You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Still at 92% with seven hours to go.

I guess in the weekends, since there's no danger of overtrading, I would look at compulsive trading in the chart game as an equivalent. Usually I fail at both, so the urge is more or less the same, except on the chart game, it takes me ten times as many trades before I lose control.

I guess in the weekends, since there's no danger of overtrading, I would look at compulsive trading in the chart game as an equivalent. Usually I fail at both, so the urge is more or less the same, except on the chart game, it takes me ten times as many trades before I lose control.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

new groups of negative actions to be controlled

Rather than my previous distinction into financial, physical and social damaging actions, which was good, but it didn't look at the nature and causes of my behaviours, I will now group my "negative behaviours to be controlled" according to these 3 categories:

1) acting out my general depression:

2) giving in to a compulsive urge for action and for getting things done, even if useless or negative:

3) urge to reward myself and / or take a break from compulsive work / thinking

Groups 1 and 3 are not that bad and don't hurt me much. Group 2 is the real bad group, that hurts me in terms of time and money (especially when i trade compulsively), and keeps me from relaxing. Probably if group 2 didn't exist, there wouldn't be a need for group 3 to exist. Because I need to be drunk to stop compulsive behaviours and constant worrying about something.

On the other hand, what you don't see in this group 2 list is all the good compulsive behaviours, which of course I don't list because I want to keep them:

I learned English compulsively checking the dictionary and looking up things whenever I had a doubt. Same for French and all the things I know.

I developed good automated systems by compulsively going back and making sure everything was perfect and fixing it when it wasn't.

I kept healthy teeth by compulsively brushing them each time after I ate something.

And on and on. The compulsive behaviours are so ingrained in me because they were taught to be as part of my education by my parents, to make me work and keep me alive. But now they got too far and i need to stop them. It doesn't make sense that i finish all the food in the refrigerator to satisfy a feeling of getting things done. A beahaviour that originates when I finish the food in my plate. It doesn't make sense to compulsively check every spot on my nose to look for pimples. It doesn't make sense to compulsively trade every opportunity in the market. It makes sense to compulsively check every car when you're crossing the street, and so on. Something need to be done compulsively while others do not. My dad does all of them compulsively and ruined our life by being like that. Of course, thanks to him we were never in trouble neither physically nor financially.

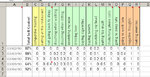

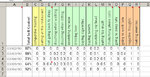

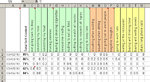

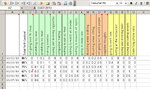

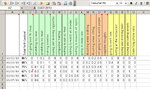

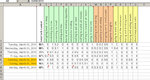

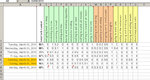

Anyway, here's the updated excel sheet, with today's ratings:

Ever since I started monitoring these levels, I've improved my self-control a whole lot. Simply by being aware of myself. I don't feel that I've made more efforts. I just knew the whole list of my weaknesses to watch out for. I don't want this list to get too big or I won't be able to monitor it on a daily level. As soon as a behaviour will stop for a few months, I will remove it from the list.

The major achievement so far was not for trading, because that still goes on, but for scratching my head. It was probably years since I had stopped scratching my head for 3 days in a row. I haven't done it in major way ever since i started recording it.

Rather than my previous distinction into financial, physical and social damaging actions, which was good, but it didn't look at the nature and causes of my behaviours, I will now group my "negative behaviours to be controlled" according to these 3 categories:

1) acting out my general depression:

- slouching when walking

- slouching when sitting

- negative thoughts about bad memories

2) giving in to a compulsive urge for action and for getting things done, even if useless or negative:

- rush to finish all food (all yogurts, etc.)

- rush to watch all movies (by an actor/director, etc.)

- scratching my nose

- scratching my head

- buying and smoking cigarettes

- going to sleep late (rush to do things)

- not going back to sleep if I wake up in the middle of the night (rush to do things)

- making enemies

- compulsive trading

3) urge to reward myself and / or take a break from compulsive work / thinking

- drinking beer

- chain/long phone calls

- eating at the restaurant

- buying sweets

- going to work late

Groups 1 and 3 are not that bad and don't hurt me much. Group 2 is the real bad group, that hurts me in terms of time and money (especially when i trade compulsively), and keeps me from relaxing. Probably if group 2 didn't exist, there wouldn't be a need for group 3 to exist. Because I need to be drunk to stop compulsive behaviours and constant worrying about something.

