It's somewhat getting better. At least by the values I assigned to each of my rules. I don't feel any more stable than I was before. Or maybe yes: the lack of trading (I am still in a multi-day trade and planning to take a loan and resume my automated trading) has affected me in a positive way. Not trading discretionary, whether profitably or unprofitably, is preserving me from a lot of destabilizing stress. If there's destabilization, then I can refrain from giving in to more urges. In other words, resisting some of the urges on the list helps me resist the others.

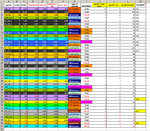

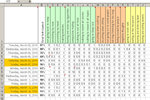

View attachment 78554

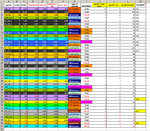

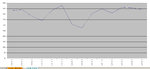

View attachment 78556

Another interesting thing is that if I buy sweets (cookies and similar), I get more satisfaction than by smoking and drinking together. This way I still hurt myself, but maybe less than by smoking and drinking (together), and also I can keep my self-control rating higher, as a consequence. Of course, during the summer, I get satisfaction just by swimming or playing frisbee, so my score then is even better. Essentially this scale/rating is not merely on self-control but rather on my ability to refrain from actions that hurt me (and in keeping others from hurting me) by using self-control. Of course now I am feeling my belly getting bigger every minute, as I eat the cookies and the other sweets, so I that is not a permanent solution or I am screwed worse than if I did other things.

Anyway, monitoring self-control is a useful thing to understand and improve myself. Of course there's other people on this forum, writing healthier journals, about their profitable trading in the meanwhile. I envy them. They not only manage to control themselves, but even to control themselves while trading. I am at a prehistoric stage compared to them. I have to accept my limits and build on what I have, and do my geeky self-control charts and everything, while brad pitt is out screwing beautiful women and stuff. After all, all these successful actors who have it all, deserve it, because they've mastered their self-control by giving it their best shot when it was needed. I didn't, I played it safe, and here I am: having achieved nothing.

I always chose the comfortable choice, the easiest route. I never wanted to risk looking bad, or failing at something, so I never went for a long shot, in everything. Jobs, women... everything had to come to me. The consequence was that I rarely failed but I achieved nothing. Those other guys who went for long shots, might have failed more than I did, but when they succeeded they got much more than I got with everything I've achieved. I guess we could define this in terms of risk/reward and % of wins. I had few losses but small and rare winning trades, they had huge wins and many small losses. I don't like taking losses, so I couldn't use their method unless I changed.

Ever since I was in junior high, teachers wrote on my report that I did well, but that I could have done better. I never tried. I wanted to win without trying my best, as if there was to be ashamed of giving it your best shot, as if I lost my composure by giving it my best shot. Instead I simply didn't achieve much. Even now I can't change it. If someone asked me to learn to dance, I'd say "no, man, I don't want to look ridiculous", i don't want to risk failing at something. The opposite of a "go-getter" essentially. Rather than "go-get it", I've always been a "stay-forget it" kind of person. I've never begged anyone for anything. I've never fought hard and I've always disliked the saying "no pain no gain".

In fact, when there was pain involved, I've always declined the activity. "Polar bears" activities (getting up early to go swimming in icy waters) and similar crap was never for me. I remember i was in a cycling race once, and there was a hill, which was quite steep. And all of a sudden i said to myself "what the hell am I doing this for?", so I stopped pedaling, got off my bike, went back down, said bye to everyone and went back home. The next day on the highschool newspaper, they had the list of the race and they wrote "travis bickle quit" or something like that. I've never found out for sure if there was any irony in writing it or not. I guess americans don't have much irony and had to write down everyone's name as a rule. But yes, basically I've been a quitter at everything they've imposed on me. I've never quit things I chose to do simply because I only chose to do things I was going to finish, so I am not a quitter literally, but I am someone who rarely begins doing anything, which maybe is even worse.