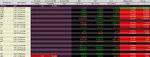

7 minutes to go and praying for my GBL seventh contract not to be closed on margin call.

If it doesn't get closed in the next 7 minutes... I am fine.

...

5 minutes to go... amazing how strong GBL is being, and on a Thursday. Damn me.

It is going to close above 146, quite impressive.

...

4 minutes and my seventh contract still didn't get closed, despite a message saying "margin..." (the "less than 5%..." message) a few minutes ago.

3 minutes to go.

2 minutes to go.

The stock indexes futures, YM, NQ, ES, rise, and yet GBL rises as well. This is not normal. I will post its chart in a few minutes.

1 minute to go and still 7 contracts open.

... great! I managed to keep all 7 contracts. Tomorrow is a new day. Hopefully, being Friday the most bullish day for stocks and bearish for GBL... hopefully this future won't stay above 146.

Wow. I am so exhausted. I've done a lot of damage today. A LOT.

I must have lost 10k with the grains and JPY, and then, thanks to my doubling up on JPY and closing GBP, I missed 1000 dollars of profit on GBP and lost an additional 1300 on JPY. So that's another 2k lost on top of that 10k due to not monitoring the economic calendar.

Wow, I just threw away 12k, and that is why I am where I am right now. Very low capital.

I could make it all back, depending on how well I will pray to god tonight for GBL to fall, fall, fall.

...

OK. Now I can do no more damage. The only thing that could go wrong is if GBL rises even more. Then I am totally screwed.

Right, I had to post that chart...

... here's all the GBL charts:

chart from here:

eSignal.com free world stock market quotes and charts

As high as ever, but these above are only a few months.

This is 5 years of the yield, from here:

German Government Bonds 10 Yr Dbr Chart - GDBR10 - Bloomberg

As you can see from the chart above, the yield has never gone below 1.2sh%, where we are now.

All the charts below are from here, with various timeframes (monthy candles, daily candles, daily candles but with a shorter history):

Euro Bund Charts | Euro Bund Futures Streaming Chart | Euro Bunds Futures Chart

This last chart above shows exactly how close GBL got to 146 but never staying above it for longer than one day, which happened today.

This is what I am counting on and why I came up with the concept of stoplosslessness. There is clearly a roof up there. But an earthquake in Germany would definitely help. So that's what we have to pray for.

...

A bigger detail of the last picture I posted, quite frightening, shows that once, just once, things went further:

If it happens again, damn, I am screwed. Let's pray for something to happen to Germany, because we don't want that one instance to happen tomorrow. If I can get through the weekend, I should be fine.

If instead tomorrow the Bund closes at 146.50, like it did once in the whole history of mankind, they'll definitely close at least one of my contracts.

I don't have much more mental strength left in me. We all need to get together, join our hands, and pray for something to go very wrong with Germany. Within the next few hours.