On the other hand, what you don't see in this group 2 list is all the good compulsive behaviours, which of course I don't list because I want to keep them:

I learned English compulsively checking the dictionary and looking up things whenever I had a doubt. Same for French and all the things I know.

I developed good automated systems by compulsively going back and making sure everything was perfect and fixing it when it wasn't.

I kept healthy teeth by compulsively brushing them each time after I ate something.

And on and on. The compulsive behaviours are so ingrained in me because they were taught to be as part of my education by my parents, to make me work and keep me alive. But now they got too far and i need to stop them. It doesn't make sense that i finish all the food in the refrigerator to satisfy a feeling of getting things done. A beahaviour that originates when I finish the food in my plate. It doesn't make sense to compulsively check every spot on my nose to look for pimples. It doesn't make sense to compulsively trade every opportunity in the market. It makes sense to compulsively check every car when you're crossing the street, and so on. Something need to be done compulsively while others do not. My dad does all of them compulsively and ruined our life by being like that. Of course, thanks to him we were never in trouble neither physically nor financially.

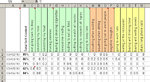

Anyway, here's the updated excel sheet, with today's ratings:

Ever since I started monitoring these levels, I've improved my self-control a whole lot. Simply by being aware of myself. I don't feel that I've made more efforts. I just knew the whole list of my weaknesses to watch out for. I don't want this list to get too big or I won't be able to monitor it on a daily level. As soon as a behaviour will stop for a few months, I will remove it from the list.

The major achievement so far was not for trading, because that still goes on, but for scratching my head. It was probably years since I had stopped scratching my head for 3 days in a row. I haven't done it in major way ever since i started recording it.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

cost/benefit vs risk/reward and probability of success

It's quite natural for us to think in terms of cost/benefit and do things that we deem convenient. For example: I'd like to eat a cake now, but I'd have to get up, get dressed, go out, buy it... so I don't eat the cake, because i don't consider it convenient in terms of cost/benefit ratio. But the cake will be there for sure, and if I get out of the house, I will come home with the cake.

With trading it's different. The cake doesn't only have a cost in terms of commissions, but in terms of possibly not being at the store (or the store being closed), once I go through the trouble of going there.

It's not as normal nor easy to think in terms of risk/reward combined with the probability of success.

If trading were a sure way to increase your money, everyone would trade. But the fact is that it can also decrease your money. And whether it's one or the other, gets influenced very much by how you think and calculate in your mind risk/reward and probability of success.

For regular activities, the more you try the more you succeed. For trading it's different. Take chopping wood. The more you chop, the more wood you have. For trading you can't just chop away trades and see your money increase.

The urge to increase quantity will cause quality to decrease

It's not just quantity but also quality. Below a given quality level, you'll start losing money. If you could increase your quantity of trades and keep their quality constant, your money will increase. But, with discretionary trading, the urge to increase your quantity will cause your quality to decrease, and that will decrease your money. So your number one concern as you trade is to not feel any urge to increase your quantity, but to just look at quality alone, and trade when you can guarantee it.

It's quite natural for us to think in terms of cost/benefit and do things that we deem convenient. For example: I'd like to eat a cake now, but I'd have to get up, get dressed, go out, buy it... so I don't eat the cake, because i don't consider it convenient in terms of cost/benefit ratio. But the cake will be there for sure, and if I get out of the house, I will come home with the cake.

With trading it's different. The cake doesn't only have a cost in terms of commissions, but in terms of possibly not being at the store (or the store being closed), once I go through the trouble of going there.

It's not as normal nor easy to think in terms of risk/reward combined with the probability of success.

If trading were a sure way to increase your money, everyone would trade. But the fact is that it can also decrease your money. And whether it's one or the other, gets influenced very much by how you think and calculate in your mind risk/reward and probability of success.

For regular activities, the more you try the more you succeed. For trading it's different. Take chopping wood. The more you chop, the more wood you have. For trading you can't just chop away trades and see your money increase.

