wow, interesting blog by this guy:

http://www.lifetimefinance.blogspot.com/

A bit too many formulas for me.

It turns out he's a teacher and explains his formulas here:

http://www.stanford.edu/~wfsharpe/art/sr/sr.htm

Mmh, this seems a little different from what a friend of mine recently told me:

It is a simple matter to compute an ex post Sharpe Ratio using a spreadsheet program. The returns on a fund are listed in one column and those of the desired benchmark in the next column. The differences are computed in a third column. Standard functions are then utilized to compute the components of the ratio. For example, if the differential returns were in cells C1 through C60, a formula would provide the Sharpe Ratio using Microsoft's Excel spreadsheet program:

AVERAGE(C1:C60)/STDEV(C1:C60)

The historic Sharpe Ratio is closely related to the t-statistic for measuring the statistical significance of the mean differential return. The t-statistic will equal the Sharpe Ratio times the square root of T (the number of returns used for the calculation). If historic Sharpe Ratios for a set of funds are computed using the same number of observations, the Sharpe Ratios will thus be proportional to the t-statistics of the means.

He used square root of 250 but the number of returns was only 150. Why is that?

Oh, here's another link:

http://www.stanford.edu/~wfsharpe/ws/wi_perf.htm

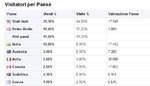

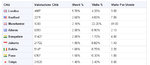

Anyway, I'll now take my best systems (except the GBLs because I have no data) and measure what we will call their "sharpe" ratios (it's the name of the guy who wrote on that blog).

I am going to multiply the final value by the number of weeks in a year (52) times the number of years used. Yeah, that's what I'll do.

Sharpe Ratio:

=10*AVERAGE(B6:B104)/STDEV(B6:B104)

Profit Factor:

=SUMIF(B6:B104,">0",B6:B104)/ABS(SUMIF(B6:B104,"<0",B6:B104))

Most of the systems that perform well... by the way I am ranking the systems by an average of profit factor and sharpe ratio because they're very close to one another and I find it useful to use an average of the two.

Most of the systems that perform well we're already using. YES!!! Good finding. This means they performed well in forward-testing, too, because that's how I picked them.

Those we are not using, it's because they were recently created and I haven't forward-tested them long enough yet.

Here's attached the file with the whole list of the best systems and their sharpe ratio on a monthly basis.