isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Market Breadth Update

I've been away for the last few weeks having a break from work and trading. I feel refreshed and ready to get trading again, although the 13 hour overnight flight from Singapore has dampened that a little bit. Maybe I'll stick closer to home in the future unless I'm going away for longer than two weeks. Anyway lets look at what's happened to the main breadth charts while I was away...

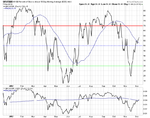

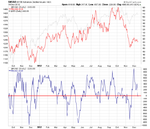

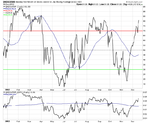

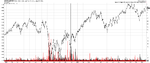

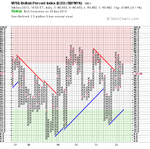

Interestingly, there was no changes in statuses in any of the main four in the last two weeks since all three moving average breadth charts reversed on the 19th November. So they remain on a short term bull alert, and a medium and long term bear correction - i.e the major trend is still bearish, but we've had a strong short term recovery rally, which has pushed the columns of Xs up close to their recent highs in the short term. For example the short term needs to move above 58% in order to give a new bull signal, which can also be clearly seen on the line chart version also, which has stalled at it's falling 50 day MA, and below the relative performance 200 day MA. The only comparison in the last year on the chart can be seen in April when the recovery rally failed under it's falling 50 day MA and relative performance 200 day MA.

So my analysis from the charts is that we are currently lingering around a point of relative fair value within a overall down trend still. So hence I personally feel that the risk reward is very good for a short trade around these levels, but that's just my opinion from what I'm seeing on these charts and you may interpret them differently.

Anyway attached is the updated charts and table:

Longer Term Charts

Medium Term Charts

Short Term Charts

I've been away for the last few weeks having a break from work and trading. I feel refreshed and ready to get trading again, although the 13 hour overnight flight from Singapore has dampened that a little bit. Maybe I'll stick closer to home in the future unless I'm going away for longer than two weeks. Anyway lets look at what's happened to the main breadth charts while I was away...

Interestingly, there was no changes in statuses in any of the main four in the last two weeks since all three moving average breadth charts reversed on the 19th November. So they remain on a short term bull alert, and a medium and long term bear correction - i.e the major trend is still bearish, but we've had a strong short term recovery rally, which has pushed the columns of Xs up close to their recent highs in the short term. For example the short term needs to move above 58% in order to give a new bull signal, which can also be clearly seen on the line chart version also, which has stalled at it's falling 50 day MA, and below the relative performance 200 day MA. The only comparison in the last year on the chart can be seen in April when the recovery rally failed under it's falling 50 day MA and relative performance 200 day MA.

So my analysis from the charts is that we are currently lingering around a point of relative fair value within a overall down trend still. So hence I personally feel that the risk reward is very good for a short trade around these levels, but that's just my opinion from what I'm seeing on these charts and you may interpret them differently.

Anyway attached is the updated charts and table:

Longer Term Charts

Medium Term Charts

Short Term Charts

Attachments

-

$BPNYA_4-12-12.png18.2 KB · Views: 843

$BPNYA_4-12-12.png18.2 KB · Views: 843 -

NYA200R_4-12-12.png19.3 KB · Views: 820

NYA200R_4-12-12.png19.3 KB · Views: 820 -

NYA150R_4-12-12.png18.5 KB · Views: 843

NYA150R_4-12-12.png18.5 KB · Views: 843 -

NYA50R_4-12-12.png16.8 KB · Views: 814

NYA50R_4-12-12.png16.8 KB · Views: 814 -

sc-57-200.png37.1 KB · Views: 839

sc-57-200.png37.1 KB · Views: 839 -

market-breadth-table_4-12-12.png10.8 KB · Views: 785

market-breadth-table_4-12-12.png10.8 KB · Views: 785 -

sc-56-50.png39.9 KB · Views: 828

sc-56-50.png39.9 KB · Views: 828 -

sc-58-150.png41.4 KB · Views: 871

sc-58-150.png41.4 KB · Views: 871