The urge to increase quantity will cause quality to decrease

It's not just quantity but also quality. Below a given quality level, you'll start losing money. If you could increase your quantity of trades and keep their quality constant, your money will increase. But, with discretionary trading, the urge to increase your quantity will cause your quality to decrease, and that will decrease your money. So your number one concern as you trade is to not feel any urge to increase your quantity, but to just look at quality alone, and trade when you can guarantee it.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Seykota, from Market Wizards

I've often made the same mistakes the management did, in applying good trading systems but interfering with them.How did your trading program do?

The program did fine; the problem was that management couldn't keep from second-guessing the signals. For example, I remember one time the program generated a buy signal for sugar when it was trading around 5 cents. Management thought that the market was already overbought and decided not to take the signal. When the market kept on going higher, they came up with the rule that they would buy on the first 20-point pullback [ 100 points equal 1 cent]. When no such pullback developed, they modified the rule to buying on the first 30-point reaction.

As the market kept moving higher without any meaningful retracements, they changed the rule to 50 points and eventually 100 points. Finally, with sugar prices around 9 cents, they finally decided that it was a bull market, and that they had better buy before prices went much higher. They put the managed accounts long at that point. As you might guess, the sugar market peaked shortly thereafter. They compounded the error by ignoring the sell signal as well—a signal which also would have been very profitable.

The bottom line was that because of this interference, the most profitable trade of the year ended up losing money. As a result, instead of a theoretical return of 60 percent for the year, quite a few accounts actually lost money. This type of meddling was one of the main reasons why I eventually quit.

What were the other reasons?

Management wanted me to change the system so that it would trade more actively, thereby generating more commission income. I explained to them that it would be very easy to make such a change, but doing so would seriously impede performance. They didn't seem to care.

I've often felt the same way: reluctant to stop my creative side, even though i was seeing it was costing me money. I still feel that it's good to keep my eyes open. But best to separate entirely your discretionary trading from your automated trading.[...]

Witty and true, but the question remains, albeit in translated form: There are many trend-following systems with money management rules; why have you done so much better?

I seem to have a gift. I think it is related to my overall philosophy, which has a lot to do with loving the markets and maintaining an optimistic attitude. Also, as I keep trading and learning, my system (that is the mechanical computer version of what I do) keeps evolving. I would add that I consider myself and how I do things as a kind of system which, by definition, I always follow. Sometimes I trade entirely off the mechanical part, sometimes I override the signals based on strong feelings, and sometimes I just quit altogether. The immediate trading result of this jumping around is probably breakeven to somewhat negative. However, if I didn't allow myself the freedom to discharge my creative side, it might build up to some kind of blowout. Striking a workable ecology seems to promote trading longevity, which is one key to success.

Quite a disappointing answer. He could have said a little more about the huge differences there are.How would you compare the relative advantages and disadvantages of systems trading versus discretionary trading?

Systems trading is ultimately discretionary. The manager still has to decide how much risk to accept, which markets to play, and how aggressively to increase and decrease the trading base as a function of equity change. These decisions are quite important—often more important than trade timing.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

meyer lansky

http://en.wikipedia.org/wiki/Meyer_Lansky

These 5 mobsters had it quite good, in that they were neither murdered nor died in jail:

bonanno

costello

gambino

lansky

luciano

It's interesting how if you kill one person you could get the death penalty in the states, but if you have 100 people killed, you don't even stay too long in jail. But maybe that's only the way it used to be.

Getty images search

Gambino crime family:

1910–1928 — Salvatore "Toto" D'Aquila (by the start of Prohibition what was left of the Brooklyn Camorra and the Al Mineo group had merged with the D'Aquila's group to form the largest crime family in New York. D'Aquila was killed on orders of boss Joe Masseria in 1928)

1928–1930 — Alfred "Al Mineo" Manfredi (killed in Castellammarese War 1930)

1930–1931 — Francesco "Frank/Don Cheech" Scalise (1893-1957) (demoted after Salvatore Maranzano was killed)

1931–1951 — Vincenzo "Vincent" Mangano (disappeared April 1951, allegedly killed by Anastasia)

1951–1957 — Albert "Mad Hatter" Anastasia (1902–1957) (former head of Murder Incorporated, killed 1957 on orders of Underboss Carlo Gambino)

1957–1976 — Carlo Gambino (1902-1976) (nicknamed "The Godfather")

1974–1985 — Paul Castellano (killed on the orders of John Gotti)

1985–2002 — John Gotti (1940–2002) (jailed 1990-2002)

http://en.wikipedia.org/wiki/Victoria_Gotti

http://en.wikipedia.org/wiki/Meyer_Lansky

These 5 mobsters had it quite good, in that they were neither murdered nor died in jail:

bonanno

costello

gambino

lansky

luciano

It's interesting how if you kill one person you could get the death penalty in the states, but if you have 100 people killed, you don't even stay too long in jail. But maybe that's only the way it used to be.

