isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

US Industry Sectors Breadth

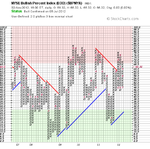

I've updated the US Industry Sectors Breadth charts. Six of the nine sectors moved higher this week with Consumer Staples regaining it's buy signal. However, Utilities was the biggest mover and broke down from the overbought zone with 7.97% of stocks in the sector breaking below their 150 day MAs and took it onto a sell signal.

Below is the data table for the Percent of Stocks Above 150 Day Moving Average in each sector which I've ordered by the percentage change since last week in each sector.

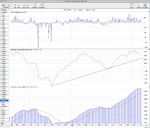

Attached is the charts of the 9 sectors and a visual diagram to show where the sectors are relative to each other and the NYSE Percent of Stocks Above 150 Day Moving Average.

I've also created the point and figure versions of the US Industry Sectors Breadth charts now, so that I can see the standard breadth status such as Bear Confirmed, Bull Correction etc. For example Utilities double bottom breakdown from above 70% this week puts it onto Bear Confirmed status. My software doesn't plot P&F in the same way as proper point and figure programs in that it shows 3 box reversals before they complete. i.e. note the single O on the XLP chart which is actually still in a column of Xs as it needs 3 Os (6%) to actually reverse. Attached is the standard 2% box size by 3 reversal and faster 1% box size by 3 reversal.

I've updated the US Industry Sectors Breadth charts. Six of the nine sectors moved higher this week with Consumer Staples regaining it's buy signal. However, Utilities was the biggest mover and broke down from the overbought zone with 7.97% of stocks in the sector breaking below their 150 day MAs and took it onto a sell signal.

Below is the data table for the Percent of Stocks Above 150 Day Moving Average in each sector which I've ordered by the percentage change since last week in each sector.

Attached is the charts of the 9 sectors and a visual diagram to show where the sectors are relative to each other and the NYSE Percent of Stocks Above 150 Day Moving Average.

I've also created the point and figure versions of the US Industry Sectors Breadth charts now, so that I can see the standard breadth status such as Bear Confirmed, Bull Correction etc. For example Utilities double bottom breakdown from above 70% this week puts it onto Bear Confirmed status. My software doesn't plot P&F in the same way as proper point and figure programs in that it shows 3 box reversals before they complete. i.e. note the single O on the XLP chart which is actually still in a column of Xs as it needs 3 Os (6%) to actually reverse. Attached is the standard 2% box size by 3 reversal and faster 1% box size by 3 reversal.

Attachments

Last edited: