In some ways I am relaxed and in some ways I am deeply disturbed.

Let's analyze my mind.

How am I relaxed?

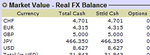

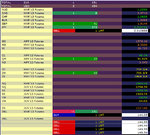

I have 3 positions, in GBP, JPY and GBL and:

1) GBP very likely to bounce

2) JPY very likely to bounce

3) GBL very likely to bounce (downward)

So, overall, what seems to be an account at 27k, which sucks, is actually an account that is likely to reach 32k at the very least.

But the real question is how did I get to as low as 27k?

That really bothers me.

That's the part that makes me depressed and worried. How did I fall so low?

JPY made money, lots of it. So did ZW and ZC, and yes GBP and CAD lost money, but only 1000, which cancelled the gain by ZW and ZC...

so how did all this money disappear from my account despite the big gain on JPY?

Simple, a huge loss on GBL: I was losing 6000 euros on it by Friday night.

That is equivalent to about 8000 dollars, which is exact, because it puts the account 4000 dollars lower, given the 4000 made on JPY.

How did I get to lose 8000 dollars on GBL?

I didn't lose them: the position on GBL is still open.

So, the big issue is not really JPY or GBP, which will most likely help me recover some of this loss, maybe 2000 or even 3000. The big issue, that's haunting me, is how am I losing 8000 dollars on GBL?

The problem with GBL is that it reached the staggering 145.60 and it's still staying there.

The other problem with my GBL position is that I reached that level with as many as 4 contracts. Going up with 4 contracts, for 100 ticks against you, means incurring a loss of... over 5000 dollars. I don't know how I lost the other 3000 dollars. Yeah, maybe I was short 5 contracts, and not just 4.

Anyway, now that I am short 7 contracts, what is going to happen?

How long more will it stay there? How much time, how many events do I need for it to fall?

What god do I need to pray to?

I don't know where... how much higher it can go from 145.60. The highest it ever reached is 146.

But the contract expires in 4 days, and the next contract is almost 200 ticks lower.

At any rate, if I roll over... and get lucky... how long will I be able to hold my position when I've been so scared?

Friday is the most bullish day of the week and it didn't seem to want to fall at all.

What will happen on Tuesday that is the most bearish (for stock indexes) day of the week?

Anyway.

If the gods listen to my prayers, GBL will fall.

And if it falls... given that I will have made 3000 by Tuesday with GBP and JPY, I will be back at 30k, which is reassuring.

At that point, GBL. If GBL falls a mere 100 ticks, to a still pretty high level of 144.55, I will make 7000 euros.

That is close to 10 thousand dollars, and I will finally reach the long-awaited goal of 40k, thereby decupling my account.

But will things go according to my plans? Will I allow GBL to fall, after being so scared for all last week?

Initially, I was planning for GBL to fall all the way to 143. If I did wait for that long, I would make 21 thousand dollars, and bring capital to 50k.

Do I have the balls, the patience, the confidence to wait until it reaches 143?

All I have to wait is 4 days, because at any rate I will have to roll over by Thursday. Actually by Wednesday night, because I will be at work on Thursday at noon:

Bund - Page 70

L'expiration du bund , mars13, expire, selon la réglementation de l'eurex, jeudi 7 mars à 12h30.

A 12h30 et 1 seconde, fini! Champagne.

I guess my big big mistake was picking the wrong contract. I should have picked the GBL of June 2013. And it would have been lower, I would have waited longer before entering, and I would not have felt in such a rush. Now I am kind of screwed and have to be happy with a fall of just 100 ticks. This rolling over and expiring is really the thing that is bothering me the most. Because I don't know where the hell the Bund is, whether at 146sh or at 144sh. That is a huge difference.

I wonder when the GBL will be rolled over by all these traders if it will be influenced in any direction by the rolling over, whether up or down. Hopefully down. Hopefully everyone was long on it, and it will make it fall more. I wonder. I hope.

Well, this wait on JPY, GBP and GBL won't take much longer.

Dude, this looks quite good and quite in my favor:

I could even very easily roll over, and hold it for as long as a fall of 200 ticks. It just looks very very good, and ripe for a fall. This is the weekly chart of the June contract by the way.

I think I will do this. I will close GBL as soon as I can reach 40k. Then I will wait to see if it rises a little bit, at which point, on the June contract, I will start going short again and repeat this whole process.

...

Here's what I'll do until Wednesday.

I have inserted some LMT orders, on all three positions.

I will stop monitoring things.

I have in place LMT exits that cause the following profit:

GBL, 9000 dollars

GBP, 2000 dollars

JPY, 2500 dollars

If all three get triggered, I reach about 40k of capital.

They should all be triggered by Wednesday. All I need to do now is run the systems, once a day, and not monitor anything otherwise.

Of course I will also have to disable all systems, or else a lack of margin will make IB close my positions.

Then, on Wednesday, I will roll over GBL, if there's anything still open. Hopefully GBP and JPY will be closed by then.

Wednesday night. Nothing to do until then except starting the systems once a day. Let's try to stick to this.