Getty images search

Gambino crime family:

1910–1928 — Salvatore "Toto" D'Aquila (by the start of Prohibition what was left of the Brooklyn Camorra and the Al Mineo group had merged with the D'Aquila's group to form the largest crime family in New York. D'Aquila was killed on orders of boss Joe Masseria in 1928)

1928–1930 — Alfred "Al Mineo" Manfredi (killed in Castellammarese War 1930)

1930–1931 — Francesco "Frank/Don Cheech" Scalise (1893-1957) (demoted after Salvatore Maranzano was killed)

1931–1951 — Vincenzo "Vincent" Mangano (disappeared April 1951, allegedly killed by Anastasia)

1951–1957 — Albert "Mad Hatter" Anastasia (1902–1957) (former head of Murder Incorporated, killed 1957 on orders of Underboss Carlo Gambino)

1957–1976 — Carlo Gambino (1902-1976) (nicknamed "The Godfather")

1974–1985 — Paul Castellano (killed on the orders of John Gotti)

1985–2002 — John Gotti (1940–2002) (jailed 1990-2002)

http://en.wikipedia.org/wiki/Victoria_Gotti

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

self-control today

Today I've done a lot of research on the Italian mafia in the US. Watched movies and documentaries on it. But I didn't do it too frantically. No compulsion or addiction there, not that much at least. Pretty good level of self-control, above 95%. Tomorow the usual big test, due to being able to trade, so that is a big temptation. It's easy to not give in to temptations when they're not there. Of course, every weekend my self-control score is better than during the weekdays, since I couldn't do any compulsive trading even if I wanted to.

The most amazing things I have to record are that, ever since i started monitoring my self-control, about a week ago, I've been able to go to sleep on time (even on week-ends), wake up on time, go back to sleep in case I woke up early, and even refrain from scratching my head. This is amazing. I hadn't be able to do all this together since my last vacation at the sea (where I swim and it's hard to scratch my head while i swim or after doing so much sport).

Even though I haven't seen any improvement on my trading that are due to this self-control monitoring, I think they might come soon, because I am seeing some very powerful changes in these other areas. It's interesting, because I don't feel like I am determined to do anything more than I was determined to do a month ago, and yet changes are happening. But this happens even when I get mad (rarely): you only realize later how mad you were. So maybe I will only realize later how determined to change I was.

Today I've done a lot of research on the Italian mafia in the US. Watched movies and documentaries on it. But I didn't do it too frantically. No compulsion or addiction there, not that much at least. Pretty good level of self-control, above 95%. Tomorow the usual big test, due to being able to trade, so that is a big temptation. It's easy to not give in to temptations when they're not there. Of course, every weekend my self-control score is better than during the weekdays, since I couldn't do any compulsive trading even if I wanted to.

The most amazing things I have to record are that, ever since i started monitoring my self-control, about a week ago, I've been able to go to sleep on time (even on week-ends), wake up on time, go back to sleep in case I woke up early, and even refrain from scratching my head. This is amazing. I hadn't be able to do all this together since my last vacation at the sea (where I swim and it's hard to scratch my head while i swim or after doing so much sport).

Even though I haven't seen any improvement on my trading that are due to this self-control monitoring, I think they might come soon, because I am seeing some very powerful changes in these other areas. It's interesting, because I don't feel like I am determined to do anything more than I was determined to do a month ago, and yet changes are happening. But this happens even when I get mad (rarely): you only realize later how mad you were. So maybe I will only realize later how determined to change I was.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

self-control monitoring

Pretty satisfied as long as I avoid doing some of the things on my list. And that's what's happening ever since i started monitoring my self-control. It's as if you were able to defeat your enemies simply by monitoring them. This is all getting closer and closer to "automated living".

