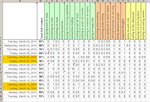

Ok, let's start with this job, above-described. Here's all the systems, once again.

View attachment 78826

My objectives were to pick:

1) CL: one intraday and one overnight system

CL_ID and CL_ON_3 (no doubts here)

2) the best EUR intraday system I've got

EUR_ID_2, EUR_ID_3, EUR_ID_6 (they're all good)

3) the intraday GBL system to be traded with 2 contracts

GBL_ID

4) one GBP system, for diversification's sake

NO GBPs - they're not good enough (would just use up margin)

5) 2 more intraday systems, the best ones

Nope, there's none that are good enough.

6) 2 more overnight systems, the best ones

YM_ON and ZN_ON_2

Let's now see what we've come up with and if there's any margin being wasted:

Intraday

CL_ID, EUR_ID_2, EUR_ID_3, EUR_ID_6, GBL_ID

Overnight

CL_ON_3, YM_ON, ZN_ON_2

The overnight can use two more good systems, because otherwise those systems will trade twice a week.

I will add CL_ON_2 and JPY_ON. I'll also add one ZN_ID and one ZN_ID_2, because they have a low drawdown and do well.

Overall I'll then trade these futures:

Intraday

CL_ID, EUR_ID_2, EUR_ID_3, EUR_ID_6, GBL_ID, ZN_ID, ZN_ID_2

Overnight

CL_ON_2, CL_ON_3, JPY_ON, YM_ON, ZN_ON_2

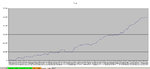

These 12 systems (2 contracts for the GBL_ID) will bring me from 14k to 50k. Then I will look into changing things, after having repaid my debt. Until 50k I will use the same systems, without increasing contracts, because I might sooner or later encounter a big drawdown.

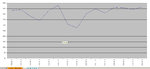

Here is how they look if I traded them for the past 8 months:

View attachment 78828

Maximum drawdown in these past 8 months of 5k, which is pretty much all I can handle if I am at 30k, but which would destroy me if it happened when I start at 14k, bringing me to 9k to a lot of sleepless nights.

Adamus, you got me thinking, and I tested again and I tried again (as in the past) the idea of trying to reverse signals based on the "cause" (the EUR going down) rather than the "consequence" (the past week being unprofitable), but it doesn't work at all. I can't seem to make it work properly no matter how many moving averages I try.