place for quite some time.

Its just the vested interests making sure every last drop is milked from

the oil cashcow before it keels over.

survey and extraction technology. That still comes at a cost - extraction and field

development are more expensive, adding to upwards pressure on oil price.

As for alternatives, until recently I always thought the progression to

electric vehicles was a massive mistake.

For me the hydrogen fuel cell seemed more practical and realistic:

Honda Worldwide | Fuel Cell

BBC NEWS | Business | Honda makes first hydrogen cars

Obviously the dowside is perception,

the hindenburg being an obvious example despite technological advances.

That was until I came across a solar power variant:

Victorville Solar Power Generating Station, California - Power Technology

Solar mirror - Wikipedia, the free encyclopedia

Seems to be gathering pace and is on track to be the worlds largest

solar power experimental project.

Rolled out on a mass scale, that would answer the argument of fossil fuel

power stations generating electricity to charge electric vehicles.

With electric vehicles, the practicalities of recharging could be overcome by

adopting a universally agreed battery format.

That would allow a quick battery cahnge at a battery centre or even

as an additional service provided by petrol stations in the interim.

Personally, I think alternative energy plans have been in place for quite some time.

Its just the vested interests making sure every last drop is milked from

the oil cashcow before it keels over.