Pretty satisfied as long as I avoid doing some of the things on my list. And that's what's happening ever since i started monitoring my self-control. It's as if you were able to defeat your enemies simply by monitoring them. This is all getting closer and closer to "automated living".

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

self-control monitoring

This is really how yesterday ended:

It was a disaster and I got down to 60% of self-control. First my friend came and I let her keep me up until late (midnight). Then my dad came, and I let him keep me in a long boring conversation: his usual lecture on random subjects.

Anything you give him, even your own expertise subject, he ends up giving you a long lecture on it, as if you didn't know anything about it and asked to be enlightened. He was indeed a professor. It's really heavy to have a father who doesn't care what you have to say, but is constantly busy teaching you and lecturing on every possible subject. Let's say I tell him that taxi driver is my favorite movie: does he ask me about it? Nope, he'll lecture me about it. He'll tell me what he knows about de niro and about scorsese.

There's one variation: when he really doesn't know about a topic, like for example your job, he will interrogate you about the technical details, like a general on a battlefield. He won't say "so, how's your job?" and let you express yourself freely. He'll ask quick short questions such as: what place, how many people, what hours, details on the people, details on everything. If you want to say anything outside that, he'll give you silence, as if he's not interested. I consider subjecting myself to these lectures/interrogations as a lack of will power and self-control. I could and should say "now it's time to go to bed". I guess debriefings are natural when you're dealing with a professor who on top of that has a military background. Lectures/interrogations are all I ever got from my dad. There didn't seem to ever be any caring, support, affection.

Trading-wise, it was ok, because I felt that I couldn't make any good trades while my friend was coming and when she was there, so I didn't make any.

This is really how yesterday ended:

It was a disaster and I got down to 60% of self-control. First my friend came and I let her keep me up until late (midnight). Then my dad came, and I let him keep me in a long boring conversation: his usual lecture on random subjects.

Anything you give him, even your own expertise subject, he ends up giving you a long lecture on it, as if you didn't know anything about it and asked to be enlightened. He was indeed a professor. It's really heavy to have a father who doesn't care what you have to say, but is constantly busy teaching you and lecturing on every possible subject. Let's say I tell him that taxi driver is my favorite movie: does he ask me about it? Nope, he'll lecture me about it. He'll tell me what he knows about de niro and about scorsese.

There's one variation: when he really doesn't know about a topic, like for example your job, he will interrogate you about the technical details, like a general on a battlefield. He won't say "so, how's your job?" and let you express yourself freely. He'll ask quick short questions such as: what place, how many people, what hours, details on the people, details on everything. If you want to say anything outside that, he'll give you silence, as if he's not interested. I consider subjecting myself to these lectures/interrogations as a lack of will power and self-control. I could and should say "now it's time to go to bed". I guess debriefings are natural when you're dealing with a professor who on top of that has a military background. Lectures/interrogations are all I ever got from my dad. There didn't seem to ever be any caring, support, affection.

Trading-wise, it was ok, because I felt that I couldn't make any good trades while my friend was coming and when she was there, so I didn't make any.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

opting for full automation and asking for a loan

I am sick and tired of not being able to control myself and keep myself from gambling. I can't seem to be able to do it, no matter how hard I try. I either do no trading at all, and then I can stay months without touching my systems, or if I try to only make the good trades, pretty soon I relapse into full gambling mode.

Today for example, my stop got hit by one tick. I was so mad that I started revenge trading and lost another 800 dollars.

I will make a loan and only do automated trading. I run a big risk: incurring a drawdown from the start and losing the whole loan. Then I'd have to work for a year and do no trading, just to repay the loan.

On the other hand, like this, I am slowly bleeding to death. Each month I am losing 2000 dollars, and this has been happening for the past 8 months. In the past 8 months I've lost over 20k, merely due to discretionary trading.

I can't do it. I am quitting. I can't even control myself in the chart game. The impatience and drive to trade more in order to make more money is too strong to be able to control it.

Tomorrow I will ask for a 10k loan from the bank I am working at, so I can stop this torture of discretionary trading. I am done. I just can't do it. After over 12 years of trying, I am giving up again: hopefully for the last time. Hopefully I will never try again.

I am sick and tired of not being able to control myself and keep myself from gambling. I can't seem to be able to do it, no matter how hard I try. I either do no trading at all, and then I can stay months without touching my systems, or if I try to only make the good trades, pretty soon I relapse into full gambling mode.

