Hedging with option

I had doubts about NR's strategy to hedge futures positions with options, or at least I wasn't sure how it would look in the book. I tested this with Nasdaq100 futures and the use of future options. I took screen shots and tracked the prices everyday.

Entry 22 April SHORT THE MARKET [ NQM10 2016.00. ]

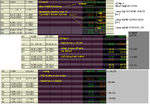

Hedged by buying future options, NR said he used ATM but I wanted a variety so I chose 3 . [ ITM Sep, ATM Jun, OTM Jun]

Currently, NQM10 futures short position is up +78 and the hedged options are down roughly -28. Net positive for about 50 handles on NQ100. It is supporting NR's statement about paying 1/3 of total profits for hedging costs. { It's not in the image attached as I took it yesteday}.

When the market went up and futures position was down by about 30, options gained value by about 1/2 of it, resulting in net -15 handle open loss.

Summary

A hard stoploss of 15 handles will be almost sure to touch on NQ futures as daily ATR is about 30. If I wanted to scratch the trade, then the cost would have been -15, a very resonable cost for no-stress position trade entry. However, be prepared to pay for hedging costs in the eventual win.

... thank you NR 😎