timsk

Legendary member

- Messages

- 8,855

- Likes

- 3,554

Hi isatrader,

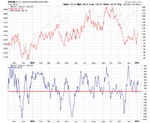

I particularly like the one hour chart. To my eye, it's easier to see the flow of volume moving between advancing and declining issues. It's smoother too than other timeframes. 30 mins is just about usable, but any timeframe shorter than that isn't so instructive as it's hard to see the wood for the trees. Ditto with a longer timeframes to some extent. Anyone who gets excited by divergences will need to chance their underwear when they look at this chart - they're all over the place!

😆

Tim.

I particularly like the one hour chart. To my eye, it's easier to see the flow of volume moving between advancing and declining issues. It's smoother too than other timeframes. 30 mins is just about usable, but any timeframe shorter than that isn't so instructive as it's hard to see the wood for the trees. Ditto with a longer timeframes to some extent. Anyone who gets excited by divergences will need to chance their underwear when they look at this chart - they're all over the place!

😆

Tim.