Today for example, my stop got hit by one tick. I was so mad that I started revenge trading and lost another 800 dollars.

I will make a loan and only do automated trading. I run a big risk: incurring a drawdown from the start and losing the whole loan. Then I'd have to work for a year and do no trading, just to repay the loan.

On the other hand, like this, I am slowly bleeding to death. Each month I am losing 2000 dollars, and this has been happening for the past 8 months. In the past 8 months I've lost over 20k, merely due to discretionary trading.

I can't do it. I am quitting. I can't even control myself in the chart game. The impatience and drive to trade more in order to make more money is too strong to be able to control it.

Tomorrow I will ask for a 10k loan from the bank I am working at, so I can stop this torture of discretionary trading. I am done. I just can't do it. After over 12 years of trying, I am giving up again: hopefully for the last time. Hopefully I will never try again.

Last edited:

FXTrend240

Well-known member

- Messages

- 292

- Likes

- 10

Re: opting for full automation and asking for a loan

go for it 👍

ain't nothing worng with going fully automatedI am sick and tired of not being able to control myself and keep myself from gambling. I can't seem to be able to do it, no matter how hard I try. I either do no trading at all, and then I can stay months without touching my systems, or if I try to only make the good trades, pretty soon I relapse into full gambling mode.

Today for example, my stop got hit by one tick. I was so mad that I started revenge trading and lost another 800 dollars.

I will make a loan and only do automated trading. I run a big risk: incurring a drawdown from the start and losing the whole loan. Then I'd have to work for a year and do no trading, just to repay the loan.

On the other hand, like this, I am slowly bleeding to death. Each month I am losing 2000 dollars, and this has been happening for the past 8 months. In the past 8 months I've lost over 20k, merely due to discretionary trading.

I can't do it. I am quitting. I can't even control myself in the chart game. The impatience and drive to trade more in order to make more money is too strong to be able to control it.

Tomorrow I will ask for a 10k loan from the work I am working at, so I can stop this torture of discretionary trading. I am done. I just can't do it. After over 12 years of trying, I am giving up again: hopefully for the last time. Hopefully I will never try again.

go for it 👍

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Yeah, I will. That's the only way I ever saw my money grow. With discretionary trading, every month has been unprofitable. With automated trading, every month has been profitable. I don't see why I can't get this into my head.

It's been seen with my self-control excel sheet: I can pretty much control everything better than I can control my trading. I can refrain from:

scratching my head, my nose

slouching

smoking

drinking beer/wine

overeating

...

But I cannot refrain from gambling IF I trade. I can easily not gamble if I completely stay away from it. But if I do trade, sooner or later, within a matter of days, I'll start gambling again.

The trick for everything else is to keep your hands away from your nose, head, not buying beer, not buying cigarettes, not buying cakes. You can't expect to stuff your refrigerator with all sorts of cakes and pastries, and then refrain from eating them.

That's how I keep those other things under control: I stay as far away from them as possible. I even told the maid: do not ever bake cakes or bring any sweets home. It's like giving a gun to someone who's very upset: it's not a good idea.

With trading, instead, having to trade discretionary to make a living, is possible because others achieved it but it would be equivalent to selling cigarettes and not smoke any, sell wine and not drink any, sell pastries and not eat any, and so on.

I mean: it's ridiculous. Even some of those 4 year old children of the marshmallow experiment knew that the way to avoid eating the marshmallow was to not look at it. Those who looked at it, always ended up eating it.

So, here I am, trying not to gamble, which is clearly a strong urge to me, and yet expecting to do it while I am right in front of the trading platform, which is like for a gambler to sit at the casino (with money). It has not happened and it will not happen. I can resist the urge to gamble BUT only if I am away from the trading platform, and discretionary trading does not allow me to do that, because it forces me to stare at charts the whole day long. And that way greatly increases temptations.

I just can't do it. I either trade with a group, which is impossible for practical reasons, or I don't do any discretionary trading. Not until I am like this, which is probably forever.

Trading with other people is impossible because they're hard to find in person and via internet no one will monitor what you do. So, forget it. I've already tried it in the past few months, but it didn't work. I can't keep trying things that don't work forever. Automated trading works, so let's do that.

It's been seen with my self-control excel sheet: I can pretty much control everything better than I can control my trading. I can refrain from:

scratching my head, my nose

slouching

smoking

drinking beer/wine

overeating

...

But I cannot refrain from gambling IF I trade. I can easily not gamble if I completely stay away from it. But if I do trade, sooner or later, within a matter of days, I'll start gambling again.

The trick for everything else is to keep your hands away from your nose, head, not buying beer, not buying cigarettes, not buying cakes. You can't expect to stuff your refrigerator with all sorts of cakes and pastries, and then refrain from eating them.

That's how I keep those other things under control: I stay as far away from them as possible. I even told the maid: do not ever bake cakes or bring any sweets home. It's like giving a gun to someone who's very upset: it's not a good idea.

With trading, instead, having to trade discretionary to make a living, is possible because others achieved it but it would be equivalent to selling cigarettes and not smoke any, sell wine and not drink any, sell pastries and not eat any, and so on.

I mean: it's ridiculous. Even some of those 4 year old children of the marshmallow experiment knew that the way to avoid eating the marshmallow was to not look at it. Those who looked at it, always ended up eating it.

So, here I am, trying not to gamble, which is clearly a strong urge to me, and yet expecting to do it while I am right in front of the trading platform, which is like for a gambler to sit at the casino (with money). It has not happened and it will not happen. I can resist the urge to gamble BUT only if I am away from the trading platform, and discretionary trading does not allow me to do that, because it forces me to stare at charts the whole day long. And that way greatly increases temptations.

I just can't do it. I either trade with a group, which is impossible for practical reasons, or I don't do any discretionary trading. Not until I am like this, which is probably forever.

Trading with other people is impossible because they're hard to find in person and via internet no one will monitor what you do. So, forget it. I've already tried it in the past few months, but it didn't work. I can't keep trying things that don't work forever. Automated trading works, so let's do that.

Last edited:

FXTrend240

Well-known member

- Messages

- 292

- Likes

- 10

by the way, just because you trade with algorithms, doesn't make you any worse or less worthy than a dsicretionary trader🙂

james simons, billionaire hegde fund manager, all algorithms, ain't done a tad of discretion . 😎

james simons, billionaire hegde fund manager, all algorithms, ain't done a tad of discretion . 😎

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Yeah, lucky him. I envy him. I've never been able to really take off with my automated trading. I wish there were some mini-futures like there are mini-lots. But my situation has always been the same: I have one tenth the margin I would need to trade my systems properly. Instead of 50k, I've always had 5k. Then, the few times I got to 30k, which was close enough, I blew it, because my systems weren't good enough yet, and because I still kept doing discretionary trading in the hope to increase my capital (but only helped it shrink).

FXTrend240

Well-known member

- Messages

- 292

- Likes

- 10

Yeah, lucky him. I envy him. I've never been able to really take off with my automated trading. I wish there were some mini-futures like there are mini-lots. But my situation has always been the same: I have one tenth the margin I would need to trade my systems properly. Instead of 50k, I've always had 5k. Then, the few times I got to 30k, which was close enough, I blew it, because my systems weren't good enough yet, and because I still kept doing discretionary trading in the hope to increase my capital (but only helped it shrink).

you have two options-risk taking out a loan.

save up for a while.

Noting wrong with trying again, it's up to you whether to give up or continue, even though you may not succeed. but here you say you already have profitable systems, so all you need is $$$

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Yes. I wish it were that easy and simple. The problem is that "profitable" only means "probably profitable". Even if I felt sure about them, there wouldn't be a certainty that they will be profitable in the future. I would definitely invest a whole 5000 dollars on them and never look back, but the problem is that it would not be enough to trade them. But I would never take out a loan of 50k and invest it on my systems, because if it doesn't work out, I'll be forever indebted to the bank. I wish I could go back in time, to when these systems made me 20k to 30k and each time I proceeded to blow the winnings via restaurants, or discretionary trading. Back then I was really reckless and didn't realize the value of money and time. Damn. This recklessness has gone on until this past summer. Each time I reached 20k, I started inviting people to the restaurant, but then the drawdown came and I was screwed, panicked, started increasing my discretionary trading to make up for losses which I didn't feel I could afford... and here I am, from 30k to 3k.

- Status

- Not open for further replies.

Similar threads

- Replies

- 10

- Views

- 3K